The United States Securities and Exchange Commission (SEC) has actually pressed back its choice on a proposed area Solana exchange-traded fund (ETF), with the cryptocurrency market now seeking to the due dates for the Polkadot and XRP-based ETFs in June.

The SEC pressed its choice on noting Grayscale’s area Solana (SOL) Trust ETF on the New York Stock Exchange (NYSE) to October 2025, according to a Might 13 filing by the securities regulator.

The choice came the week after the SEC postponed its judgment on Canary Capital’s Litecoin (LTC) ETF, Bloomberg Intelligence expert James Seyffart composed in a Might 5 X post.

Area ETFs are deemed essential chauffeurs of liquidity and institutional adoption for digital possessions. For Bitcoin (BTC), the United States area Bitcoin ETFs represented an approximated 75% of brand-new financial investment after releasing, which assisted BTC regain the $50,000 mark in February 2024, a month after the ETFs debuted for trading.

While a Solana ETF might produce just a portion of the inflows of Bitcoin ETFs, it might increase Solana’s institutional adoption in the long term by using financiers a “regulated financial investment automobile” that might still bring in billions of dollars in capital, Ryan Lee, primary expert at Bitget Research study, informed Cointelegraph.

Related: Solana co-founder proposes meta chain to repair blockchain fragmentation

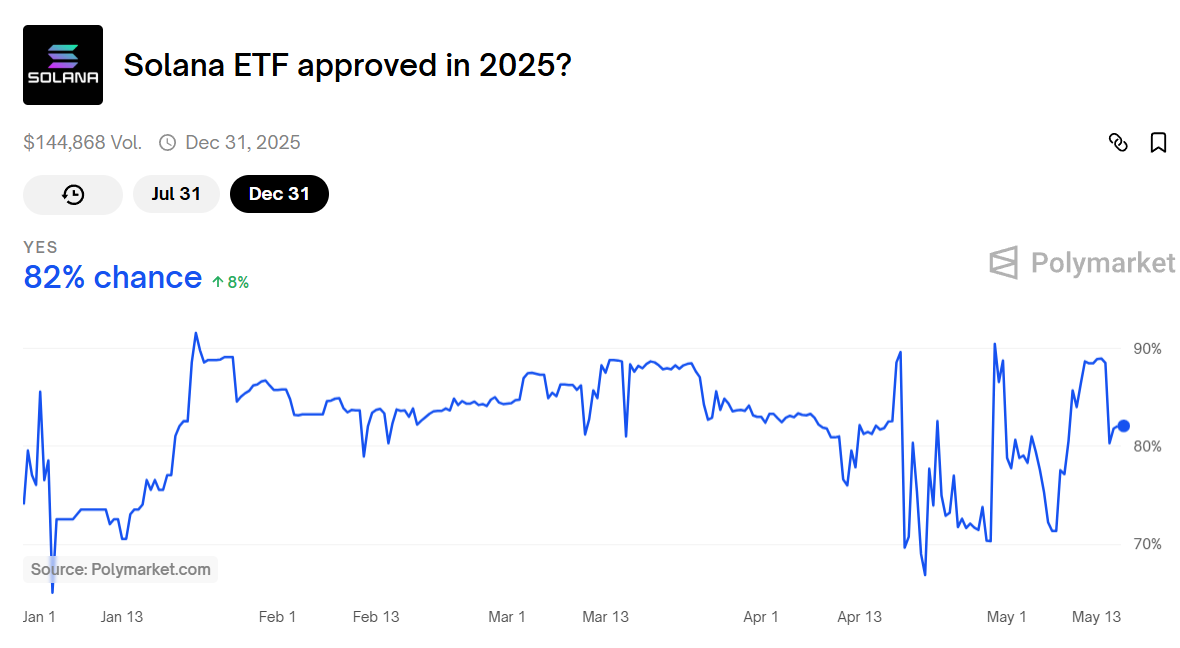

Regardless of the current hold-up by the SEC, most of financiers are positive about the approval of a SOL ETF before completion of 2025.

Financiers are anticipating an 82% opportunity for a SOL ETF approval and an 80% opportunity for a Litecoin ETF approval before completion of the year, according to information from Polymarket, the biggest decentralized wagering platform.

Related: $ 1B Bitcoin exits Coinbase in a day as experts caution of supply shock

Polkadot, XRP, DOGE ETFs wait for SEC choice in June

Numerous other crypto ETF applications are approaching SEC due dates in June.

The SEC will choose Grayscale’s Polkadot (DOT) ETF by June 11, and 21Shares’ Polkadot ETF on June 24, according to a court filing from the SEC.

On June 17, the SEC is set to decide on Franklin Templeton’s area XRP (XRP) ETF and Bitwise’s area Dogecoin (DOGE) ETF, main filings reveal.

Nevertheless, those choices might likewise be postponed. The SEC normally makes the most of its 240-day evaluation duration when examining crypto-related monetary items, as seen in its handling of the Bitcoin and Ether (ETH) ETF applications in 2023 and 2024.

Publication: Metric signals $250K Bitcoin is ‘finest case,’ SOL, buzz tipped for gains: Trade Tricks