Security issues stay the most significant challenge to the mainstream adoption of cryptocurrency payments, as hacks and phishing rip-offs continue to harm the market’s authenticity.

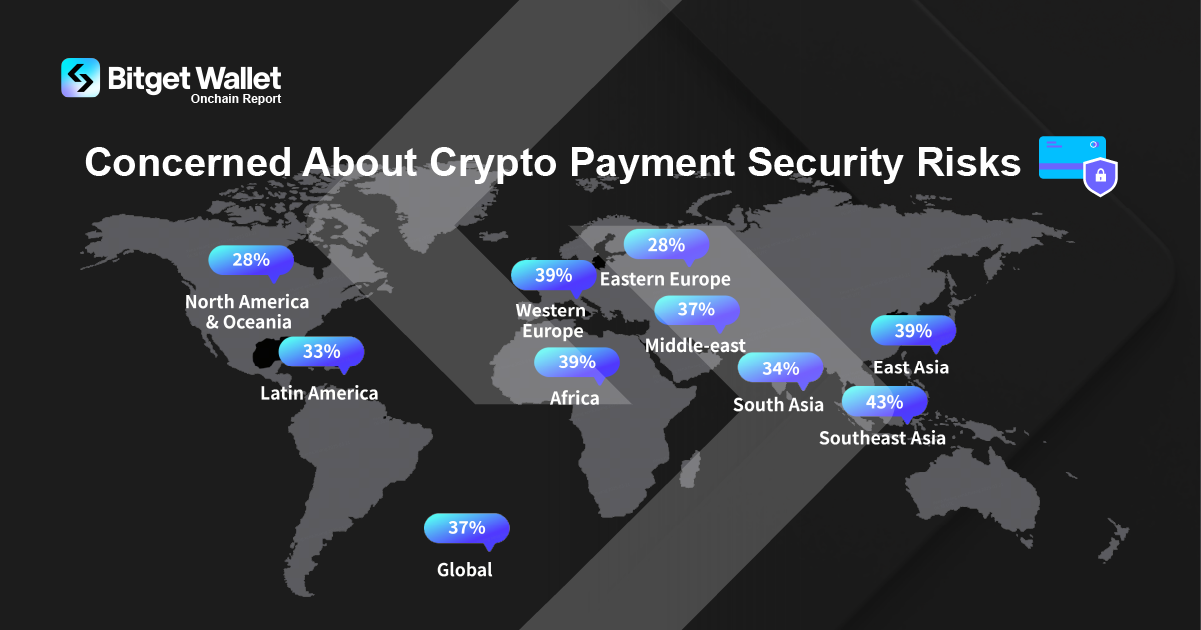

More than 37% of financiers recognized security dangers as the primary barrier to utilizing cryptocurrency for payments, according to a study of 4,599 users carried out by Bitget Wallet as part of its most current Onchain Report showed Cointelegraph.

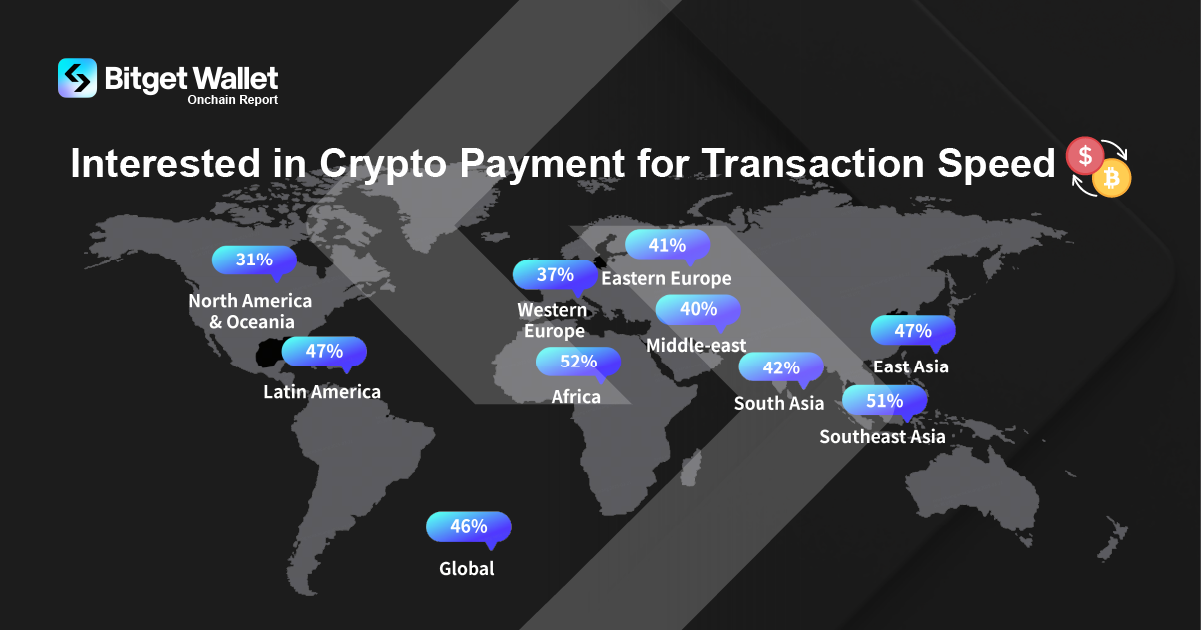

Still, 46% of users stated they chose crypto payments over fiat for their speed and effectiveness.

Source: Bitget Wallet Onchain Report

Bitget Wallet has actually executed multi-layered security systems to make security a “leading concern” and motivate more self-confidence in crypto payments, according to Alvin Kan, primary running officer of Bitget Wallet:

” This consists of MEV security, which is now allowed by default throughout significant chains like Ethereum, BNB Chain, and Solana, assisting users prevent typical dangers like front-running and sandwich attacks. “

” We likewise presented clever permission detection by means of our GetShield engine, which actively scans clever agreements, DApps, and URLs to flag harmful habits before users sign anything,” he informed Cointelegraph.

Bitget Wallet’s operations are backed by a $300 million user security fund as an extra layer of guarantee in case of an “possession loss due to platform-level concerns.”

Issues over crypto payment security by area. Source: Bitget Wallet Onchain Report

Security issues have actually afflicted the market, particularly considering that the introduction of a brand-new kind of phishing attack called address poisoning or wallet poisoning rip-offs, which include deceiving victims into sending their digital possessions to deceptive addresses coming from fraudsters.

Victims of address poisoning rip-offs were deceived into voluntarily sending out over $1.2 million worth of funds to fraudsters in the very first 3 weeks of March.

While Gen X users point out security as their leading issue, Gen Z users focus on use and cost-efficiency, Kan stated.

Related: DWF Labs releases $250M fund for mainstream crypto adoption

Africa and Southeast Asia lead in crypto payment adoption

Bitget Wallet’s report discovered that 52% of African participants and 51% of Southeast Asian participants revealed interest in crypto payments, driven by high remittance expenses and restricted banking gain access to.

Interest in crypto payments by area. Source: Bitget Wallet Onchain Report

To assist the world’s unbanked areas, Bitget Wallet uses streamlined onboarding with non-custodial wallets that do not need a conventional checking account, Kan stated, including:

” With assistance for over 130 blockchains and stablecoins, users can quickly send out and get worth worldwide, utilizing possessions that keep acquiring power.”

” Regional fiat on-ramps and multichain assistance make sure that users can use crypto without requiring deep technical understanding or central platforms,” he included.

Related: Crypto security will constantly be a video game of ‘feline and mouse’– Wallet officer

In Latin America, high deal expenses related to standard wire transfers are the primary aspect driving users to embrace crypto payments, Kan stated.

Such remittance costs balanced 7.34% throughout 2024 if they included checking account transfers, according to Statista.

Publication: Phony Rabby Wallet fraud connected to Dubai crypto CEO and much more victims