Secret takeaways:

-

SOL is having a hard time to hold $80 as a 75% drop in futures’ open interest reveals that traders are heading for the exits instead of opening brand-new bets.

-

Solana stays greatly based on retail and memecoin activity, while Ethereum preserves its lead in high-value decentralized financing.

Solana’s native token, SOL (SOL), has actually struck a wall, consistently stopping working to break back above $89 over the last 2 weeks. This slow rate action follows a rejection at the $145 level in mid-January and a sharp drop to $67.60 throughout the Feb. 6 crash. Need for bullish take advantage of has actually basically vaporized as traders brace for more discomfort.

Those wagering versus SOL are presently paying a yearly rate of 20% simply to keep their brief positions open, an unusual and aggressive relocation. When financing rates remain unfavorable like this for over a week, it reveals that bears have a great deal of conviction. On the other hand, ETH’s annualized financing rate sat at 1% on Wednesday. While that’s listed below the normal 6% neutral mark, it’s no place near the uneven levels seen in SOL.

Disappointment is installing as SOL underperformed the remainder of the crypto market by 11% over the previous one month.

Despite The Fact That SOL is still holding its area amongst the leading 7 cryptocurrencies by market cap, the 67% slide from its $253 peak in September 2025 has actually left a mark on both onchain activity and derivatives. In reality, SOL futures open interest has actually dropped 75% from its $13.5 billion high seen just 5 months back.

Lower SOL rates lower rewards, preventing long-lasting holding

This rate downturn is likewise harming the decentralized applications (dApps) constructed on Solana. Profits are down throughout the board, from staking and decentralized exchanges to launchpads and providing platforms. Financiers are beginning to fret about a “death spiral,” where falling rates result in less rewards, making it harder for individuals to validate holding SOL for the long run.

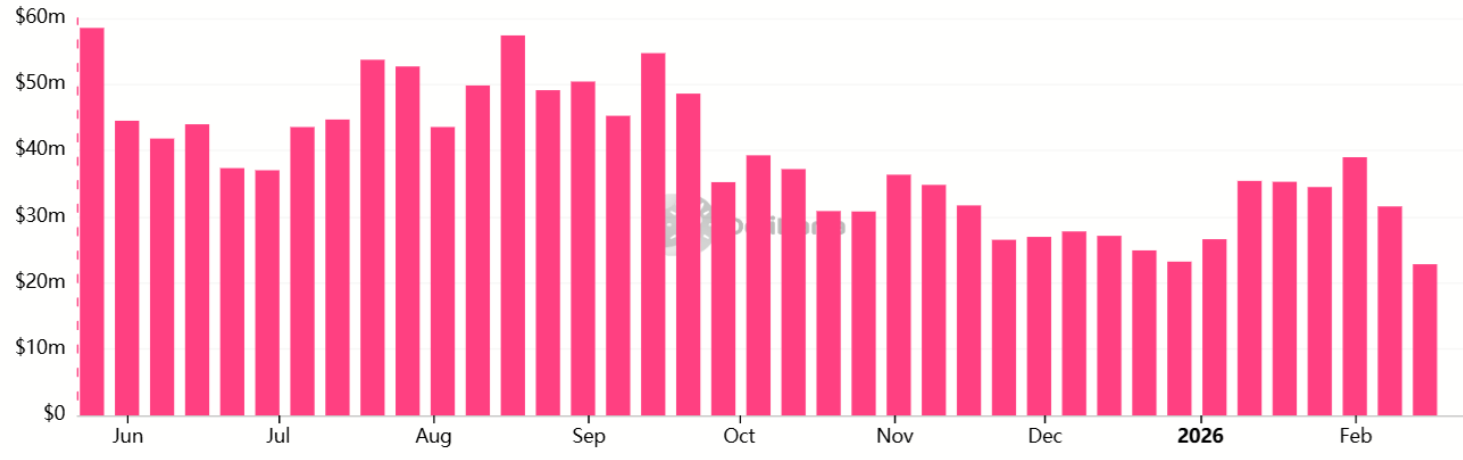

Weekly dApps income on Solana dropped to $22.8 million, the most affordable considering that October 2024. Oddly, the memecoin launchpad Pump produced $9.1 million in income throughout those 7 days, representing 40% of the whole network. In contrast, weekly DApps income on Ethereum amounted to $16 million, up 2% from the previous month.

Related: Pump.fun presents trader cashbacks in tweak to memecoin design

Unlike Solana, the leading revenue-generating DApps on Ethereum are Sky, Flashbots, and Aave– crucial facilities gamers for decentralized financing. Basically, Solana is greatly based on retail onboarding and the memecoin sector, while Ethereum has actually protected its lead in overall worth locked (TVL) and utilize cases that need greater decentralization.

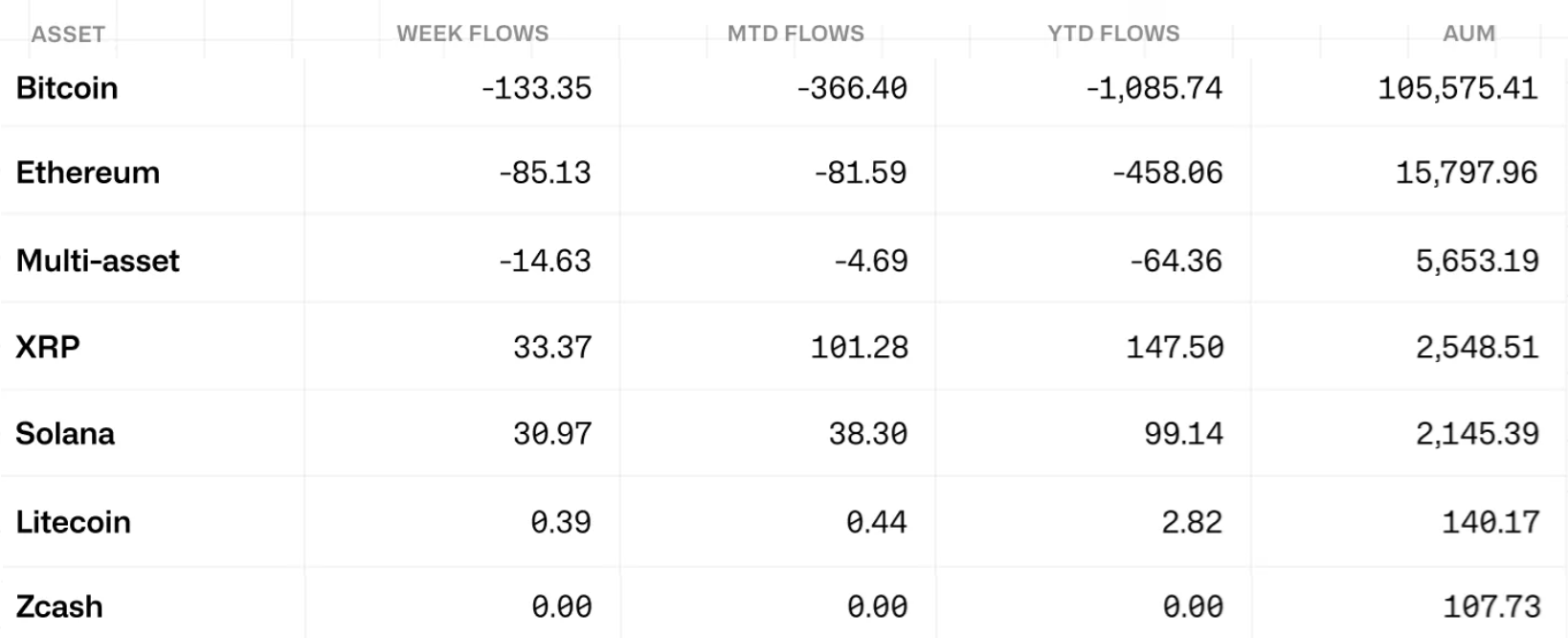

This weak institutional need shows up in SOL exchange-traded funds (ETFs). Solana’s high deal volume and second-place area in TVL have not sufficed to encourage conventional financiers to purchase into SOL ETFs used by Bitwise, Fidelity, Grayscale, 21Shares, Coinshares, and REX-Osprey.

While appropriate, Solana’s $2.1 billion in ETF possessions under management is still 86% behind Ethereum’s $15.8 billion. Lots of financiers have actually lost self-confidence that need for Solana DApps will increase anytime quickly, likely an adverse effects of the heavy buzz around memecoins and launchpads.

For SOL to restore its bullish momentum, it will likely require a push from sectors like expert system facilities and forecast markets. These locations reveal guarantee, however the competitors is intense.

Currently, weak SOL derivatives and Solana onchain metrics are an indication. Any more frustration might activate another rate drop, putting the currently unstable $78 assistance level at severe danger.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this info.