Update (April 26 at 8:57 PM UTC): This post has actually been upgraded to consist of updates from Loopscale.

Solana decentralized financing (DeFi) procedure Loopscale briefly stopped its financing markets after suffering an around $5.8 million make use of.

On April 26, a hacker siphoned roughly 5.7 million USDC (USDC) and 1200 Solana (SOL) from the financing procedure after getting a “series of undercollateralized loans”, Loopscale co-founder Mary Gooneratne stated in an X post.

Loopscale has considering that “re-enabled loan payments, top-ups, and loop closing”, however “[a] ll other app functions (consisting of Vault withdrawals) are still briefly limited while we examine and guarantee mitigation of this make use of,” Loopscale stated in an April 26 X post.

The make use of just affected Loopscale’s USDC and SOL vaults and the losses represent around 12% of Loopscale’s overall worth locked (TVL), Gooneratne included.

” Our group is totally set in motion to examine, recuperate funds, and guarantee users are secured,” Gooneratne stated.

In the very first quarter of 2025, hackers took more than $1.6 billion worth of crypto from exchanges and on-chain wise agreements, blockchain security company PeckShield stated in an April report.

More than 90% of those losses are attributable to a $1.5 billion attack on ByBit, a central cryptocurrency exchange, by North Korean hacking attire Lazarus Group.

Related: Crypto hacks leading $1.6 B in Q1 2025– PeckShield

Special DeFi financing design

Released on April 10 after a six-month closed beta, Loopscale is a DeFi financing procedure created to improve capital effectiveness by straight matching lending institutions and debtors.

It likewise supports specific financing markets, such as “structured credit, receivables funding, and undercollateralized financing,” Loopscale stated in an April statement shown Cointelegraph.

Loopscale’s order book design identifies it from DeFi financing peers such as Aave that aggregate cryptocurrency deposits into liquidity swimming pools.

Loopscale’s primary USDC and SOL vaults yield APRs surpassing 5% and 10%, respectively. It likewise supports financing markets for tokens such as JitoSOL and BONK (BONK) and looping methods for upwards of 40 various token sets.

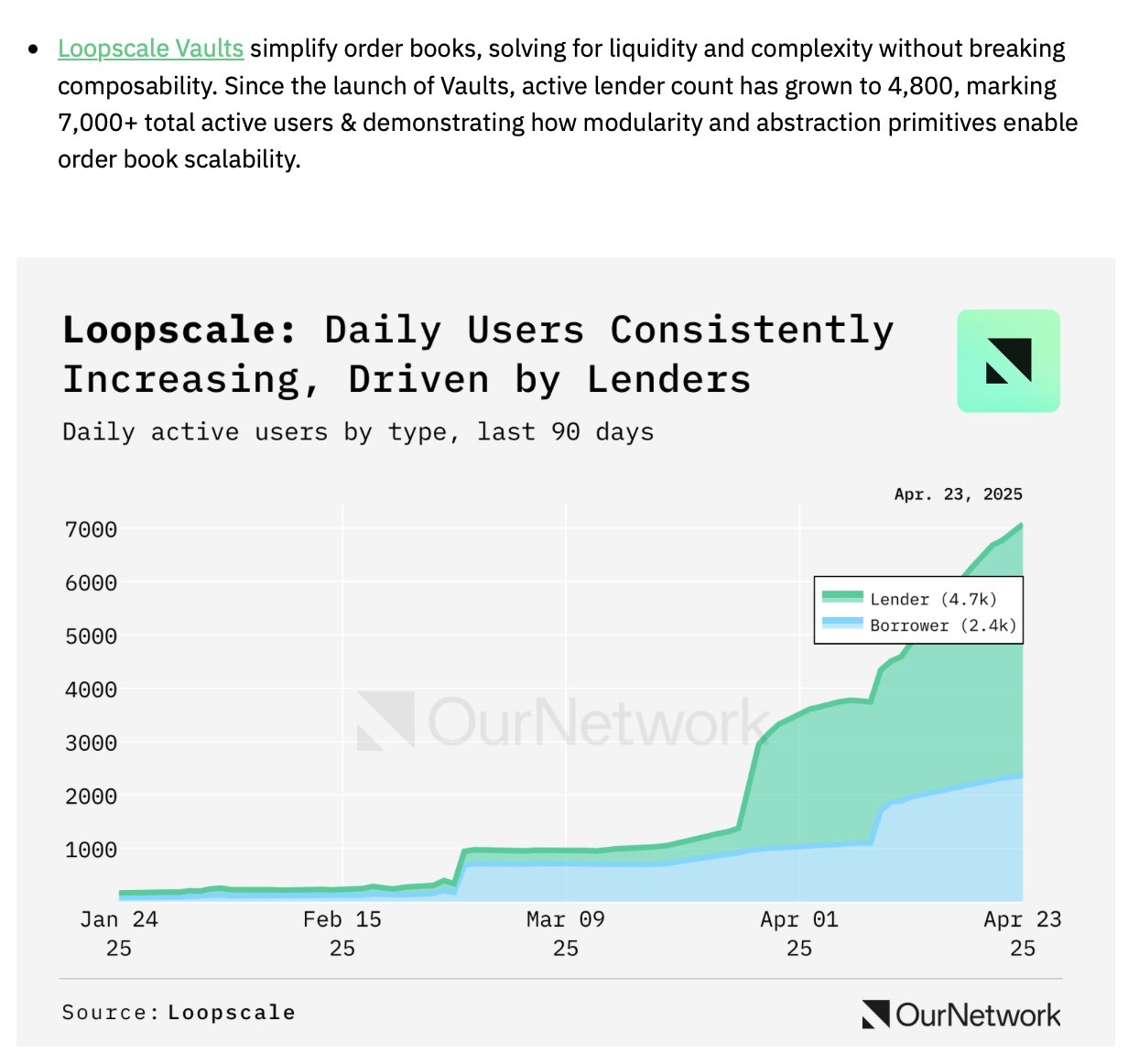

The DeFi procedure has roughly $40 million in TVL and has actually brought in upwards of 7,000 lending institutions, according to scientist OurNetwork.

Publication: Ripple states SEC suit ‘over,’ Trump at DAS, and more: Hodler’s Digest, March 16– 22