Stablecoins are “in a booming market of their own,” even as wise agreement platforms– consisting of Ethereum and Solana– sputter amidst the marketwide tumult, possession supervisor VanEck stated in an April 3 month-to-month note.

The lessened activity on wise agreement platforms shows cooling market belief in cryptocurrencies and beyond as traders brace for the effect of United States President Donald Trump’s sweeping tariff policies and a looming trade war.

However stablecoin adoption– a crucial procedure of Web3’s total health– continues apace. This is partially due to the fact that continuous macroeconomic unpredictability “might speed up the tactical case for crypto,” Matthew Sigel, VanEck’s head of research study, stated in an April 4 X post.

Tokenized treasury costs assist support stablecoin adoption. Source: VanEck

Related: Circle thinks about IPO hold-up amidst financial unpredictability– Report

Stablecoins get steam

Stablecoins jointly included almost $10 billion in overall market capitalization in March as numerous providers, consisting of VanEck, prepare to introduce top quality stablecoin items, it stated.

The inflows continued in spite of a high drop in typical stablecoin yields, the possession supervisor kept in mind.

Stablecoin yields now vary from around 3% to 5%– near or a little listed below Treasury Expenses– compared to as high as 10% at the start of the year, it stated.

However, issuance of tokenized Treasury Expenses– a main source of institutional stablecoin yield– increased 26% from February to March, going beyond $5 billion in overall issuance, according to the report.

Ethereum, Solana decrease

On the other hand, wise agreement platforms suffered across-the-board decreases in activity, with profits and trading volumes dropping 36% and 40%, respectively, according to the report.

Solana has actually suffered especially dramatically. Daily cost profits and decentralized exchange (DEX) volumes lessened by 66% and 53%, respectively, in March, VanEck stated.

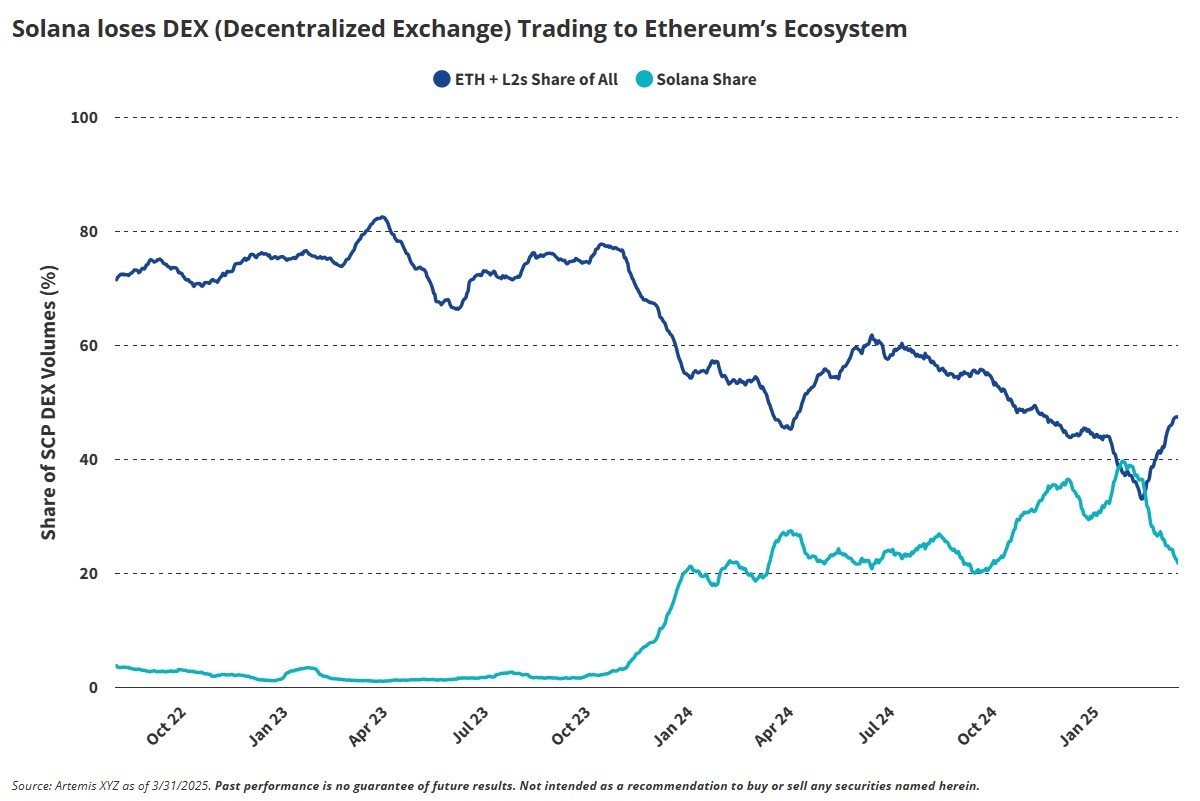

In truth, Solana’s DEX share of volumes as soon as again fell listed below those of Ethereum and its layer-2 scaling chains (L2s) after briefly exceeding them for the very first time in February.

Solana lost ground to Ethereum in DEX volume. Source: VanEck

This relative decrease partially shows a downturn in memecoin trading, which still controls Solana DEX activity.

The section has actually suffered considering that February after a series of memecoin-related scandals soured belief amongst retail traders.

On Feb. 14, Libra, a memecoin relatively backed by Argentine President Javier Milei, removed some $4.4 billion in market capitalization within hours of releasing.

In March, trading volumes on Ethereum’s L2s likewise experienced decreases– backtracking by some 18% from February– however held up much better than Solana’s, according to VanEck.

Throughout the last week of March, “blob costs,” the Ethereum network’s primary income from L2s, sunk to the most affordable weekly levels up until now this year, according to Etherscan.

Publication: 7 ICO options for blockchain fundraising: Crypto airdrops, IDOs & & more