In spite of growing competitors from emerging companies, the stablecoin market stays mostly controlled by a couple of crucial gamers. According to information from Web3 research study company Nansen, Tether’s USDt continues to lead amongst United States dollar-pegged stablecoins, even as competitors magnifies.

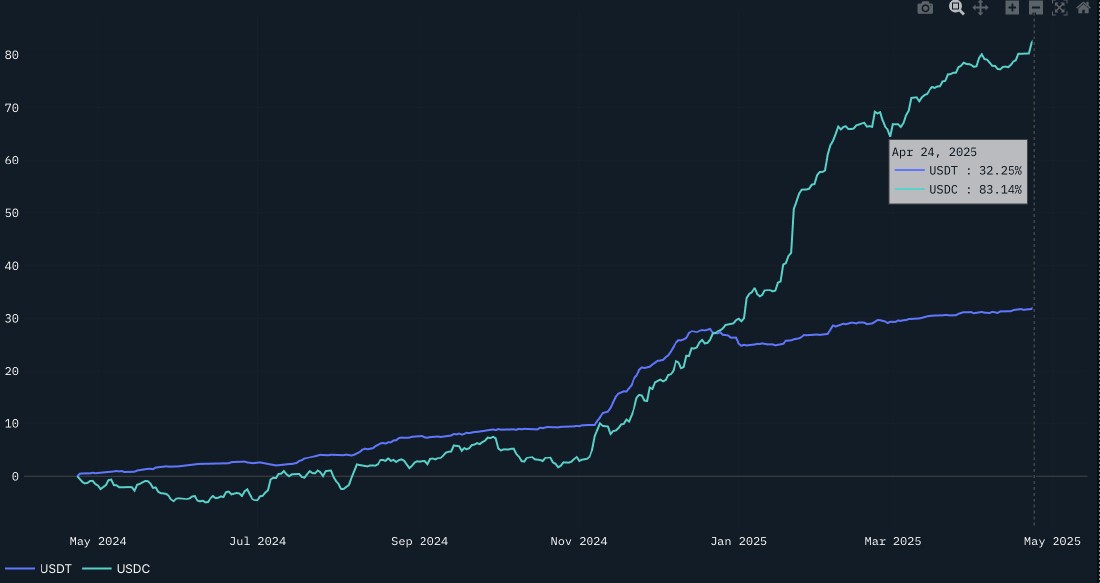

Since April 25, Tether (USDT) has an approximately 66% market share amongst stablecoins, compared to around 28% for USDC (USDC), Nansen stated in the April 25 report. Ethena’s USDe stablecoin ranks a far-off 3rd, promoting a market share of simply over 2%.

Nansen anticipates Tether’s cause withstand even as competitors such as USDC clock faster development rates.

” With almost 3x as lots of users as Uniswap and 50+% more deals than the next app, Tether is by and far the biggest usage case of onchain activity,” Nansen stated.

” In spite of the prospective dispersion in stables, we undoubtedly think this is a ‘winner-takes-most’ market dynamic,” the Web3 scientist included.

Tether is likewise the most lucrative stablecoin company, clocking almost $14 billion in 2024 earnings. The business makes earnings by accepting United States dollars to mint USDT and consequently investing those dollars into extremely liquid, yield-bearing instruments such as United States Treasury expenses.

” Offered the development of USDT and USDC, the users are plainly revealing that they do not always appreciate the yield as they are forgoing it to Tether and Circle -they merely desire access to the most liquid and ‘steady’/ least-likely-to-depeg stablecoin out there,” Nansen stated.

Competitive landscape

Adoption of USDC has actually sped up because November, when United States President Donald Trump’s election triumph introduced a more beneficial United States regulative environment for crypto, Nansen stated.

Circle’s US-regulated stablecoin has actually been “especially appealing to organizations needing regulative clearness,” the report stated.

However USDC now deals with “magnifying competitors as significant standard banks (i.e., Fidelity, PayPal, and banks) get in the marketplace,” Nansen stated, including that stablecoins, consisting of PayPal’s PYUSD and Ripple USD, are “quickly getting traction.”

On April 25, payment processor Stripe tipped strategies to develop a brand-new stablecoin item of its own after purchasing stablecoin platform Bridge in 2015.

In spite of its smaller sized market share, Ethena’s yield-bearing USDe stablecoin stays “competitive on many fronts progressing,” partially due to the fact that of combinations throughout central exchanges (CEXs) and decentralized financing (DeFi) procedures, the report stated.

Considering that releasing in 2024, Ethena’s stablecoin has actually produced a typical annualized yield of around 19%, according to Ethena’s site.

Publication: Bitcoin payments are being weakened by central stablecoins