Why did Fantom transform itself as Sonic?

Fantom was among the leaders of the directed acyclic chart (DAG) style for dispersed journals. It included quickly finality and deal costs of a portion of a cent. Nevertheless, Fantom depended on the Ethereum-derived account storage design and the EVM, which resulted in puffed up storage and sluggish execution times.

To deal with these traffic jams and execute various other updates, the group behind Fantom presented Sonic, a totally independent brand-new blockchain network. A brand-new report by HTX checks out Sonic’s technological background, its brand-new tokenomics design and the developments it gives DeFi.

Download a complete variation of the report free of charge here

Sonic’s technical architecture

Sonic operate on the exclusive SonicVM execution engine, which dynamically equates EVM bytecode into a quicker internal format for faster execution. It likewise enhances heavy calculations to avoid repetitive work and pre-analyzes agreement code to cache legitimate dive locations. The SonicVM is completely suitable with the EVM, indicating that Fantom clever agreements can run effortlessly on the brand-new blockchain.

To deal with the problem of large onchain information storage and sluggish node synchronization, Sonic utilizes a brand-new database style called SonicDB. SonicDB separates the blockchain state into 2 databases. It utilizes the LiveDB for quick access to the present state and execution, and the ArchiveDB for saving complete historic information. This separation permits agreement nodes to cut information storage requirements by as much as 90% and hence considerably minimizes hardware requirements and synchronization time.

For a more thorough description of the technical elements of Sonic, download the complete report free of charge here.

Presenting the S token

The Sonic mainnet is powered by a brand-new native token, S. Holders of FTM can transform their tokens to S at a 1:1 ratio utilizing the main website. S stays non-inflationary over the very first 6 months following the mainnet launch in December 2024. Then, 6% of the preliminary supply will be minted to reward the early users of the blockchain. The complete report provides extensive protection of numerous capital-efficient airdrop farming methods with various threat profiles.

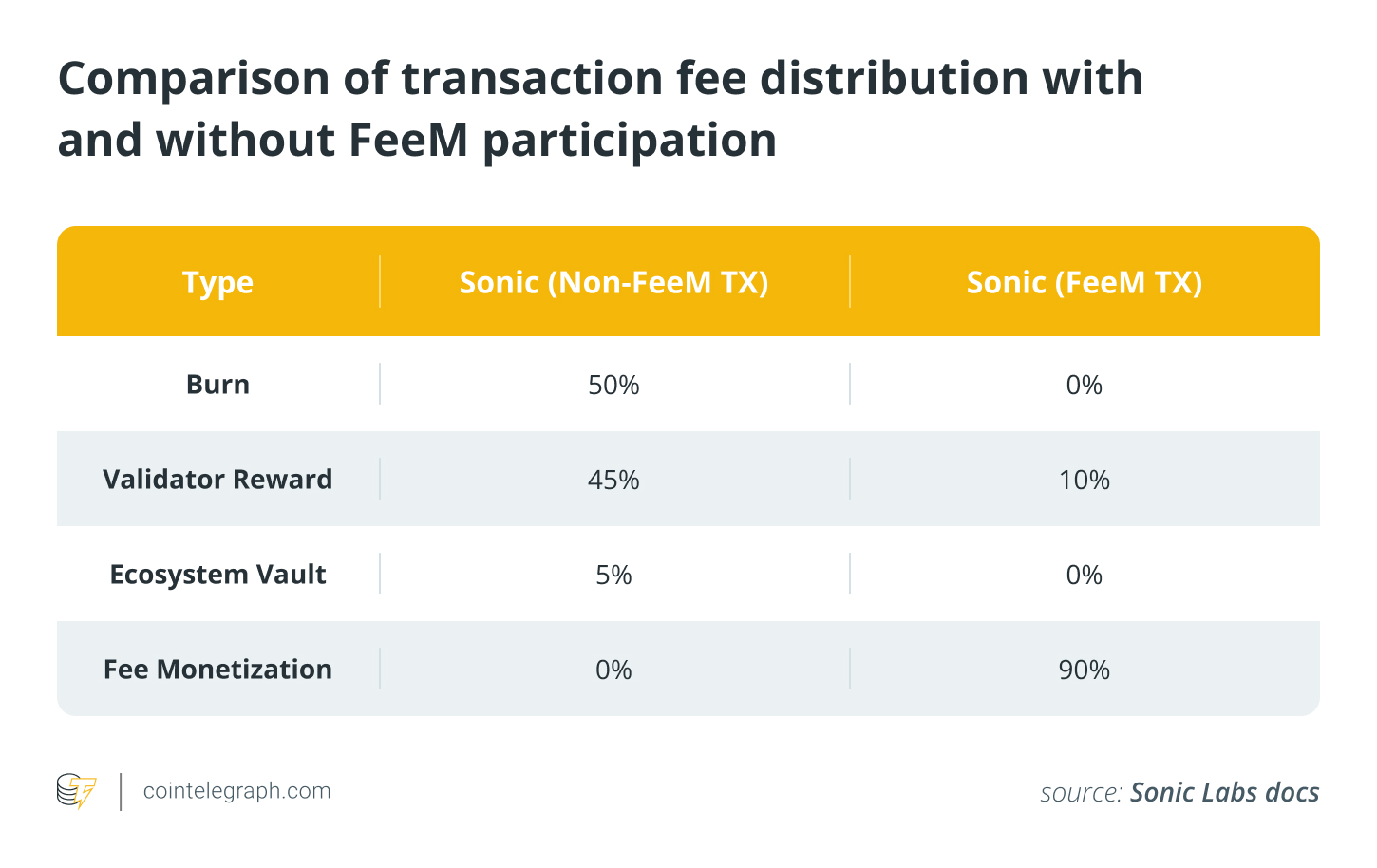

Sonic benefits designers too through its Gas Cost Money Making (FeeM) system. Approximately 90% of the deal costs throughout getting involved applications are forwarded to designers, while the rest is routed to validators.

Ending up being a brand-new center for DeFi

Andre Cronje, among the creators of Fantom and the mastermind behind the Yearn.finance procedure is leading DeFi development on Sonic. Cronje revealed Flying Tulip, a brand-new DeFi platform that integrates trading, liquidity swimming pools and providing performances. The report talks about some developments Flying Tulip gives the Sonic blockchain.

Flying Tulip is based upon the very same principle as Curve v2’s vibrant bonding curve. An AMM with a vibrant bonding curve changes its curvature based upon how close the swimming pool cost is to an external cost observed by an oracle. It likewise instantly focuses the liquidity around the present cost, streamlining liquidity management and enhancing capital effectiveness. Flying Tulip presents even faster stability curve updates and narrower varieties together with other enhancements with an unique vibrant loan-to-value design. To read more about Flying Tulip and its advantages, have a look at the complete Sonic report by HTX:

Download a complete variation of the report free of charge here

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. This post is for basic details functions and is not meant to be and need to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph. Cointelegraph does not back the material of this post nor any item pointed out herein. Readers need to do their own research study before taking any action associated to any item or business pointed out and bring complete obligation for their choices.