Viewpoint by: Annabelle Huang, co-founder and CEO of Altius Labs

For centuries, the world’s traders and speculators have actually pursued something above all else: alpha. Not simply returns, however an edge– a structural benefit that lets them capture worth before everybody else. In contemporary times, they have actually accomplished this through speed and accuracy, typically beating the competitors by simple nanoseconds.

As markets move to blockchain rails, nevertheless, the nature of alpha itself is moving. Future alpha will not originate from co-locating servers beside an exchange or shaving nanoseconds off fiber paths. Rather, it will emerge from utilizing onchain facilities in special methods.

High-frequency trading (HFT) companies developed empires out of physical resourcefulness. Dive purchased property near the Chicago Mercantile Exchange’s information center in Aurora so it might get and transfer faster than its rivals. Beyond place, FPGA chips, custom-made hardware and personal fiber networks have all served the very same function: to offer trading companies as lots of additional benefits as possible.

Because world, alpha was a hardware arms race. The business that crafted much faster connections and smarter routing controlled. As trading significantly moves into blockchain-based environments, physical restrictions liquify. There is no co-location in decentralized financing, offered the decentralized setup. You can’t develop your company right beside, state, a Uniswap server, and even if you could, it would not matter.

Mastering the digital facilities

Today’s validators, sequencers and obstruct manufacturers are the blockchain equivalents of the old matching engines at the CME or Nasdaq. The companies that can affect or enhance this layer will acquire the type of structural edge that as soon as originated from owning tailored trading hardware.

Mastering the brand-new onchain mechanics can take different kinds. For instance, utilizing the very same HFT techniques on a central exchange (CEX) and running validators for a decentralized exchange (DEX) allows you to make the most of rate spaces in between the 2 platforms before the general public even has a possibility to find them.

Latency arbitrage likewise has its blockchain analogue in the kind of optimum extractable worth (MEV), suggesting the revenue chance produced by reordering, consisting of or leaving out deals within a block. We’re speaking, in both cases, about a sort of front-running, however the approaches count on totally various facilities. Procedures like Flashbots and Avoid have actually formalized MEV into structured, auction-based systems that look strangely comparable to the clever order routers of equities trading.

The result is that high-frequency trading companies have the chance to own the rails themselves. In conventional markets, they needed to lease access to exchanges, paying costs for co-location and information feeds. Onchain, they can update the whole system’s mechanics by running validators, creating low-latency remote treatment call nodes, taking part in governance or producing sequencers for rollups, among others concepts.

Related: Institutional adoption deals with blockchain traffic jam

The alpha originates from structure and enhancing the facilities that everybody else depends upon, instead of simply exploiting it.

In lots of methods, this might blur the old border in between market maker, exchange and facilities company. The companies that comprehend how to run throughout all 3 layers will form onchain market microstructure for years to come. This is a location where high-frequency trading companies actually do have a benefit due to the fact that they currently have the engineering culture, the capital and the threat structures to browse this type of surface.

Early movers are exploring

The bridge in between high-frequency trading and blockchain facilities is currently forming, and the names included recognize.

Dive has actually currently leveraged its HFT competence to develop a high-performance validator customer for Solana called Firedancer. Another task backed by Dive, DoubleZero, is intending to generate income from an international personal fiber-optic and subsea cable television network that Dive has actually developed internal to lower latency and boost blockchain bandwidth beyond what the general public web deals.

On The Other Hand, Cumberland is contributing real-time crypto market information for the Pyth Network, a decentralized oracle network. The company likewise supports crypto facilities jobs through its Web3 incubator, Cumberland Labs.

Jane Street just recently employed crypto unicorn Copper’s previous head of facilities architecture, Paul Smith. This might be a tip that the HFT company– which acquired and offered more than $110 billion in cryptocurrencies (consisting of stablecoins) in 2024– has an interest in establishing its own blockchain facilities abilities.

It might appear like HFT companies are tip-toeing around the edges, however these efforts mean an extensive shift: Rather of waiting on the blockchain area to “mature,” Wall Street’s most technically advanced companies are actively assisting it fully grown.

Why go through the effort?

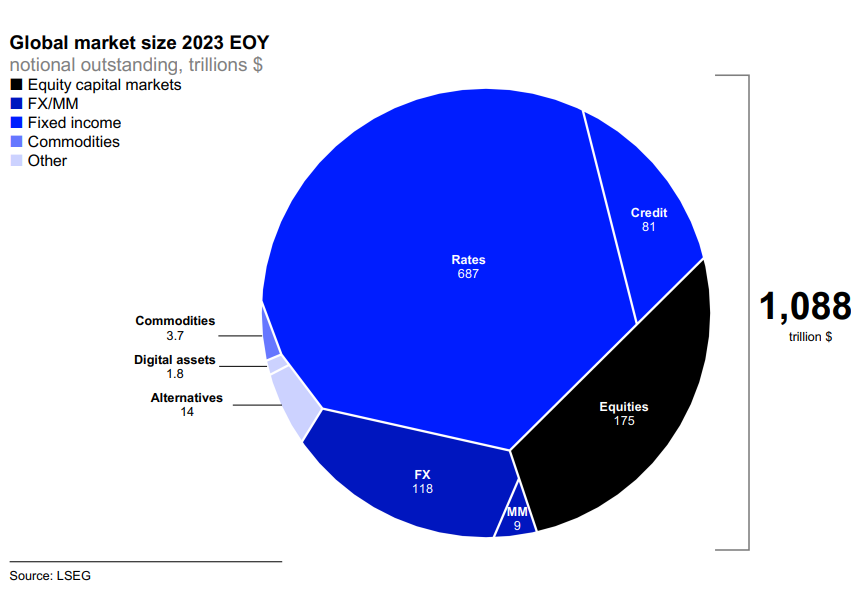

Obviously, there’s still one significant challenge: size. For all of crypto’s development, its markets stay little compared to conventional financing. Nasdaq alone routinely processes over $500 billion in day-to-day volume. The whole crypto area market, at its October peak, touched $230 billion. For a trading company that turns over 10s of billions daily, the economics of redeploying substantial capital into onchain markets is difficult to validate … a minimum of in the meantime.

That restriction is momentary. Stablecoins are gradually injecting genuine liquidity into blockchain systems, and tokenized real-world properties (RWAs) assure to bring far more. Bond settlements, cross-border payments and business money management– when genuine monetary activity moves onchain, the liquidity ceiling vanishes. We might be taking a look at trillions in day-to-day worth transfer within the years.

Doubters will argue that blockchain still does not have the maturity, compliance and dependability that institutional financing needs. They stated the very same aspect of electronic trading in the 1990s. At that time, flooring traders buffooned early algorithmic systems as toys. 20 years later on, almost all trading is electronic, and the companies that dismissed the shift no longer exist.

You understand what they state about history rhyming. The most intelligent gamers on Wall Street acknowledge the tune currently. The next frontier of alpha isn’t concealed inside an information center in Chicago or a cable television running under the Atlantic. It’s ingrained in blockspace– in how it’s produced, purchased and generated income from.

Viewpoint by: Annabelle Huang, co-founder and CEO of Altius Labs.

This viewpoint post provides the factor’s specialist view and it might not show the views of Cointelegraph.com. This material has actually gone through editorial evaluation to make sure clearness and importance, Cointelegraph stays dedicated to transparent reporting and supporting the greatest requirements of journalism. Readers are motivated to perform their own research study before taking any actions connected to the business.

This viewpoint post provides the factor’s specialist view and it might not show the views of Cointelegraph.com. This material has actually gone through editorial evaluation to make sure clearness and importance, Cointelegraph stays dedicated to transparent reporting and supporting the greatest requirements of journalism. Readers are motivated to perform their own research study before taking any actions connected to the business.