Corporations and Wall Street entities are beginning to acknowledge Ether as the next emerging treasury property as the world’s second-largest cryptocurrency and blockchain network commemorates its 10th anniversary on Wednesday.

Ethereum went live on July 30, 2015, presenting clever agreement performance and laying the structure for the decentralized financing (DeFi) community. The network has actually preserved ten years of continuous uptime.

To mark the turning point, Cointelegraph evaluated the 5 biggest business Ether (ETH) holders, highlighting Ether’s increasing status as a tactical reserve property amongst public business.

Publicly-listed Bitcoin (BTC) mining business, BitMine Immersion Technologies, is the biggest ETH treasury company, holding 625,000 ETH or 0.52% of the overall distributing ETH supply. The miner formerly revealed strategies to get approximately 5% of Ether’s supply, signifying more inbound financial investments after the company revealed a $1 billion stock bought program on Tuesday.

In 2nd location is Nasdaq-listed Sharplink, which holds 438,190 ETH as its “main” treasury reserve property. The company bought $290 million worth of Ether in between July 21 and July 27 at a typical rate of $3,756.

Related: Ether Maker taps require with $1.5 B institutional ETH lorry: Financing Redefined

Bit Digital follows as the third-largest business ETH holder, with an overall of 100,603 ETH in its holdings. On July 7, the company revealed its shift to an Ethereum treasury method, that included a $172 million public equity raise and the conversion of its balance sheet from Bitcoin to Ether.

Ethereum node validator BTCS Inc. can be found in 4th location, with 70,028 in overall ETH holdings. BTCS revealed the closing of a $10 million convertible note issuance program on Monday, bringing the company’s overall raised capital to $207 million for 2025 alone.

GameSquare Holdings Inc., a media and tech company, complete the leading 5 with 12,913 ETH. The business has actually allocated $250 million for a more comprehensive crypto treasury management method.

Related: 35 business now hold a minimum of 1,000 Bitcoin as business adoption booms

Wall Street is “heating up” to Ether as a treasury reserve property

According to Gracy Chen, CEO of crypto exchange Bitget, organizations significantly see Ethereum as the next significant digital reserve property.

” Offered the high possibility that the world’s possessions will be tokenized on the blockchain, Ethereum has a competitive benefit in recording a big share of this market,” Chen informed Cointelegraph. “Making use of this, institutional financiers think about Ethereum the next emerging treasury property after Bitcoin.”

” Wall Street companies and the wider TradFi world are simply heating up to the concept of Ethereum as a treasury reserve property,” she included.

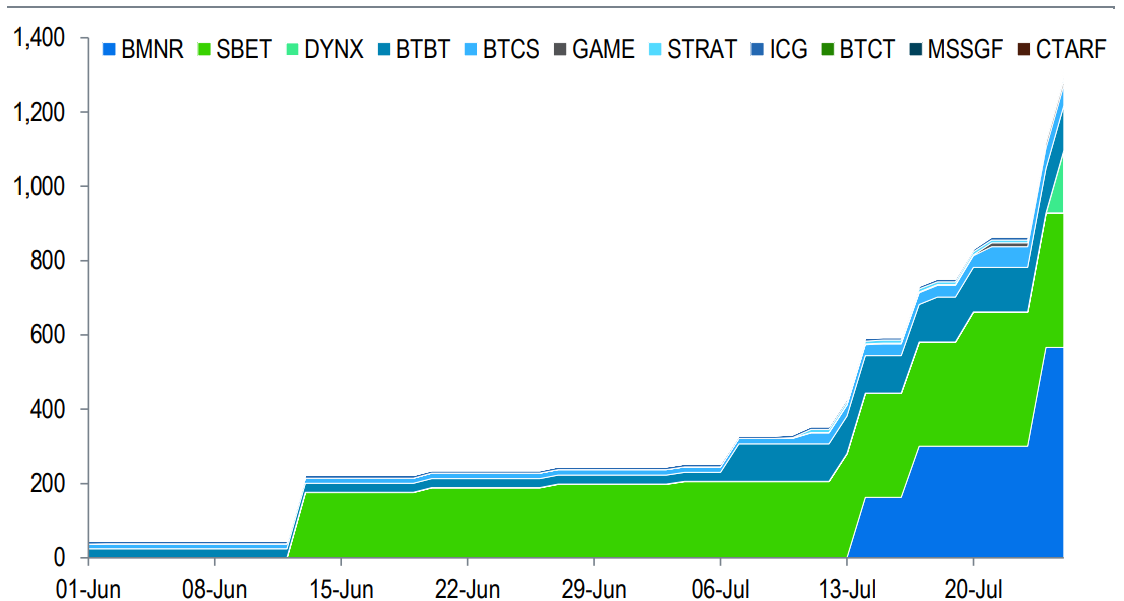

Ether treasury acquisitions have actually sped up greatly in current months. Given that June, crypto treasury companies have actually bought more than 1% of ETH’s distributing supply, surpassing Bitcoin-focused companies throughout the very same duration, according to a report released Tuesday by Requirement Chartered.

The report kept in mind that Ethereum-focused treasury companies might hold up to 10% of the overall supply in the long term, mentioning regulative arbitrage chances and programmable yield by means of staking and DeFi.

Integrated with strong inflows into United States area Ether exchange-traded funds, the ongoing institutional build-up might assist press ETH above the $4,000 level– Basic Chartered’s year-end rate target.

Publication: High conviction that ETH will rise 160%, SOL’s belief chance