The United States federal financial obligation has actually reached a record $37 trillion, fanning to calls that increasing deficits and possible cash supply development might underpin a Bitcoin rally to $132,000 by year’s end.

” Thanks to the One Big Beautiful Costs Act, the financial obligation simply formally passed the $37 trillion mark,” stated Agent Thomas Massie in a Wednesday X post.

The United States deficit has actually increased to its most current record high a month after United States President Donald Trump signed the “One Huge Lovely Costs Act” into law on July 4, which he stated would cut as much as $1.6 trillion in federal costs.

Experts stated swelling deficits can ultimately trigger looser policy, consisting of quantitative easing, which is massive bond purchases by reserve banks that inject liquidity into the monetary system.

Bitcoin supporters argue that a growing cash supply and increasing inflation issues might result in a restored acknowledgment of Bitcoin’s (BTC) financial shortage, pressing the world’s very first cryptocurrency to brand-new all-time highs.

Related: Bitcoin’s business boom raises ‘Fort Knox’ nationalization issues

Experts describe course to $132,000

United States Treasury information reveals that United States financial obligation skyrocketed from $26.7 trillion in 2020 to over $37 trillion, marking a 38% boost in simply 5 years.

Bitcoin increased over 925% throughout the exact same duration, with its historical cost development “straight associated” with United States financial obligation, according to Ryan Lee, primary expert at Bitget crypto exchange.

” Eventually, this will affect the American financial system as a substantial quantity of money will be released into servicing this financial obligation,” he stated.

” The more the financial obligation grows, the greater the probability of BTC cost skyrocketing to brand-new highs.”

Additionally, the United States federal government might likewise begin checking out Bitcoin to repair its “huge nationwide financial obligation,” stated Lee, including that the “chances are stacked in favor of Bitcoin.”

Elon Musk likewise slammed the costs costs in a June 5 X post, alerting that it would “increase the deficit to $2.5 trillion.”

Related: BTCFi VC financing strikes $175M as financiers concentrate on customer apps

Servicing the financial obligation might likewise result in a boost in the worldwide M2 cash supply, which might be the next substantial driver for Bitcoin’s cost.

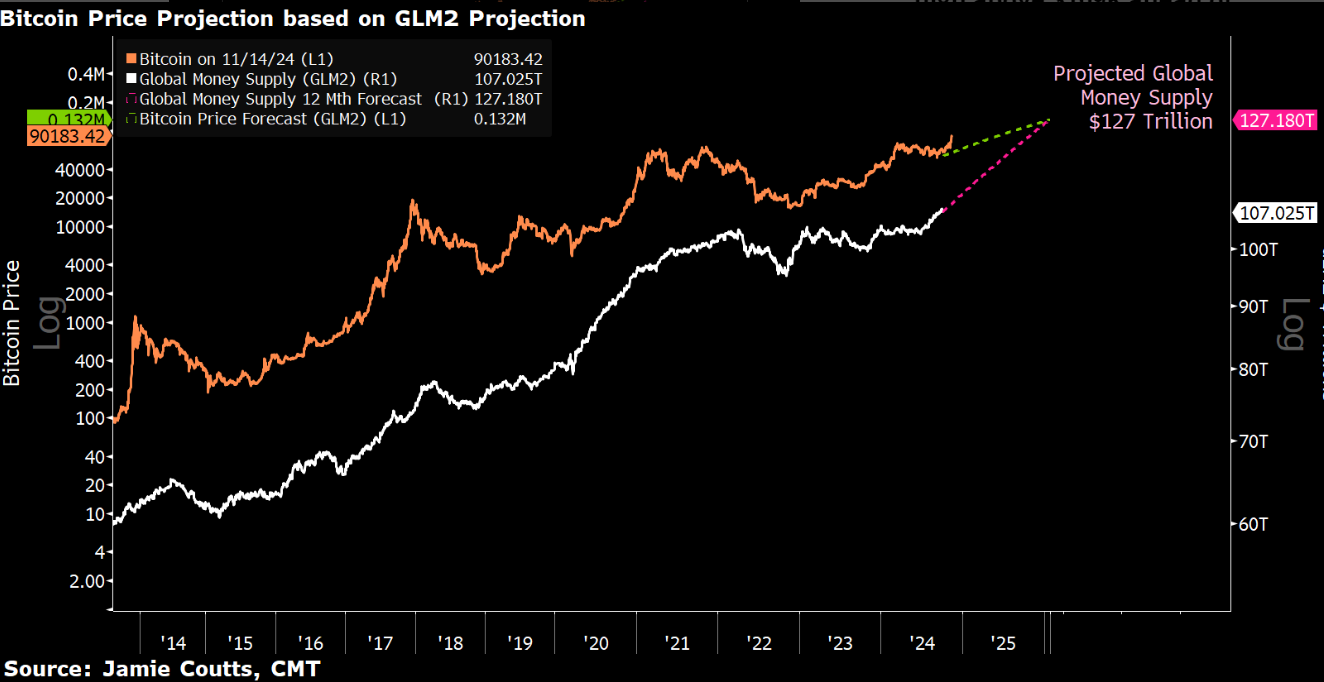

Based upon its connection with BTC, the growing cash supply might press Bitcoin above $132,000 before completion of 2025, according to price quotes from Jamie Coutts, primary crypto expert at Genuine Vision.

The growing inflation and boost in M2 cash supply might catalyze Bitcoin’s rally to the $132,000 high before completion of 2025, based upon its connection with the fiat supply.

Still, this price quote stays modest compared to viewpoints shared by Arthur Hayes, co-founder of BitMEX and primary financial investment officer at Maelstrom, who anticipated Bitcoin might reach $250,000 if the United States Federal Reserve rotates to QE, due to growing inflationary pressures.

Publication: Bitcoin OG Willy Woo has actually offered the majority of his Bitcoin– Here’s why