Intensifying trade stress and restored unpredictability in international markets are driving financiers towards alternative properties, consisting of Bitcoin and tokenized real-world properties (RWAs), as issues install over the long-lasting stability of the monetary system.

International trade stress continue pushing financier belief in spite of United States President Donald Trump revealing a 90-day time out on greater mutual tariffs on April 9, going back the tariffs to the 10% standard for a lot of nations.

At the very same time, Trump intensified his tariffs on Chinese items from 104% to 125%, the Financial Times reported on April 9.

” President Trump’s tariff escalation marks a considerable inflection point for international markets,” a relocation that signifies “more than a trade difference,” stated Teddy Pornprinya, co-founder of Plume, a layer-1 blockchain concentrated on tokenized real-world properties. He included:

” It exposes much deeper fractures in the international financial system.”

With both the United States and China facing what he referred to as unsustainable financial obligation levels, Pornprinya cautioned of increased dependence on inflationary tools, consisting of the possible devaluation of the Chinese yuan.

” These characteristics will evaluate the strength of every property class” and motivate higher adoption for tokenized credit and personal yield items that “aren’t exposed to sovereign decline video games,” he stated.

Related: Bitcoin ETFs lose $326M amidst ‘progressing’ vibrant with TradFi markets

The tariff fears led tokenized gold trading volume to rise to a two-year high today, topping $1 billion for the very first time because the United States banking crisis in 2023, Cointelegraph reported on April 10.

Leading tokenized gold properties, trading volume. Source: CoinGecko, Cex.io

Onchain real-world properties (RWAs) likewise went beyond the $20 billion all-time high up on April 9, with tokenized personal credit representing the lion’s share, or $12.7 billion of overall RWA worth, according to information from RWA.xyz.

RWA international market control panel. Source: RWA.xyz

Some market watchers stated that Bitcoin’s absence of advantage momentum might drive RWAs to a $50 billion all-time high before completion of 2025, as their increased liquidity will assist RWAs draw in a considerable share of the $450 trillion international property market.

Related: Bitcoin’s safe-haven appeal grows throughout trade war unpredictability

Tariffs are “United States bargaining tool,” not enduring policy shift

Regardless of financier issues, experts at crypto exchange Bitfinex stated the tariff walking might not represent a long-lasting policy shift.

” Our company believe, nevertheless, that the danger of tariffs by the present United States administration is a working out tool to be utilized to encourage other nations to lower tariffs on American produced items and services and are not likely to end up being long-term policy,” they informed Cointelegraph.

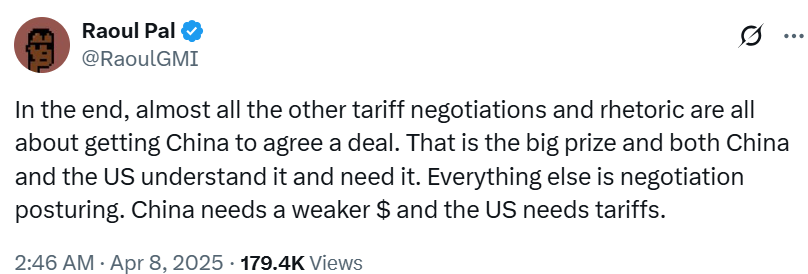

Source: Raoul Buddy

Raoul Buddy, creator and CEO of International Macro Financier, likewise stated that the tariff settlements might just be “posturing” for the United States to reach an arrangement with China.

The tone of the settlements might determine the healing of international danger properties, consisting of the crypto market which has a 70% opportunity to bottom by June 2025 before recuperating, Nansen experts forecasted.

Publication: Bitcoin ATH faster than anticipated? XRP might drop 40%, and more: Hodler’s Digest, March 23– 29