A blockchain platform connected with United States President Donald Trump has actually invested $10 million in Falcon Financing to support the advancement of stablecoin facilities, the business stated Wednesday.

The financial investment intends to enhance liquidity and interoperability in between 2 stablecoins: Falcon USD (USDf) and World Liberty Financial USD (USD1), a token released by the Trump-linked World Liberty Financial (WLFI) platform in March.

Falcon Financing will utilize the $10 million financial investment to construct shared liquidity, multichain compatibility and fast conversion facilities in between USDf and USD1, the business stated.

The USD1 token, related to Trump’s kid Eric, will likewise be utilized as security on Falcon Financing.

In May, USD1 was utilized to settle MGX’s $2 billion financial investment into Binance Exchange, according to a statement by Eric Trump throughout a panel conversation at Token2049 in Dubai.

Related: Trump’s WLFI tripled Ether holdings in a week in the middle of market recession

The collaboration looks for to produce a “more robust and versatile digital dollar facilities” for both retail and institutional individuals, stated Zak Folkman, co-founder of World Liberty Financial.

Folkman included that Falcon’s overcollateralized design, integrated with USD1’s reserve-backed structure, will assist provide a reputable artificial dollar option for worldwide retail and institutional usage.

Falcoon Financing’s artificial dollar procedures accept a series of security properties under its overcollateralized design. USD1’s one-to-one redeemability and reserve support intends to match Falcon’s artificial dollar offering as an extra security possession.

Cointelegraph was not able to separately confirm the $10 million financial investment.

The statement comes 3 weeks after Falcon’s USDf dropped listed below its desired $1 peg to as low as $0.9783 on July 8, developing financier issues over the artificial overcollateralized stablecoin’s security quality. USDf restored its dollar parity by July 14.

The WLFI platform’s USD1 likewise lost its dollar peg, being up to $0.9954 on Tuesday. The stablecoin has actually up until now been not able to restore dollar parity and traded at $0.9993 at the time of composing, CoinMarketCap information programs.

Related: Solana reveals 2027 roadmap to lead web capital markets

Could the Trump family-linked crypto endeavors make complex crypto legislation?

The Trump-family-linked stablecoin is seeing growing energy in the crypto area. Yet, some market watchers are worried that the Trump family-linked blockchain platform’s growing participation in the crypto area might make complex the passage of emerging United States blockchain legislation.

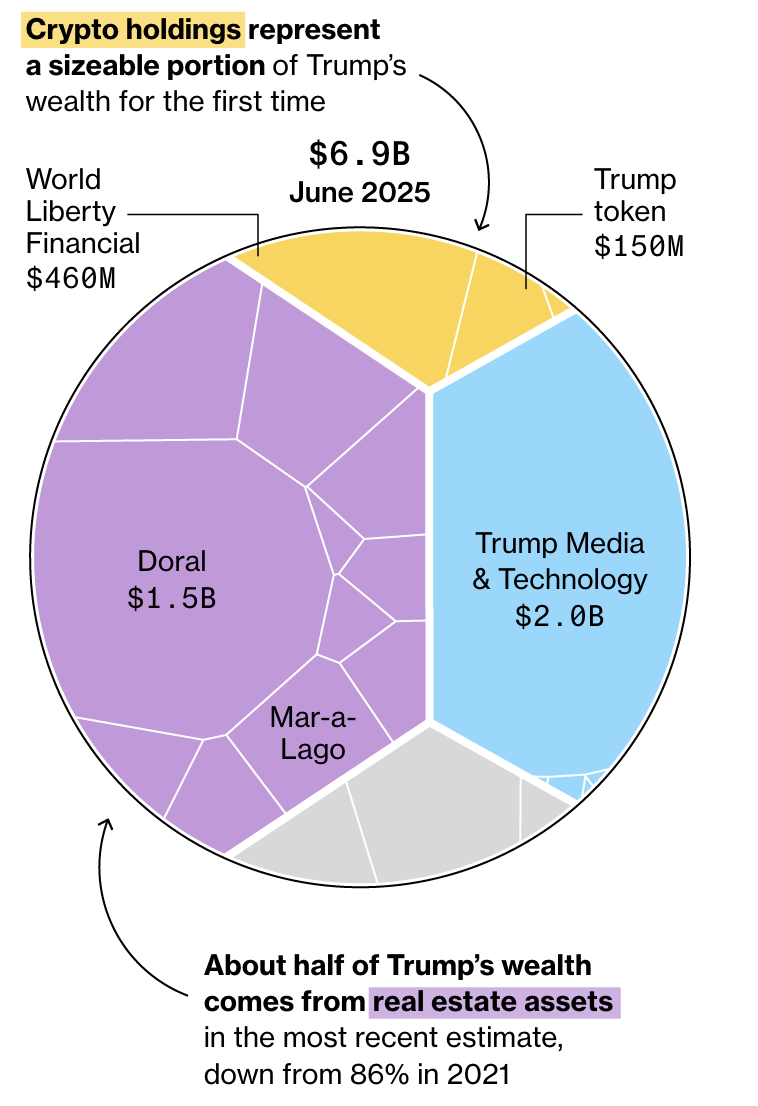

According to a Bloomberg report, crypto-related endeavors have actually included a minimum of $620 million to Trump’s over $6 billion net worth.

On the other hand, political department is deepening over crypto legislation in the United States Congress after some leading Democratic Celebration members in your house of Representatives revealed a cumulative effort to oppose Republican efforts to pass what they called “hazardous” legislation.

“[Republicans are] doubling down by fast-tracking a hazardous bundle of crypto legislation through Congress,” stated Home Financial Provider Committee ranking member Maxine Waters.

Waters particularly slammed the Anti-CBDC Monitoring State Act– a Republican-backed costs that would restrict the launch of a United States reserve bank digital currency– and the clearness Act, which looks for to specify the structure of digital possession markets.

” Aside from doing not have urgently required customer securities and nationwide security guardrails, these costs would make Congress complicit in Trump’s unmatched crypto fraud,” she stated.

Publication: Trump’s crypto endeavors raise dispute of interest, expert trading concerns