While the majority of experts anticipate the crypto bull cycle to continue till completion of 2025, issues over a financial recession in the United States, together with crypto’s “circular” economy, might still threaten crypto evaluations.

In spite of the current market correction, most crypto experts anticipate the bull cycle to peak after the 3rd quarter of 2025, with Bitcoin (BTC) cost forecasts varying from $160,000 to above $180,000.

Beyond external issues, such as a prospective economic crisis on the planet’s biggest economy, crypto’s most significant industry-specific threat is the “circular” nature of its economy, according to Arthur Breitman, the co-founder of Tezos.

” Within the market, the primary threat is that the market is still quite looking for grounding. It’s all still really circular,” Breitman informed Cointelegraph.

” If you take a look at DeFi, for instance, the point of financing is to fund something […], however if the only thing that DeFi financial resources is more DeFi, then that’s circular,” stated Breitman, including:

” If the only factor individuals wish to purchase your token is since they feel other individuals will wish to purchase this token, that’s circular.”

This remains in plain contrast to the stock exchange, which is “developed on revenue-generating companies,” making the crypto market’s “absence of grounding” among the primary market risks, Breitman included.

Other market experts have actually likewise slammed the state of the crypto economy, particularly associated to the most recent memecoin crises, which are siphoning liquidity from more recognized cryptocurrencies.

Solana outflows. Source: deBridge, Binance Research study

Solana was struck by over $485 million worth of outflows in February after the current wave of memecoin carpet pulls activated a financier flight to “security,” with a few of the capital streaming into memecoins on the BNB Chain, such as the Broccoli memecoin, influenced by the Changpeng Zhao’s pet.

Related: Increasing $219B stablecoin supply signals mid-bull cycle, not market leading

United States economic crisis worries are crypto’s most significant external threat: Tezos co-founder

Beyond industry-specific occasions, bigger macroeconomic issues, consisting of a prospective United States economic crisis, threaten conventional and cryptocurrency markets.

” In regards to macro occasions, I still believe we might see an economic crisis,” stated Breitman, including:

” There’s a great deal of bullish winds for the marketplace, however there’s likewise a great deal of conventional economic crisis signs which have actually been flashing for a while now. So I do not believe you can rule it out.”

Cryptocurrency markets still sell considerable connection with tech stocks, suggesting that an economic crisis will trigger an extensive sell-off, he included.

Related: Libra, Melania developer’s ‘Wolf of Wall Street’ memecoin crashes 99%

The existing trade war issues, driven by United States President Donald Trump’s import tariffs and continued vindictive steps, have actually reignited issues over a prospective economic crisis.

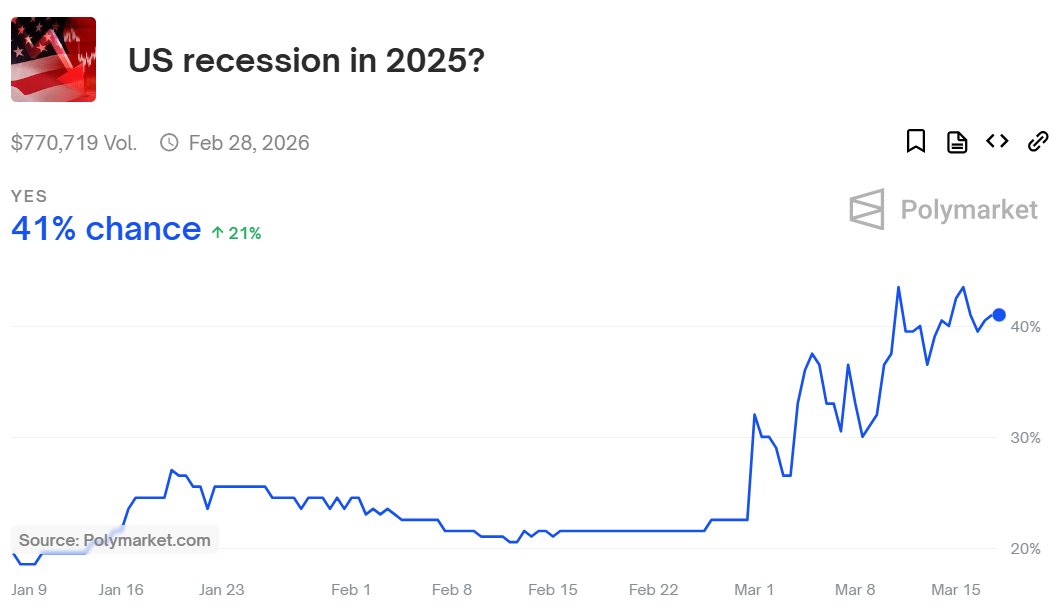

Source: Polymarket

Over 40% of market individuals anticipate an economic crisis in the United States this year, up from simply 22% a month back on Feb. 17, according to the biggest decentralized forecasts market, Polymarket.

Publication: Crypto fans are consumed with durability and biohacking: Here’s why