Ethena’s synthetic-dollar stablecoin USDe saw among its sharpest month-to-month contractions yet, while fiat-backed stablecoins consisting of USDT, USDC and PYUSD brought in billions in inflows.

CoinGecko information revealed that Ethena’s USDe stablecoin fell from a market capitalization of $9.3 billion on Nov. 1 to $7.1 billion on Nov. 30. The token saw about $2.2 billion in redemptions, marking a 24% decrease in supply in November.

Ethena’s USDe is an artificial stablecoin that preserves its dollar peg through trading methods with crypto and futures agreements instead of holding real dollars. USDe outflows suggest that users are either offering USDe on the free market, withdrawing from swimming pools or relaxing their positions on decentralized applications (DApps).

At the time of composing, CoinGecko information reveals that the general stablecoin market cap is at $311 billion. The marketplace stays controlled by United States dollar stablecoins, catching $303 billion of the sector’s overall evaluation.

USDe outflows follow October depeg

USDe’s November contraction comes weeks after the artificial stablecoin suffered a depegging occasion on the crypto exchange Binance. At the time, USDe briefly plunged to $0.65 on the exchange.

Ethena creator Guy Young stated that the drop was triggered by a Binance-specific oracle problem and not an issue with USDe’s underlying security system that backs the possession.

Young stated that the USDe token’s minting and redemption functions ran “completely” throughout the event, with about 2 billion tokens redeemed throughout decentralized financing (DeFi) platforms.

On Oct. 9, USDe market cap hovered at $14.8 billion, making it the third-largest stablecoin at the time. Ever since, it has actually lost over 53% of its market capitalization.

At the time of composing, CoinGecko information reveals that USDe has an overall evaluation of $6.9 billion, dropping it to the 4th area in the stablecoin market cap rankings.

Related: Legislators find stablecoin terms as United States Congress grills Fed’s Bowman

Fiat-backed stablecoins increased by $3.2 billion in November

While the synthetic-dollar stablecoin had a hard time throughout the month, fiat-backed stablecoins tape-recorded modest however stable gains over the very same period.

Tether’s USDt (USDT) saw a $1.3 billion boost to $184.6 billion, while Circle’s USDC (USDC) reached $76.5 billion, including approximately $600 million to its supply.

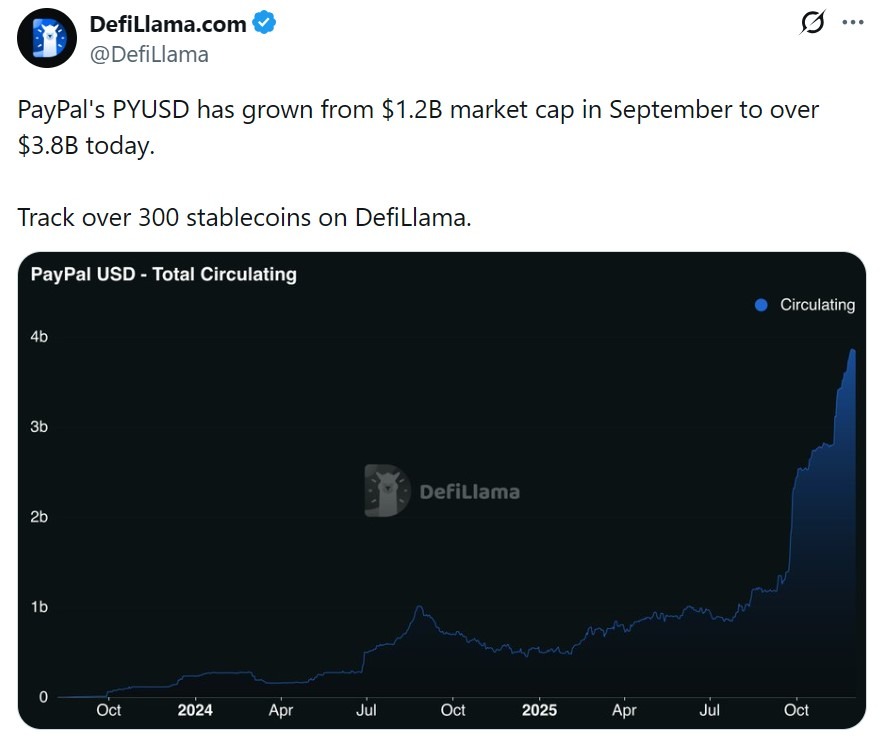

PayPal USD (PYUSD) published the greatest development amongst the significant dollar-pegged stablecoins, leaping from $2.8 billion to $3.8 billion in November. This marks 1 billion inflow for the month, a 35% month-on-month development.

DefiLlama information revealed that the PayPal PYUSD stablecoin broadened by over 216% given that September, when it had a market cap of $1.2 billion. This represents a $2.6 billion boost in simply 3 months.

Ripple’s (RLUSD) stablecoin, which breached a market capitalization of $1 billion for the very first time in November, continued its development throughout the month.

According to CoinGecko, RLUSD went from a $960 million market cap on Nov. 1 to a market cap of $1.26 billion on Nov. 30, marking a $300 million boost.

Publication: China formally dislikes stablecoins, DBS trades Bitcoin choices: Asia Express