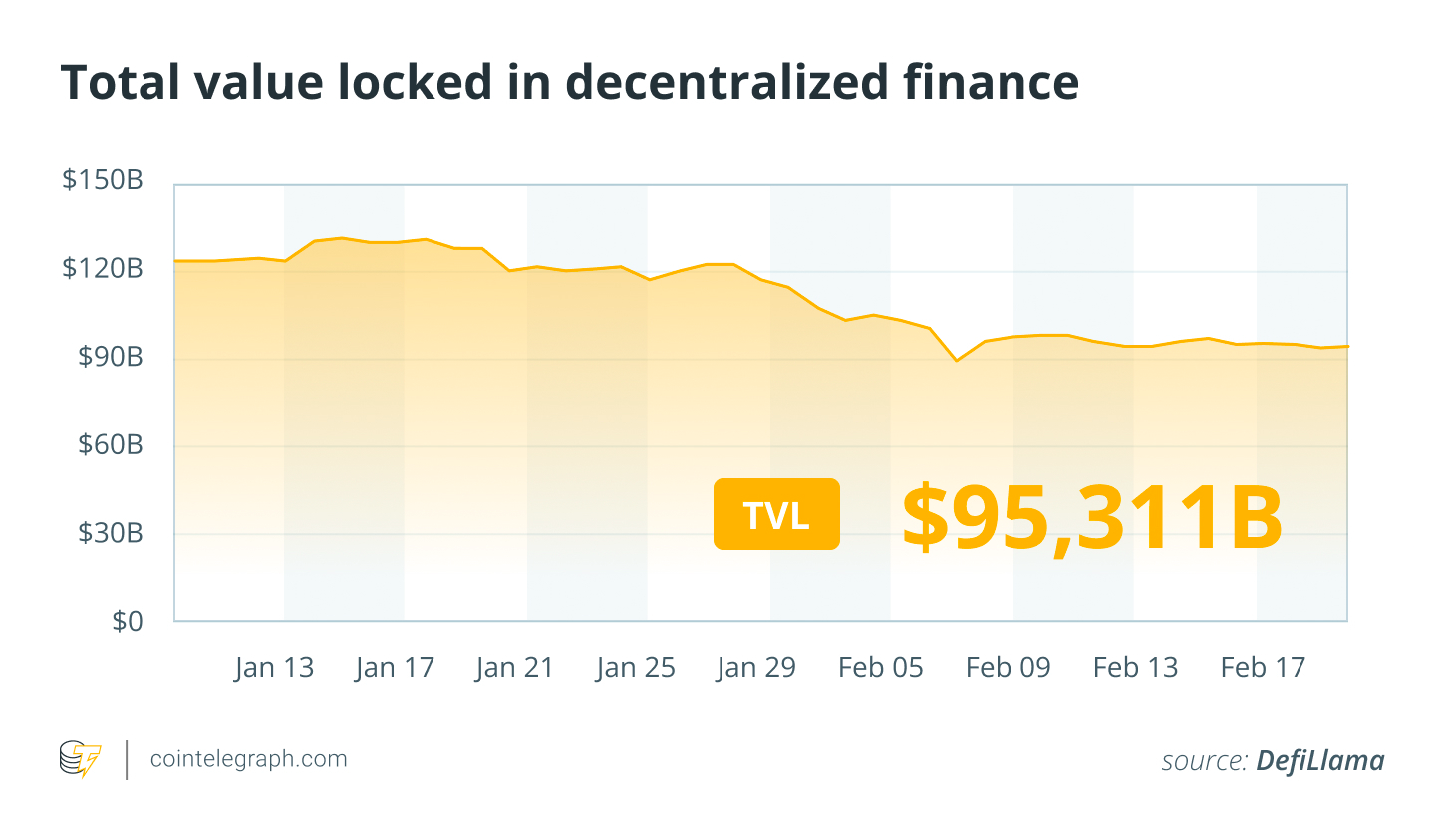

Big institutional financiers continued to include direct exposure to crypto treasury business over the previous week, even as bear-market illiquidity required another round of shakeouts throughout decentralized financing (DeFi).

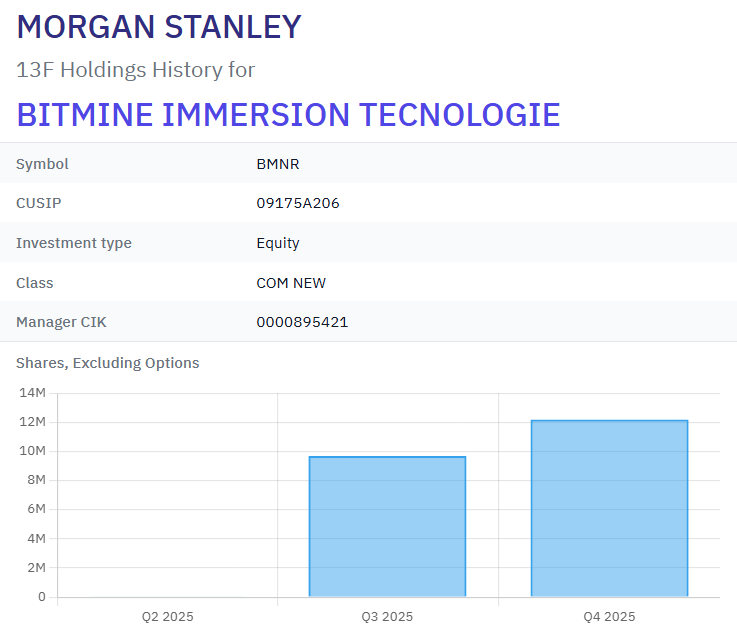

The greatest business investors of Bitmine Immersion Technologies, consisting of Morgan Stanley and Bank of America, increased direct exposure to the Ether (ETH) treasury business throughout Q4 2025 in spite of a wider market sell-off.

Still, continuous bear-market illiquidity is requiring some procedures to unwind operations, with DeFi lending institution ZeroLend closing down. Crypto analytics platform Parsec has actually likewise shuttered, pointing out crypto market volatility as the primary factor.

On The Other Hand, Bitcoin (BTC) and ETH each increased about 2.6% throughout the previous week, amidst installing outflows from United States area Bitcoin exchange-traded funds (ETFs), which logged 3 successive days of offering leading up to Thursday’s $165 million outflow, Farside Investors information programs.

Ether ETFs began the week with $48 million in inflows on Tuesday, however reversed to log 2 succeeding days of outflows, consisting of $41 million in outflows on Wednesday and $130 million on Thursday.

Morgan Stanley, other leading holders include Bitmine direct exposure amidst sell-off

The biggest investors of Bitmine Immersion Technologies (BMNR) stock increased their financial investments in the leading Ethereum treasury business in the 4th quarter of 2025 in spite of a broader crypto market crash and bad stock rate efficiency.

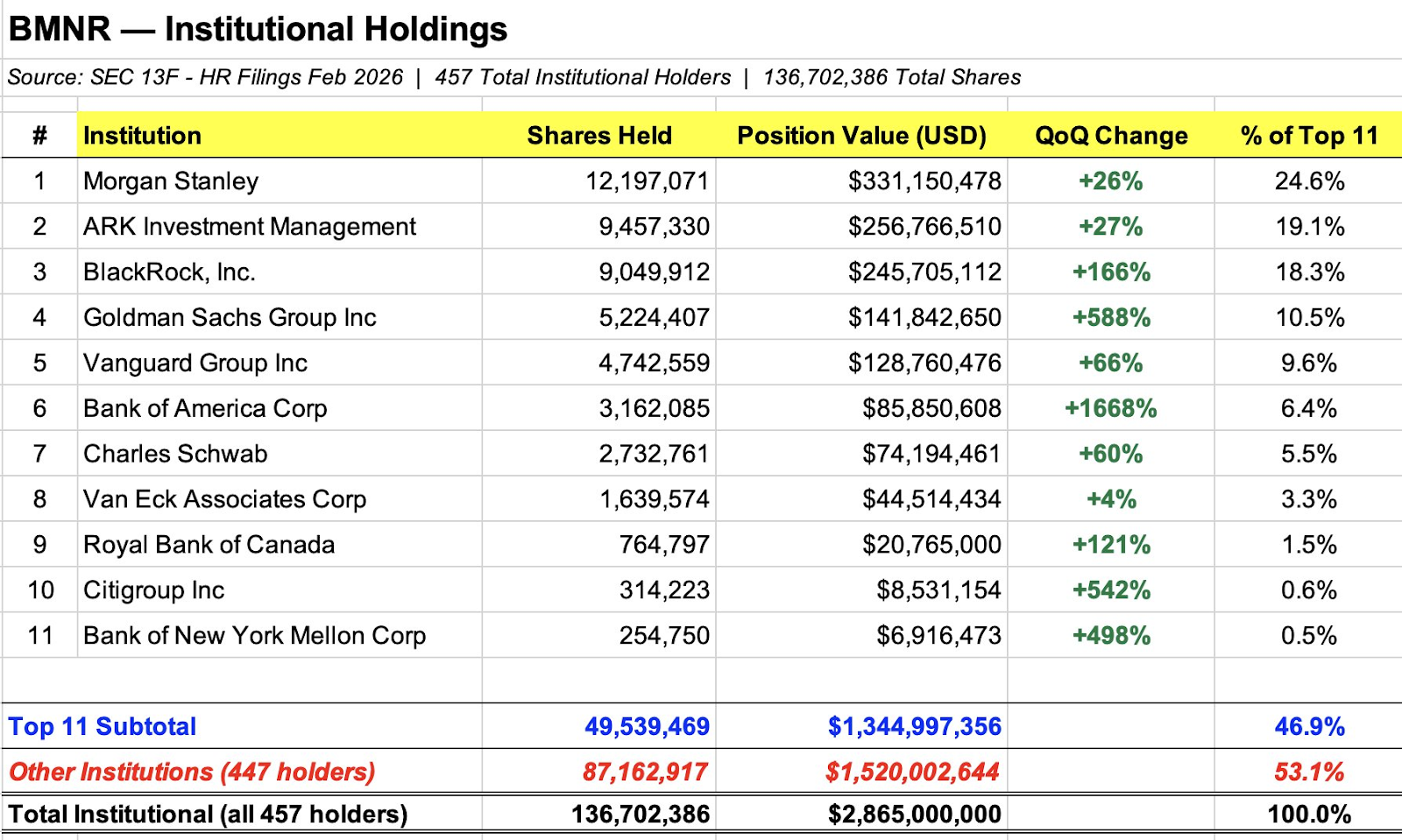

Morgan Stanley, the top reported holder, increased its position by about 26% to more than 12.1 million shares, valued at $331 million at the quarter’s end, according to its Kind 13F filing with the United States Securities and Exchange Commission. ARK Financial Investment Management, the second-biggest holder, increased its stake by about 27% to more than 9.4 million shares worth $256 million, its filing programs.

Numerous other leading institutional holders likewise increased direct exposure. BlackRock increased its BMNR holdings by 166%, Goldman Sachs by 588%, Lead by 66% and Bank of America by 1,668%.

Wall Street includes BMNR direct exposure in spite of 48% stock slide

Each of the leading 11 biggest investors increased direct exposure to BMNR throughout Q4 of 2025, consisting of Charles Schwab, Van Eck, Royal Bank of Canada, Citigroup and the Bank of New York City Mellon Corporation, according to main filings assembled by crypto financier Collin.

The build-up came in spite of a sharp drop in Bitmine’s share rate. BMNR fell about 48% in the 4th quarter of 2025 and about 60% over the previous 6 months, trading near $19.90 in premarket action Thursday, according to Google Financing.

Continue reading

DeFi lending institution ZeroLend closes down, blames illiquid chains

Decentralized financing procedure ZeroLend stated it is closing down totally after the blockchains it runs on experienced low user numbers and liquidity.

” After 3 years of structure and running the procedure, we have actually made the tough choice to unwind operations,” ZeroLend’s creator, understood just as “Ryker,” stated in a post the procedure shared to X on Monday.

” In spite of the group’s ongoing efforts, it has actually ended up being clear that the procedure is no longer sustainable in its present type,” he included.

ZeroLend focused its services on Ethereum layer-2 blockchains, when promoted by Ethereum co-founder Vitalik Buterin as a main part of the network’s strategy to scale and stay competitive.

Nevertheless, Buterin stated previously this month that his vision for scaling with layer twos “no longer makes good sense,” that numerous have actually stopped working to correctly embrace Ethereum’s security, which scaling must significantly originate from the mainnet and native rollups.

Continue reading

DerivaDEX debuts Bermuda-licensed derivatives DEX

DerivaDEX has actually introduced a Bermuda-licensed crypto derivatives platform, becoming what it states is the very first DAO-governed decentralized exchange to run under official regulative approval.

According to a declaration from the platform, the exchange got a T license from the Bermuda Monetary Authority and has actually started using crypto continuous swaps trading to a restricted variety of innovative retail and institutional individuals.

The BMA’s T, or test license, is provided for a digital property organization looking for to evaluate an evidence of idea.

At launch, DerivaDEX supports significant crypto continuous items and stated it prepares to broaden into extra markets, consisting of forecast markets and standard securities. The business stated the platform integrates offchain order matching with onchain settlement to Ethereum, while permitting users to keep non-custodial control of funds.

Continue reading

Parsec closes down amidst continuous crypto market volatility

Onchain analytics business Parsec is shutting down after 5 years, as crypto trader streams and onchain activity no longer resemble their previous setups.

” Parsec is closing down,” the business stated in an X post on Thursday, while its CEO, Will Sheehan, stated the “market zigged while we zagged a couple of a lot of times.”

Sheehan included that Parsec’s main concentrate on decentralized financing and non-fungible tokens (NFTs) fell out of action with where the market has actually now headed.

” Post FTX DeFi area financing utilize never ever actually returned in the exact same method, it altered, changed into something we comprehended less,” he stated, including that onchain activity altered in a manner he never ever comprehended.

NFT sales reached about $5.63 billion in 2025, a 37% drawdown from the $8.9 billion taped in 2024. Typical list price likewise decreased year-on-year, being up to $96 from $124, according to CryptoSlam information.

Continue reading

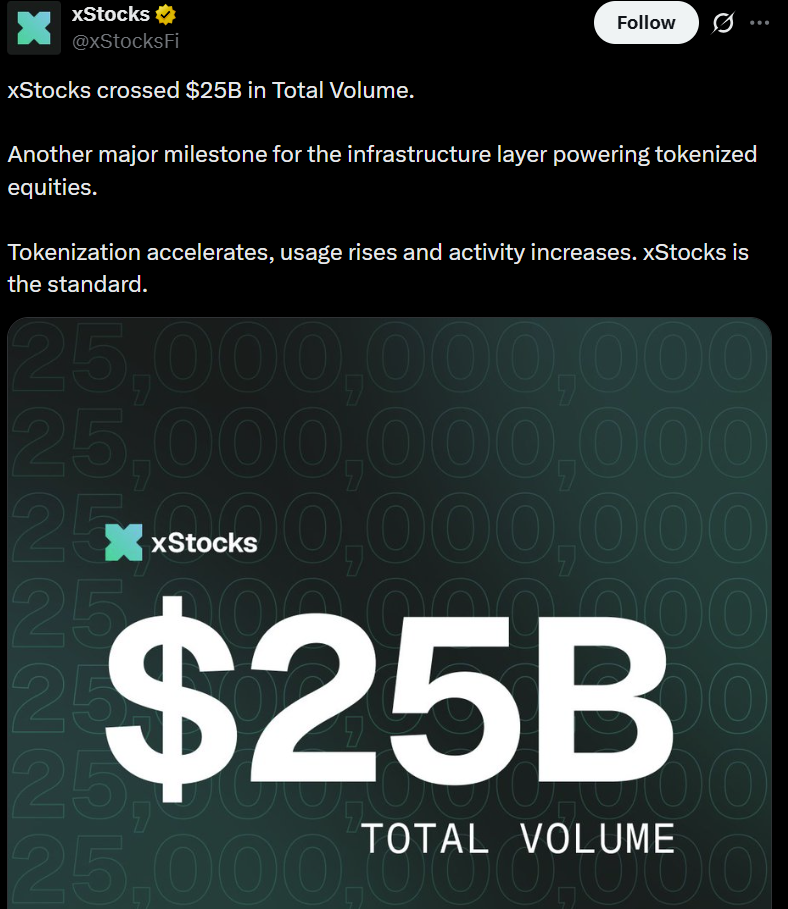

Kraken’s xStocks tops $25 billion in volume with more than 80,000 onchain holders

Kraken’s tokenized equities platform, xStocks, has actually exceeded $25 billion in overall deal volume less than 8 months after launch, highlighting speeding up adoption as tokenization gains traction amongst traditional financiers.

Kraken divulged Thursday that the $25 billion figure consists of trading throughout central exchanges and decentralized exchanges, in addition to minting and redemption activity. The turning point represents a 150% boost considering that November, when xStocks crossed $10 billion in cumulative deal volume.

The xStocks tokens are provided by Backed Financing, a regulated property company that produces 1:1 backed tokenized representations of openly traded equities and exchange-traded funds. Kraken functions as a main circulation and trading location, while Backed is accountable for structuring and releasing the tokenized instruments.

When xStocks debuted in 2025, it used more than 60 tokenized equities, consisting of shares connected to significant United States innovation business like Amazon, Meta Platforms, Nvidia and Tesla.

Kraken stated onchain activity has actually been a crucial development chauffeur considering that launch, with xStocks producing $3.5 billion in onchain trading volume and going beyond 80,000 distinct onchain holders.

Unlike trading that takes place exclusively within central exchanges’ internal order books, onchain activity happens straight on public blockchains, where deals are transparent and wallets can self-custody possessions.

Growing onchain involvement recommends users are not just trading tokenized equities however likewise incorporating them into more comprehensive decentralized financing (DeFi) communities.

Kraken stated that 8 of the 11 biggest tokenized equities by distinct holder count are now part of the xStocks environment, signaling increased market share in the emerging tokenized equities sector.

Continue reading

DeFi market summary

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the green.

The layer-1 blockchain Kite (KITE) token increased 38% as the greatest gainer in the leading 100, followed by stablecoin payment environment token Steady (STEADY), up over 30% throughout the previous week.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.