A Bitcoin whale has actually closed over half a billion dollars in other words positions, banking on Bitcoin cost’s decrease ahead of the much-awaited Federal Free market Committee (FOMC) conference today.

A big crypto financier, or whale, made almost $10 million revenue after closing a 40x take advantage of brief position for 6,210 Bitcoin (BTC)– worth over $516 million– which works as a de facto bet on Bitcoin’s cost fall.

Leveraged positions utilize obtained cash to increase the size of a financial investment, which can enhance the size of both gains and losses, making leveraged trading riskier compared to routine financial investment positions.

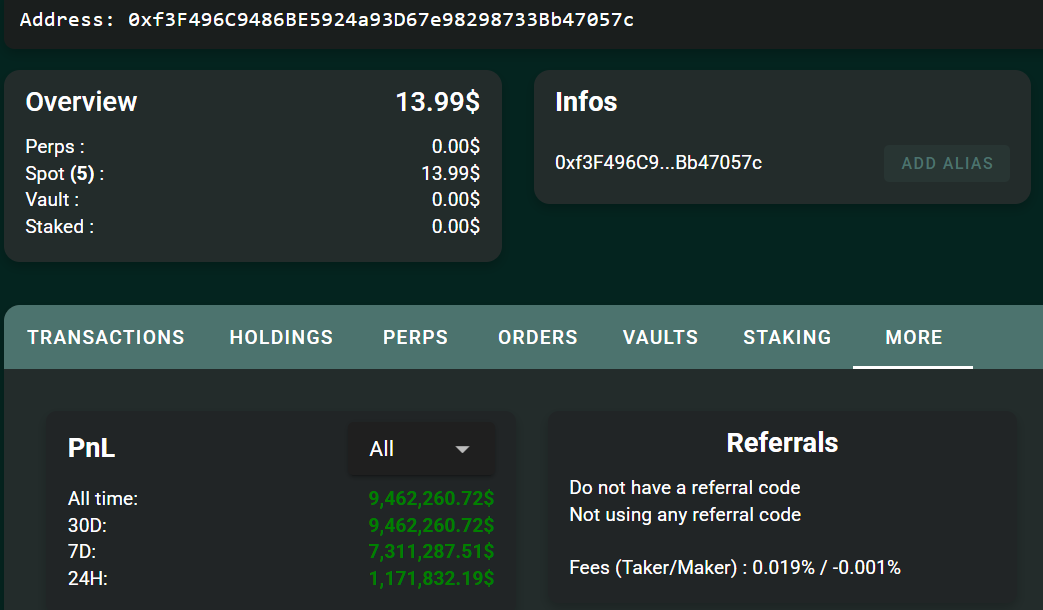

Bitcoin whale closed t-shirt positions. Source: Hypurrscan

The smart whale closed all his brief positions within a couple of hours, making a $9.46 million make money from Bitcoin’s decrease, Hypurrscan information programs.

The whale opened the preliminary $368 million position at $84,043 and dealt with liquidation if Bitcoin’s cost exceeded $85,592.

The whale handled to make a profit, regardless of needing to include $5 million to his brief, after a publicly-formed group of traders began to “hunt” his brief position’s liquidation, which eventually stopped working, kept in mind Lookonchain, in a March 17 X post.

Bitcoin whale made $9.4 million in revenue. Source: Hypurrscan

After closing his Bitcoin shorts, the whale began building up Ether (ETH) with his revenues, obtaining over 3,200 Ether for over $6.1 million at 7:31 am UTC on March 18, Etherscan information programs.

The profit-taking comes a day ahead of the upcoming FOMC conference on March 19, which will use market individuals more hints on the Federal Reserve’s financial policy course for 2025 and has the prospective to affect financier cravings for danger properties such as Bitcoin.

Related: Bitcoin experiencing ‘shakeout,’ not end of 4-year cycle: Experts

Bitcoin might see upside on alleviating inflation issues: Expert

Inflation-related issues are beginning to alleviate following the release of February’s United States Customer Rate Index (CPI), which exposed a lower-than-expected 2.8% year-on-year boost compared to the anticipated 2.9%.

Relieving inflation-related issues might be a favorable indication for the upcoming FOMC conference, according to Fumihiro Arasawa, co-founder and CEO of xWIN Research study.

The lower CPI reading might likewise be a favorable indication for Bitcoin’s trajectory, the CEO informed Cointelegraph, including:

” This recommends that inflationary pressures are slowly alleviating, which might affect the Federal Reserve’s financial policy choices.”

” Bitcoin’s short-term cost action will depend upon whether it can hold the $81,000 assistance level. A continual hold might support belief, while a breakdown might activate more corrections,” included Arasawa.

Related: Crypto market’s greatest threats in 2025: United States economic downturn, circular crypto economy

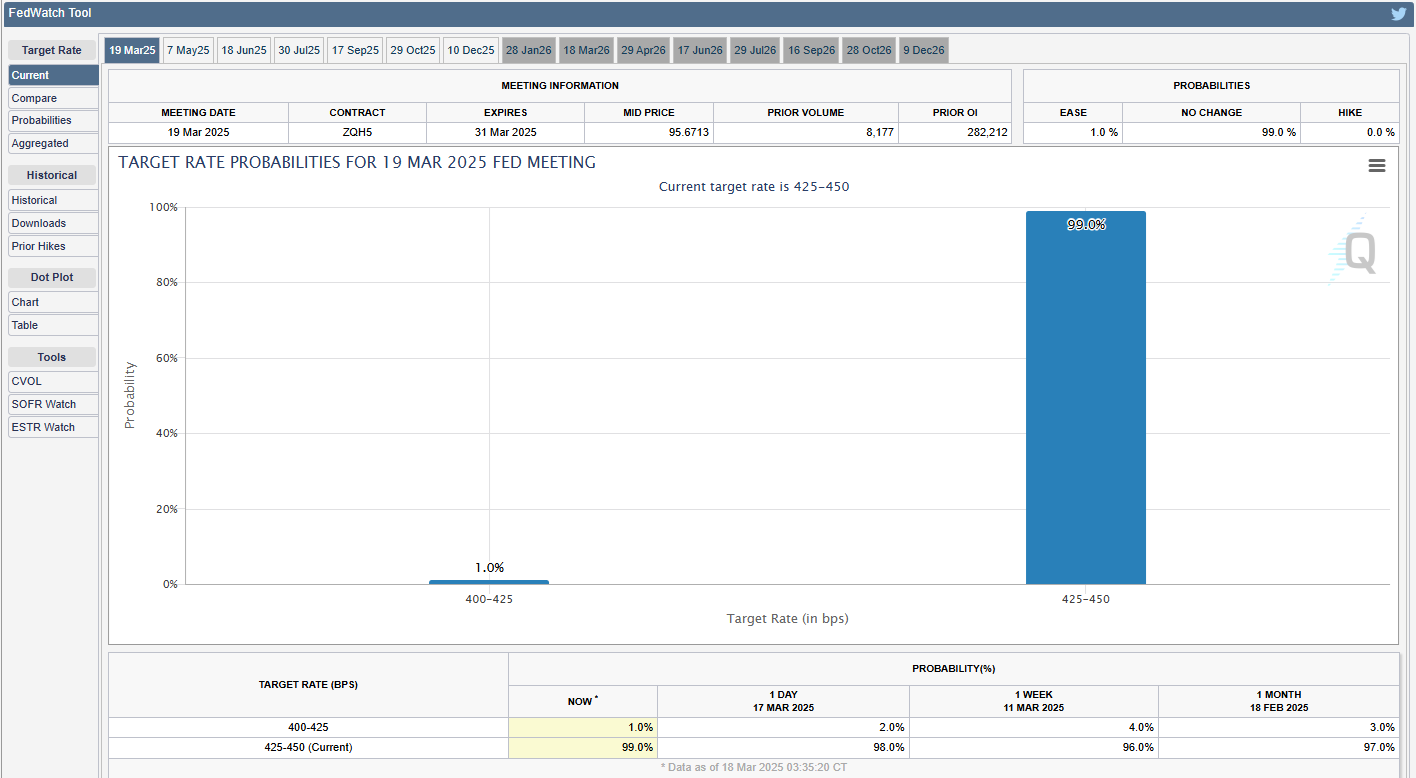

Bitcoin target rate possibilities. Source: CME Group’s FedWatch tool

Markets are presently pricing in a 99% opportunity that the Fed will keep rate of interest consistent, according to the most recent price quotes of the CME Group’s FedWatch tool.

” The marketplace mainly anticipates the Fed to hold rates consistent, however any unforeseen hawkish signals might put pressure on Bitcoin and other danger properties,” Ryan Lee, primary expert at Bitget Research study, informed Cointelegraph.

Publication: SEC’s U-turn on crypto leaves essential concerns unanswered