An unidentified Hyperliquid trader has actually gone beyond James Wynn, ending up being the trading platform’s greatest losing whale, with more than $40 million in losses within a month, according to blockchain information.

Lookonchain exposed that the trader made high-leverage trades, with almost $40 million loss on Hyperliquid (BUZZ), after offering about 900,000 tokens before the property rebounded.

The whale later on lost another $35 million on an Ether (ETH) position. After that, he rotated to a brief position and after that lost another $614,000. His Bitcoin (BTC) position is likewise undersea, with latent losses of almost $2 million.

In the last month alone, Hyperdash information reveals that the whale’s wallet has actually currently lost $39.5 million. Regardless of this, the whale still has a $152 million position with almost 29x take advantage of.

Continue reading

Kinto plunges 81% as ETH L2 set to unwind months after hack

The native token of the decentralized financing (DeFi) platform Kinto Network dropped over 80% after news that its Ethereum layer-2 blockchain is closing down in September.

Kinto stated aggravating market conditions have actually required the task to close down. The procedure stated they have actually run without incomes considering that July, and considering that it could not go through with its last funding effort, they have actually decided to close down.

The choice to close down follows a $1.6 million hack arising from a vulnerability in the ERC-1967 Proxy requirement.

While the task blamed the failure on the hack and increasing monetary pressures, a neighborhood member indicated the task’s high yearly portion yield offerings on stablecoins, even after the hack. The task formerly provided a 130% yearly yield on stablecoins, among the greatest in DeFi.

Continue reading

SwissBorg hacked for $41 million SOL after third-party API compromise

Exchange platform SwissBorg lost almost $41 million in a make use of since of a vulnerability in the API of its staking partner Kilin.

The task stated about 193,000 Solana tokens, worth $41 million, were taken from its Earn program. Regardless of this, the task stated its app and other Earn items were not affected.

The business likewise stated that it stays in great monetary health in spite of suffering millions in losses. It stated day-to-day operations were untouched, and users who lost funds will be called straight by the platform.

SwissBorg CEO Cyrus Fazel guaranteed users that while it’s a huge quantity of cash, it does not put the platform at threat.

Continue reading

Ethereum L2 MegaETH presents a yield-bearing stablecoin to money procedure

Ethereum layer-2 procedure MegaETH, a task backed by Vitalik Buterin, revealed the launch of a yield-bearing stablecoin that would distinguish its service design from conventional layer-2s.

The procedure stated it’s establishing the USDm stablecoin in collaboration with Ethena, a procedure with over $13 billion in overall worth locked (TVL). The token will release on Ethena’s facilities, which channels reserves into BUIDL, BlackRock’s tokenized United States Treasury expense fund.

Yield from the stablecoin’s reserves will be utilized to balance out sequencer costs, which are the expenses a layer-2 needs to pay when releasing batches of deals on the Ethereum mainnet.

MegaETH co-founder Shuyao Kong stated the stablecoin would decrease users’ costs and permit more meaningful style for applications.

Continue reading

Bubblemaps declares the biggest Sybil attack in crypto history on MYX airdrop

Blockchain analytics firm Bubblemaps declared that it had actually determined the biggest Sybil attack in crypto history, indicating 100 moneyed wallets that declared $170 million in MYX tokens from a current airdrop.

In a series of X posts, the analytics company revealed that the wallets got comparable BNB quantities from OKX within minutes of each other, nearly a month after the airdrop. Bubblemaps stated that while MYX struck a $17 billion totally watered down appraisal, they found something uncommon.

Bubblemaps declared that the wallets had no previous activity and declared their airdrop at almost the exact same time. “It’s tough to think this was random,” Bubblemaps stated, recommending this might be the “greatest airdrop Sybil of perpetuity.”

A Sybil attack is a security danger in decentralized networks where one assailant produces and manages several phony identities to acquire impact over the system.

Continue reading

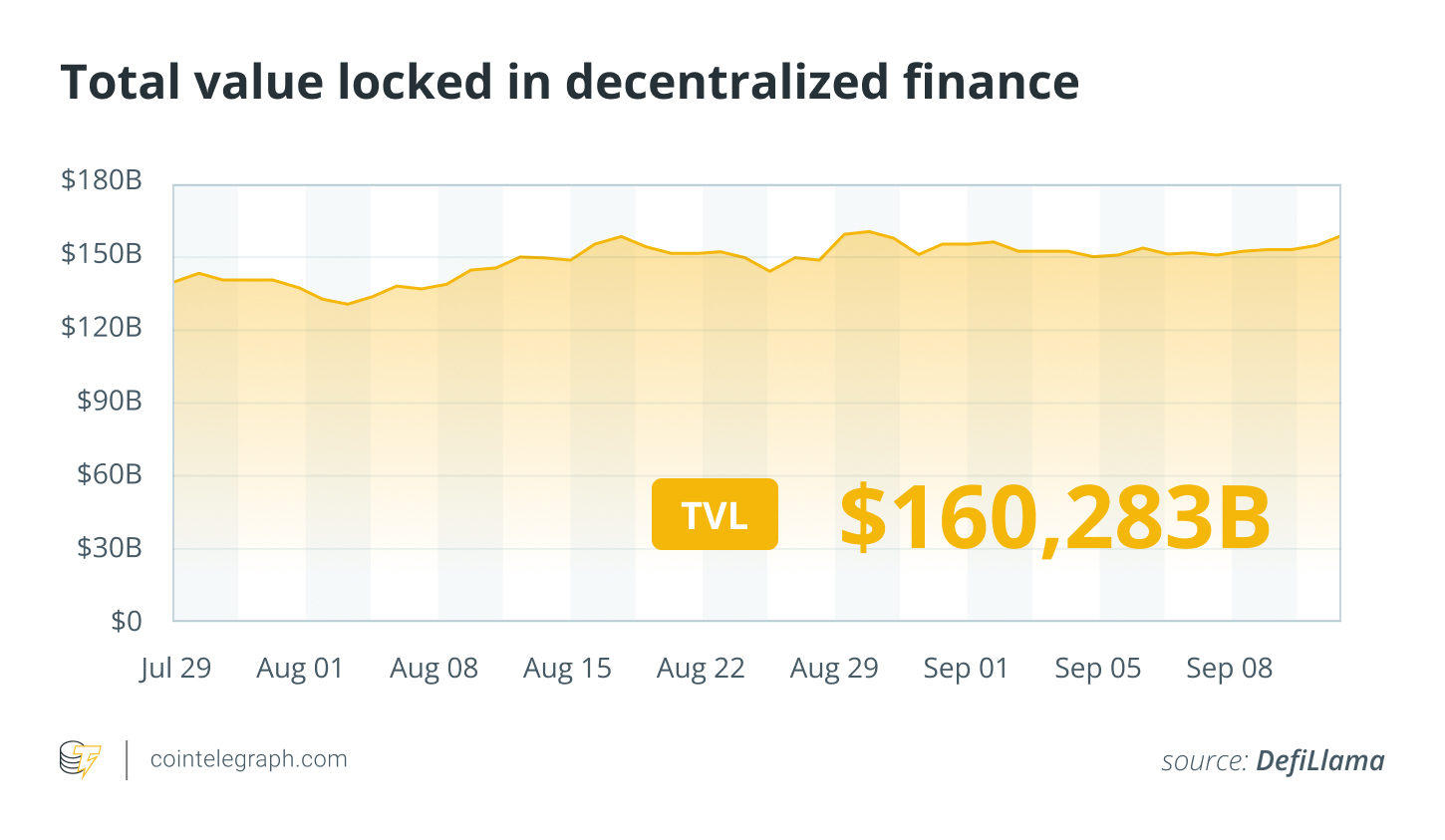

DeFi market introduction

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the green.

MYX Financing (MYX) had a 1,100% seven-day gain, ending up being the week’s biggest gainer. The token is followed by Worldcoin (WLD), which taped over 90% in gains recently.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.