Secret takeaways

-

Twenty One Capital’s NYSE launching saw an almost 20% drop, indicating mindful financier belief towards Bitcoin-heavy public listings.

-

XXI traded near to its net possession worth, recommending the marketplace did not designate a significant premium beyond the worth of the company’s Bitcoin holdings.

-

The decrease showed wider market pressures, consisting of Bitcoin volatility, fading interest for SPAC-backed listings and compromising mNAV premiums.

-

The soft response recommends financiers might now anticipate Bitcoin-focused companies to reveal clear, resilient profits designs instead of relying mostly on big BTC holdings.

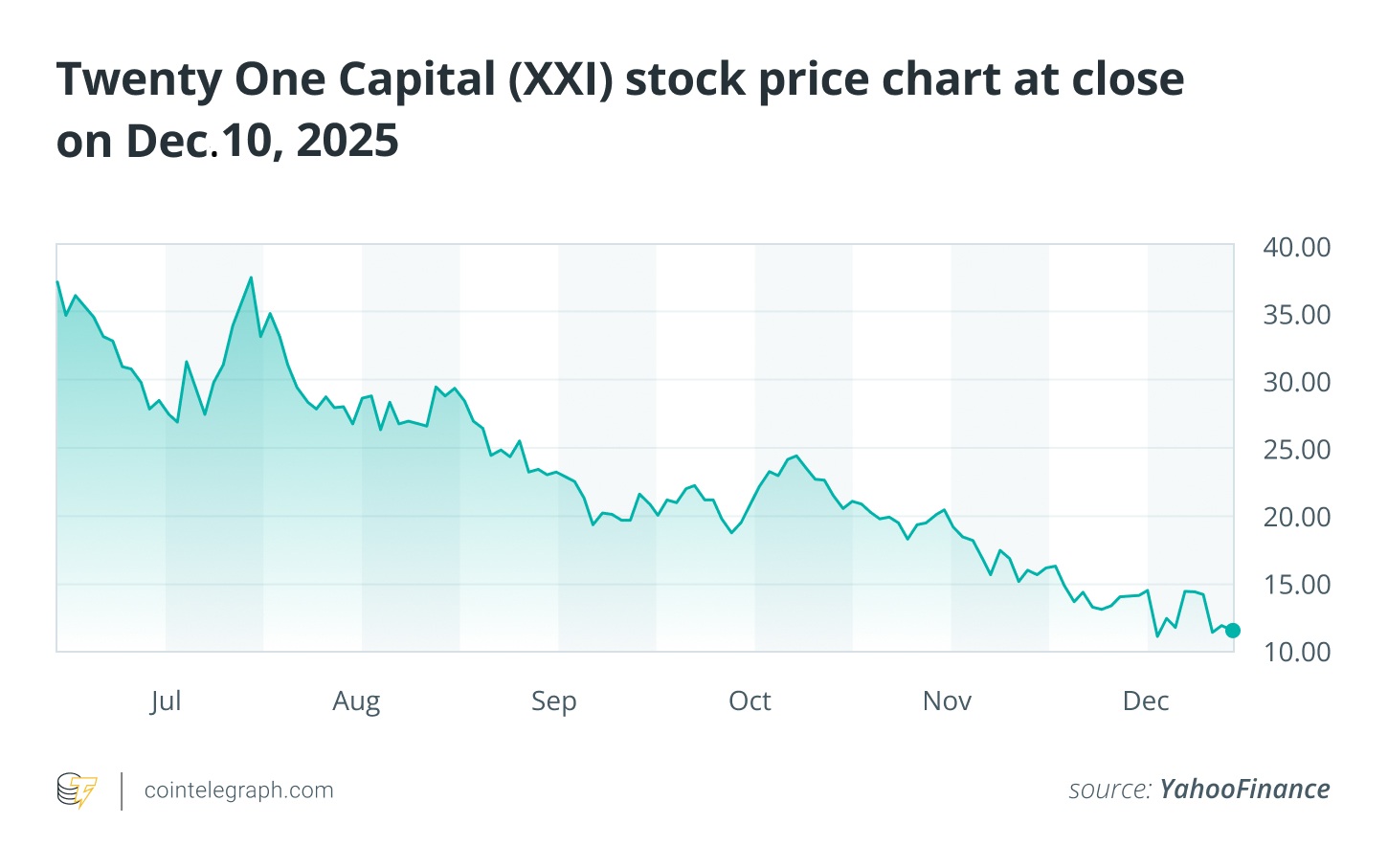

The general public launching of Twenty One Capital, a carefully enjoyed Bitcoin-focused business, on the New York Stock Exchange (NYSE) was met mindful financier belief. Trading under the ticker XXI, the company’s shares fell by almost 20% on its very first day.

This post explores what the marketplace response might signify about moving financier need, the disintegration of the mNAV premium and the wider examination dealing with Bitcoin-backed equity listings.

What Twenty One Capital really is

Twenty One Capital is an institutionally backed, Bitcoin-native public business with the specified aspiration of ending up being the biggest openly traded holder of Bitcoin (BTC). The company went public by means of a special-purpose acquisition business (SPAC) deal with Cantor Equity Partners and started trading under the ticker XXI.

At launch, the business reported a treasury of over 43,500 BTC, valued at approximately $3.9 billion-$ 4.0 billion, positioning it amongst the biggest business Bitcoin holders.

The company was developed with a clear focus: a business structure that puts Bitcoin at the center of its method. Its creators and backers position it as more than a treasury automobile. Jack Mallers, who likewise established Strike, has actually stated that Twenty One objectives to construct business facilities for Bitcoin-aligned monetary items.

This design puts Twenty One together with other digital possession treasury (DATs) business, however with essential distinctions. Its backers consist of Cantor Fitzgerald, a Federal Reserve main dealership; Tether, the company of USDt (USDT) and a significant holder of United States Treasurys; Bitfinex and SoftBank. These institutional relationships position Twenty One as one of the most greatly backed Bitcoin-native business to note openly.

The business got here in the middle of a more comprehensive wave of openly traded companies pursuing Bitcoin-centric techniques, influenced in part by the growth design utilized by Method (previously MicroStrategy). Still, Twenty One’s specified intent is not just to reproduce that technique however to pursue revenue-driven development while keeping a big Bitcoin reserve.

The launching and the sharp rate drop

Provided the scale of its treasury and the profile of its backers, lots of market individuals anticipated strong attention around Twenty One’s launch. Yet its very first day of trading on Dec. 9, 2025, provided a various result. The stock fell greatly regardless of the business’s big Bitcoin holdings and prominent institutional assistance.

When Cantor Equity Partners’ SPAC shares transformed into XXI, the brand-new stock opened at $10.74, listed below the SPAC’s previous close of $14.27. After-hours trading revealed just a modest rebound. By the close of its very first day of trading, the shares were down around 19.97%, settling at $11.96.

This efficiency highlighted a more comprehensive pattern in which freshly noted crypto-related companies frequently trade listed below their pre-merger standards. The relocation likewise left the freshly public equity trading at a discount rate relative to its underlying cryptocurrency holdings, suggesting that evaluation characteristics for this kind of stock might be moving.

Financier care and Twenty One’s NYSE slide

The sharp decrease in Twenty One Capital’s stock rate was not special to the business. It showed a merging of 3 market consider late 2025:

-

Disintegration of the multiple-to-net-asset-value (mNAV) premium

-

Continued volatility in crypto markets

-

Weaker belief towards SPAC-driven public launchings.

Comprehending the soft mNAV evaluation

The clearest indication of market care was that the stock did not trade at a significant premium to the worth of its underlying Bitcoin holdings. This is generally examined utilizing the mNAV ratio.

Historically, Bitcoin treasury companies have actually commanded a high mNAV premium at points in previous market cycles. That premium has actually frequently been analyzed as an indication of financier self-confidence in management’s capability to develop worth beyond the underlying possessions.

Twenty One Capital, nevertheless, traded at or near its possession worth, successfully designating little to no premium to its company strategies or management. This recommended the marketplace was valuing the stock mainly as a direct and possibly unpredictable proxy for Bitcoin instead of prices in an unique operating-business premium.

Market volatility and SPAC belief

Twenty One Capital debuted throughout a difficult duration for both the crypto market and SPAC-driven listings. In the run-up to the launching, cryptocurrencies dealt with selling pressure. Bitcoin had actually fallen more than 28% from its October peak, producing a risk-off environment in which financiers were less going to designate generous evaluations to crypto-linked equities.

The merger with Cantor Equity Partners was a SPAC-driven path to going public. While the possibility of the offer formerly sent out the SPAC’s shares greatly greater, by late 2025, interest for prominent crypto SPACs had actually cooled. A long performance history of post-merger underperformance has actually added to financier tiredness and apprehension, which can lead freshly noted business to trade listed below their pre-merger standards.

Did you understand? The equity trading listed below the worth of its Bitcoin treasury is an example of an appraisal paradox, where a recently public stock trades at a discount rate to the marketplace worth of the main liquid possessions it holds.

Market shift: Need for tested company designs

Another factor for financier care might be the absence of a clear, tested, revenue-generating operating design at the time of the launching. This recommends some financiers might be moving far from pure “Bitcoin treasury” stories and positioning higher focus on distinction and foreseeable capital.

Twenty One Capital went public with big Bitcoin holdings, however without a comprehensive, openly readily available company strategy or a verified timeline. The launching likewise came throughout a duration of increased examination of the digital possession treasury business sector.

According to Reuters, experts recommend it is ending up being “harder for DATs to raise capital” which business “require to reveal material distinction” to validate their trading multiples.

The sharp drop in XXI’s share rate might show that the marketplace’s point of view is developing. Some financiers might be moving their focus towards a business’s capability to carry out a sustainable company design together with its possessions. Public markets might significantly focus on companies that can produce foreseeable money streams instead of those that mostly hold Bitcoin.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this info.