Covered Bitcoin (WBTC), the biggest tokenized variation of Bitcoin, has actually broadened to the Hedera network– a relocation that might unlock to more decentralized financing (DeFi) alternatives for BTC holders.

The combination, revealed Thursday, brings extra liquidity to Hedera, which currently supports wise agreements and native tokenization and markets itself as a low-fee network with no frontrunning or miner-extractable worth (MEV).

Frontrunning and MEV are techniques where validators reorder deals to benefit at users’ cost– an issue Hedera’s agreement system is created to prevent.

The launch was supported by BitGo, a Hedera Council member and the main custodian behind WBTC, along with BiT Worldwide and LayerZero, an interoperability supplier.

WBTC got appeal as one of the very first massive options allowing Bitcoin (BTC) holders to take part in DeFi. Covering enables BTC to be transformed into a token on another blockchain while staying completely backed by Bitcoin held in custody.

In theory, this enables users to release their BTC in wise agreement environments for loaning, trading and other procedures without surrendering their hidden Bitcoin direct exposure.

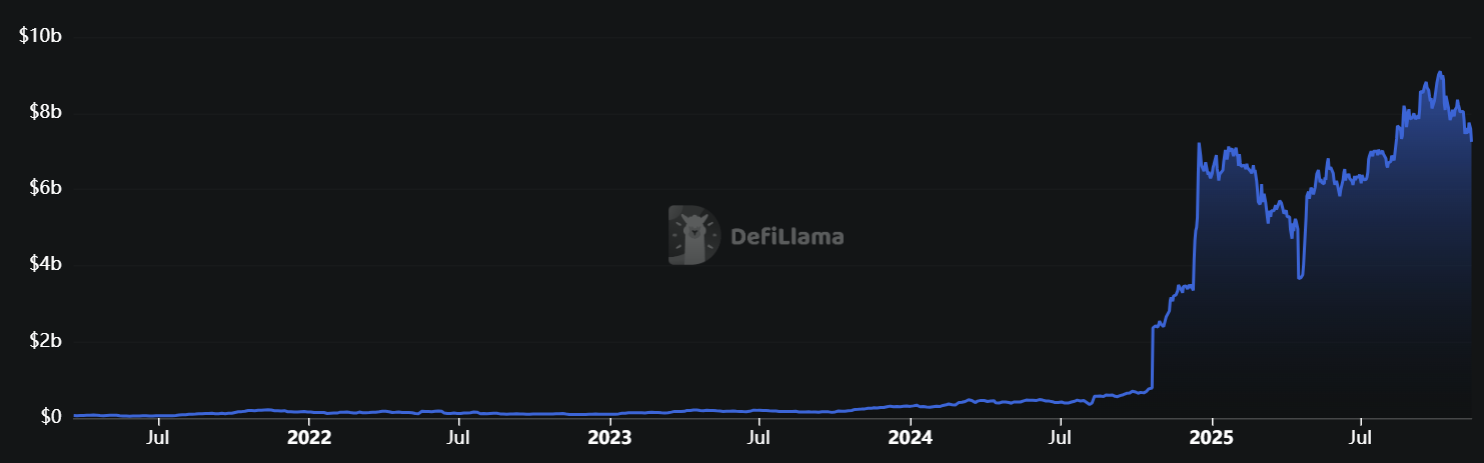

Hedera has actually experienced an uptick in DeFi activity, marked by a considerable boost in overall worth locked over the previous 12 months. Its native token, HBAR, is the 19th-largest cryptocurrency by market capitalization, with an approximated market price of about $7 billion.

Related: District attorneys demand February or March retrial for MEV bot bros

The Bitcoin DeFi sector charts a development course

Hedera’s relocation belongs to a more comprehensive pattern connecting Bitcoin more carefully to DeFi, as holders look for methods to utilize their properties in loaning, trading and yield-generating procedures.

As Cointelegraph reported, a number of Bitcoin-focused business argue that Bitcoin is too considerable a possession to stay idle in wallets and will significantly act as the structure of its own monetary community.

” Bitcoin DeFi has to do with developing a trustless, permissionless monetary system around Bitcoin, turning it into an active monetary instrument, not simply a vault,” Jacob Phillips, co-founder of liquid staking procedure Lombard Financing, stated at the Bitcoin 2025 conference in Las Vegas.

Binance has actually likewise highlighted the increase of the Bitcoin DeFi sector, describing it as BTCFi, stating it might assist drive brand-new adoption of the digital possession.

The sectors’ development “might strengthen favorable belief for Bitcoin in the medium and long term, Binance Research study stated in a report.

Related: Bitcoin is facilities, not digital gold