Secret takeaways:

-

Over $104 billion in long-held Bitcoin has actually moved considering that 2024, stimulating dispute on whether older BTC financiers are leaving the marketplace for great.

-

Onchain information reveals most moved Bitcoin was from short-term holders, not older addresses.

Bitcoin’s (BTC) rate dip from $126,000 to $100,000 accompanied a noteworthy uptick in selling by long-lasting holders (LTH). Cointelegraph reported that more than 400,000 BTC moved from LTH wallets in the previous 1 month, triggering an argument over whether these circulations represent real “OG” exits or regular redistribution by traders.

Alex Thorn, head of research study at Galaxy, stated that over 470,000 BTC older than 5 years have actually altered hands in 2025. Integrated with 2024, that figure leapt to over $104 billion, representing almost half of all Bitcoin that has actually remained in blood circulation for 5 years or more. “A massive quantity of circulation has actually taken place,” Thorn stated, calling the 2 years “extraordinary.”

The story had actually currently drawn a response from Troy Cross, a teacher of approach at Reed College and a veteran Bitcoin analyst, who stated the offering difficulties Bitcoin’s starting principles. According to Cross, if early adopters are leaving in size, it recommends that “OG” holders no longer see Bitcoin as basically various from conventional IPO-style financial investments.

Nevertheless, onchain expert Checkmate disagreed, stating the term “OG disposing” is being misused. The expert stated that while approximately half a million old coins have actually moved, most of 2025’s restored supply really originates from coins held for far much shorter durations (6 months to 2 years), common of traders securing revenues instead of real long-lasting followers leaving the marketplace.

Supporting that view, a breakdown of restored supply over 2024– 25 suggested that most of circulations stem from coins inactive under 2 years: 700,000 BTC (6 months to one year), 650,000 BTC (one year to 2 years), with much smaller sized volumes, from 3 to 5 years (120,000 BTC) and 5 to 7 years (50,000 BTC).

Blockstream CEO Adam Back concurred, stating the charts “inform an extremely various story,” that many moved coins come from recent-cycle traders, not Bitcoin’s initial OGs.

Related: Bitcoin’s appraisal metric mean a ‘possible bottom’ forming: Analysis

Bitcoin deals with double pressure from ETFs, LTHs

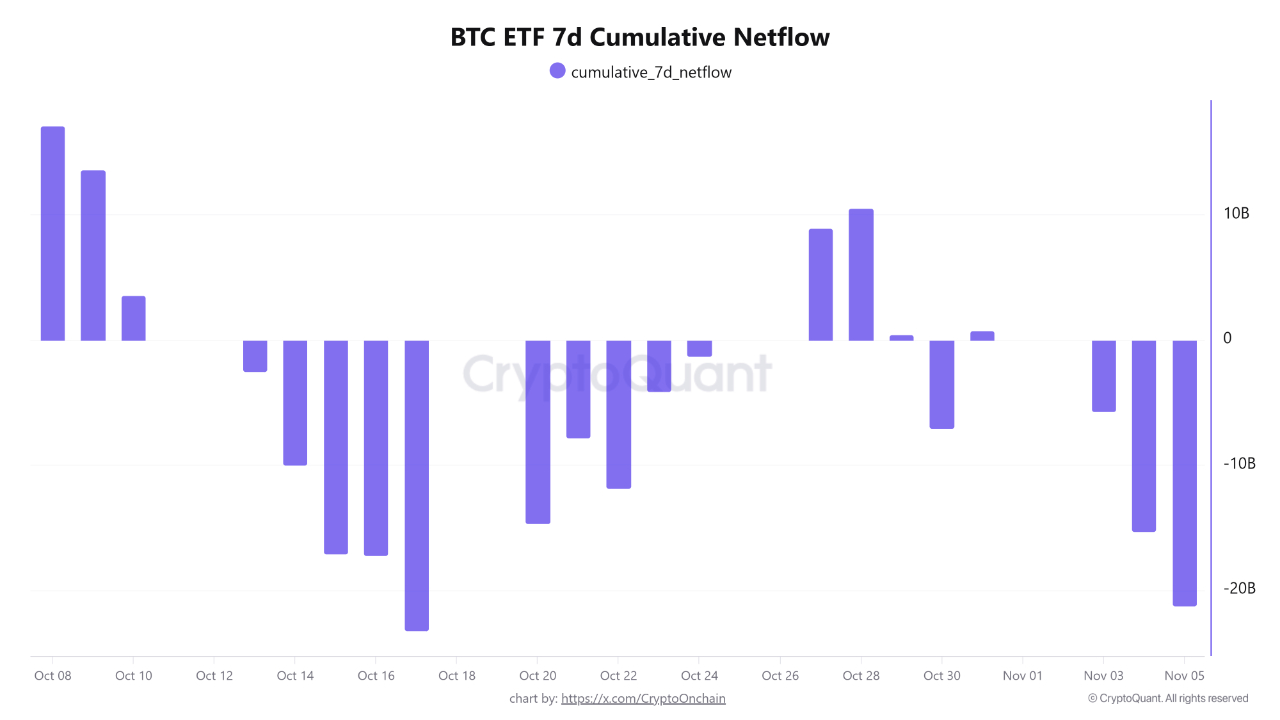

Information from CryptoQuant suggested that Bitcoin’s current dip originates from a two-front “offering war” in between institutional area exchange-traded fund (ETF) financiers and LTHs, both of whom are now applying integrated down pressure on rate.

Onchain information reveals that the seven-day cumulative netflow for area Bitcoin ETFs has actually fallen by almost $21 billion, marking the biggest outflow in 6 weeks and indicating a noteworthy shift in belief. The need engine for Bitcoin has actually successfully developed into a source of supply.

With ETF inflows no longer balancing out LTH circulation, Bitcoin now deals with a supply-heavy environment. Unless institutional need returns or long-lasting holders pause their tactical selling, experts caution the marketplace’s near-term predisposition might stay slanted to the disadvantage.

Related: Bitcoin deals with ‘ridiculous’ sell wall above $105K as stocks eye tariff judgment

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.