Secret takeaways:

-

Ether cost printed an uncommon regular monthly Dragonfly doji candlestick, which is frequently seen before significant ETH booming market cycles.

-

ETH is retesting its long-lasting parabolic assistance zone that preceded its historical 2017 rally.

-

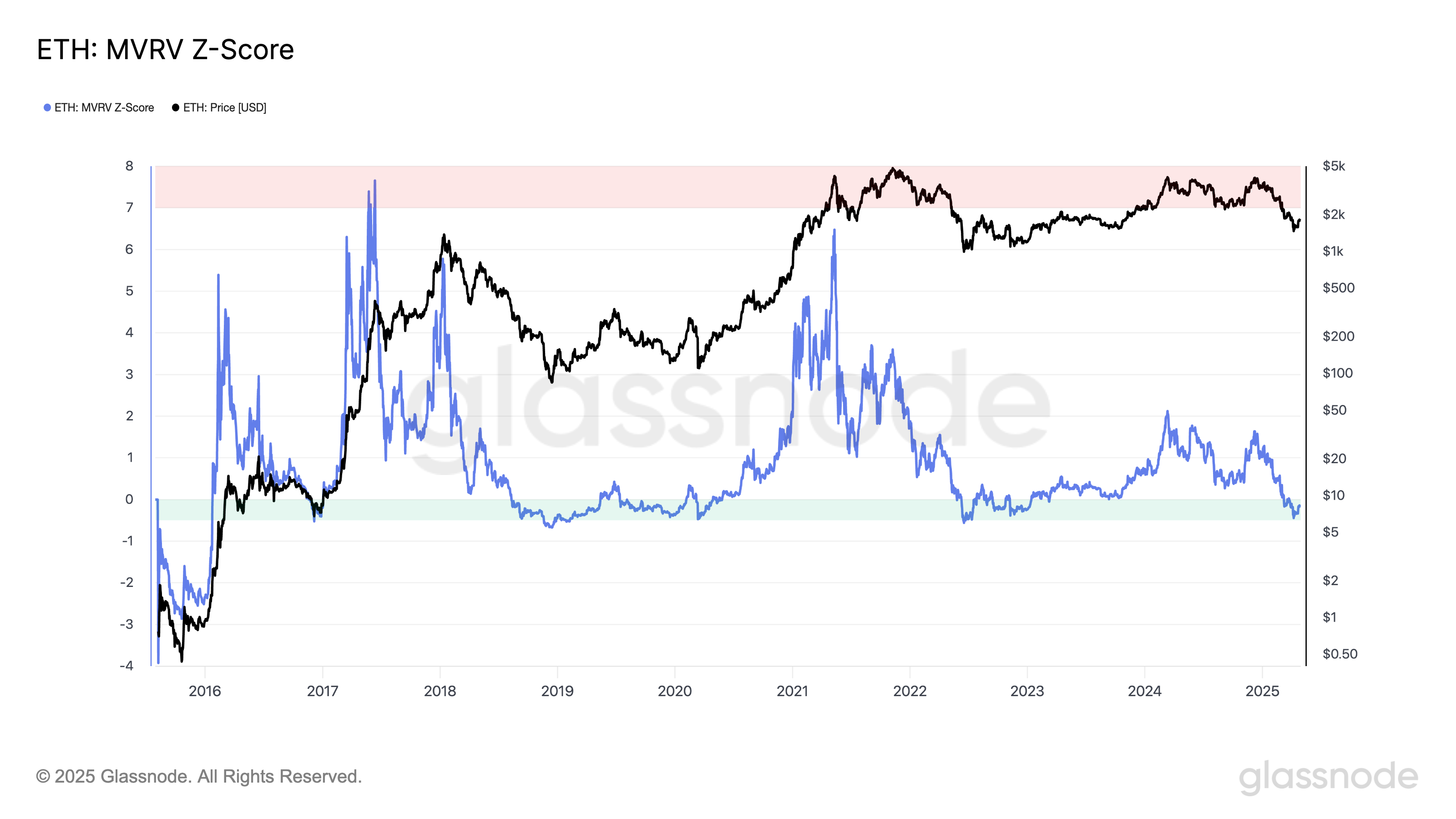

The MVRV Z-Score has actually gone into the build-up zone, indicating undervaluation.

Ethereum’s native token, Ether (ETH), is flashing a mix of technical and onchain signals when seen in the early phases of its 2017 bull run, a cycle that produced over 25,000% gains.

Dragonfly doji tips ETH bulls are gaining back control

Ether is flashing an uncommon Dragonfly Doji candlestick on its regular monthly chart, the exact same structure that preceded its historical 25,000% rally throughout the 2017 bull cycle.

This pattern is validated when the cost prints a long lower wick, little to no upper wick, and closes at or near its opening level.

On Ether’s regular monthly chart, the candlestick shows a sharp intra-month rejection of lower rates, recommending that bulls are starting to restore control after a prolonged sag.

In December 2016, Ethereum formed a comparable regular monthly Dragonfly doji before emerging from under $6 to over $1,400 in over a year. The exact same pattern has actually been seen, with smaller sized upside, in 2021 and 2023, where ETH got over 80% and 145%, respectively.

If bulls validate the signal with a strong Might open, particularly above April’s high of around $1,950, Ethereum might be primed for another multimonth rally, starting with a preliminary run towards $2,100.

Ethereum checks long-lasting parabolic assistance, similar to in 2017

Chartist Merlijn the Trader indicate Ethereum retesting its long-lasting parabolic assistance, (the green zone in the chart listed below) that has actually regularly served as a launchpad for brand-new uptrends.

” In every cycle, this zone activates a turnaround– and this time is no various,” he composed in his X post on April 30, including:

” Now starts what might be Ethereum’s the majority of explosive rally yet.”

In early 2017, ETH likewise bounced from this specific very same parabolic trendline throughout its preliminary breakout stage. The trendline supported ETH throughout that year, sustaining the vertical transfer to $1,400 from around $6.

Related: Ethereum’s ‘capitulation’ recommends ETH cost is underestimated: Fidelity report

The present retest in 2025 mirrors that breakout setup, recommending a cyclical pattern might be duplicating.

Onchain information indicate ICO-era-style ETH build-up belief

Ethereum’s MVRV Z-Score, an essential onchain metric utilized to determine market tops and bottoms, has actually returned to the historic build-up zone (the green band in the chart listed below), enhancing the argument that ETH might have discovered its cycle bottom.

In previous cycles, Ethereum’s MVRV Z-Score dipped into this green zone in late 2018, March 2020, and mid-2022. All of these dips accompanied market bottoms and preceded multimonth to multi-year rallies.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.