Secret takeaways:

-

A longer-term ETH rate rally depends on SEC approval of in-kind ETF production and staking to draw in more financiers.

-

AI adoption and Ethereum layer-2 development should drive onchain activity to bring back the network’s deflationary burn system.

Ether (ETH) rose 43.6% in between Might 7 and Might 14, however its present rate of $2,600 still disappoints the 2021 peak of $4,868. Some experts argue that the present bullish momentum is “simply the start of a much bigger and aggressive uptrend,” raising the probability of a near-term rally to $5,000.

Nevertheless, the drivers for a brand-new ETH all-time high in 2025 stay unsure, especially in the face of heightening competitors.

According to X user AdrianoFeria, ETH is “the very best prospect for institutional diversity” given that expert fund supervisors value “comparable levels of regulative clearness and availability” through several area exchange-traded funds (ETFs), although current information hasn’t been specifically motivating.

Ether stays the sole option to find Bitcoin ETFs

In Between Might 12 and Might 13, US-listed Ether ETFs saw net outflows of $4 million. The size of the Ether ETF market is 92% smaller sized than Bitcoin’s $121.5 billion, highlighting a clear absence of institutional hunger for ETH-based items. This has actually led some traders to question whether Ether can really acquire traction amongst expert financiers.

While completing cryptocurrencies have actually outshined ETH in 2025, their possibilities of being consisted of in United States state-level digital possession reserves have actually plunged. This follows President Trump’s choice on March 2 to distance himself from lobbyists supporting XRP, SOL, and ADA. The “Digital Possession Stockpile” executive order released on March 6 was significantly more careful, drawing a clear line in between Bitcoin (BTC) and other altcoins.

Ether’s best-case situation might include an absence of direct ETF competitors, which would depend upon the United States Securities and Exchange Commission turning down a number of pending applications. Experts likewise recommend that Ether ETFs might acquire momentum from in-kind production and staking approvals– advancements thought about extremely most likely before year-end, according to Bloomberg Intelligence expert James Seyffart.

‘ Pectra’ upgrade enhanced scalability, setting the phase for AI adoption

Formerly hailed as the response to Ether’s financial policy, the integrated burn system presented in 2021 was created to minimize supply development based upon network need. Nevertheless, the shift in focus towards scalability through rollups has actually mostly offset its deflationary effect. As an outcome, a considerable boost in onchain activity is now needed for Ether to end up being deflationary once again.

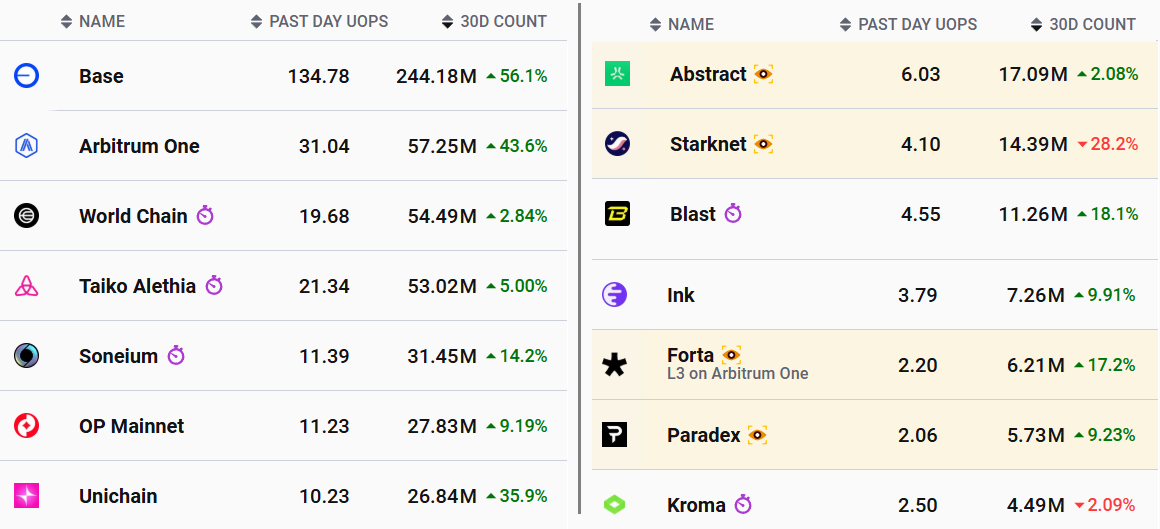

The current ‘Pectra’ upgrade has actually enhanced information transmission performance, setting the phase for boosted scalability. Layer-2 network activity increased 23% compared to the previous month, with the Base network taking the lead at 244.2 million deals in thirty days, according to L2beat. If this momentum holds, it might create continual need for ETH and assist even more separate Ethereum from competing platforms.

Related: Ethereum retakes 10% market share, however ETH bulls should not commemorate yet

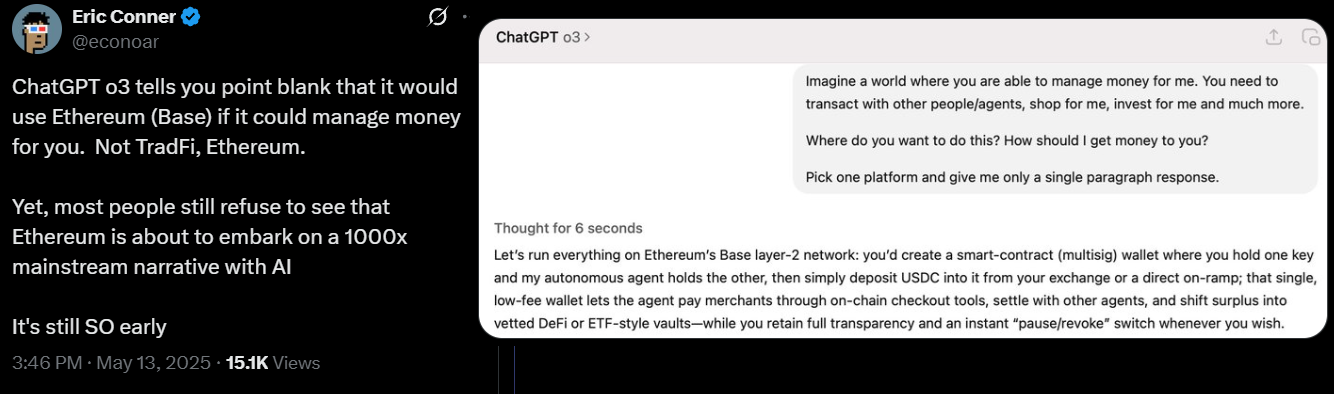

The course to a $5,000 ETH rate stays unsure, however expert system might act as an effective driver. Ethereum supporter Eric Conner observed that ChatGPT chooses Ethereum’s layer-2 facilities for handling funds by means of multisignature agreements, permitting self-governing representatives to pay merchants, settle balances, and designate surplus into decentralized financing applications.

Although it is challenging to forecast whether the AI-driven pattern will totally establish, the capacity for wise agreement activity to increase significantly from present levels is within reach. This development might make a brand-new all-time high for ETH in 2025 possible, specifically if institutional interest speeds up following long-awaited regulative modifications.

This post is for basic details functions and is not planned to be and need to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.