Solana’s native token, SOL (SOL), acquired 8.5% on March 24, recovering the $142 mark for the very first time in 2 weeks. This rally mirrored the gains seen throughout the more comprehensive cryptocurrency market as traders started to anticipate decreased dangers of a financial recession. The growing danger hunger can likewise be seen amongst memecoins, numerous of which rallied by 12% or more considering that March 23.

Beyond the broad market rally, SOL has its own benefits, consisting of an increase in network activity and the direct participation of United States President Donald Trump with the memecoin market. In addition, growing interest from leading traders on exchanges and the increasing probability of an area Solana exchange-traded fund (ETF) approval recommend additional capacity for SOL’s cost development.

SOL/USD (green) vs. crypto market cap (orange). Source: TradingView/ Cointelegraph

In spite of the current rally, SOL has actually underperformed the more comprehensive crypto market by 23.7% over the previous 2 months. This weak point is connected to a 93% decrease in Solana network charges throughout that duration. The decrease most likely started with traders’ frustration in the memecoin sector however slowly impacted the whole decentralized application (DApps) market.

SOL still trades 52% listed below its all-time high

Traders now question whether the selling was an overreaction, as SOL is presently trading 52% listed below its all-time high of $295. This comes in spite of Solana staying the second-largest blockchain in regards to overall worth locked (TVL) and ranking 3rd in onchain volumes. For contrast, BNB is trading 20% listed below its all-time high, and XRP is 28% listed below its peak.

Blockchains ranked by overall worth locked (TVL), USD. Source: DefiLlama

While Tron and BNB Chain supply competitors in regards to onchain volumes, deposits in Solana network’s clever agreements are valued at $6.8 billion. In 3rd location, BNB Chain holds 21% less TVL, with $5.4 billion. Secret highlights on Solana consist of the Jito liquid staking service, Kamino loaning and liquidity platform, and the Jupiter decentralized exchange.

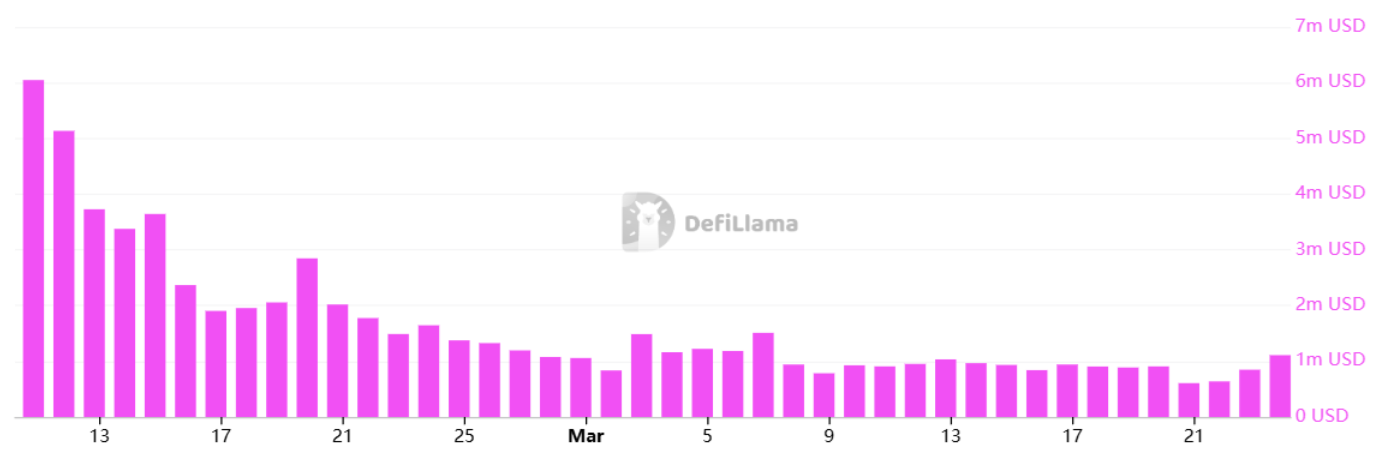

The charges on the Solana network are now greater than those on the Ethereum base layer, going beyond $1 million daily. More notably, Solana’s income has actually just recently reached its greatest levels in 2 weeks. While still far from the levels seen 2 months back, the boost in Solana network activity recommends that the bottom might have been reached as the numbers continue to enhance gradually.

Solana network everyday charges, USD. Source: DefilLlama

As a contrast, Ethereum accumulated less than $350,000 in charges on March 23, causing a boost in ETH supply as the integrated burn system stopped working to balance out weak blockchain activity. Solana, on the other hand, provides a 7.7% native staking benefit rate, going beyond the comparable 5.1% inflation rate, according to StakingRewards information.

Solana ETF choice nears while Trump tweet increases memecoin momentum

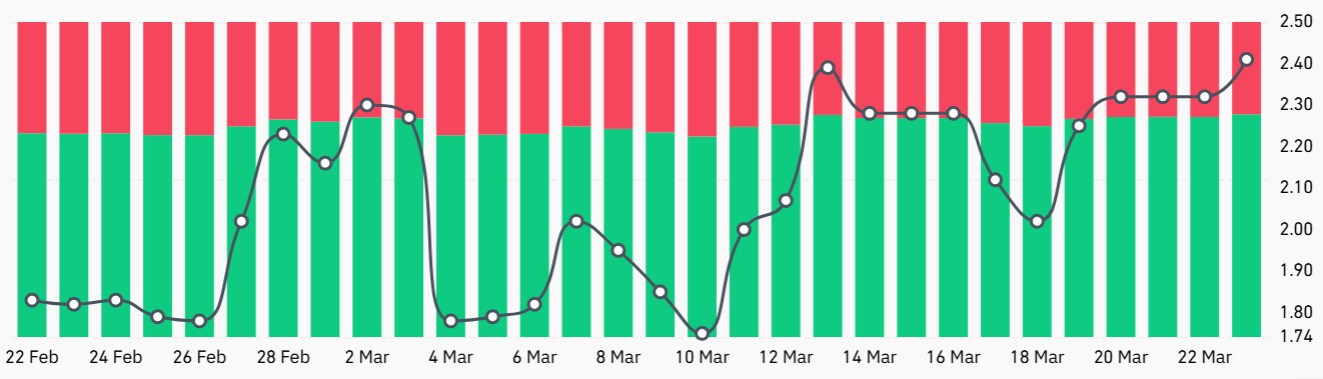

In spite of SOL’s cost weak point, leading traders on Binance have actually increased their leveraged long (bull) positions on SOL, according to CoinGlass information.

Binance leading traders’ long-to-short SOL ratio. Source: CoinGlass

The long-to-short ratio amongst leading traders on Binance rose to 2.40 on March 23, its greatest level in over 2 months. Part of the enjoyment can be credited to the anticipation of the area Solana exchange-traded fund (ETF) approval in the United States.

The United States Securities and Exchange Commission is anticipated to provide its last decision before completion of the year, according to Matthew Sigel, VanEck’s head of digital property research study. Although success is not ensured, the ultimate area Solana ETF approval would set SOL apart from its rivals, including authenticity to the property, specifically amongst institutional financiers.

Another source of momentum originated from a weekend social post by President Trump, which clearly discussed the TRUMP memecoin and assisted to produce a buzz in the sector. In the Solana environment, Fartcoin acquired 15% on March 24, Dogwifhat (WIF) rallied 12%, and Pudgy Penguins (PENGU) traded up by 12%.

Eventually, SOL has considerable capacity for greater gains, offered the network’s TVL and charges, specifically in contrast to rivals, in addition to bullish placing from whales utilizing utilize.

This post is for basic details functions and is not planned to be and must not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.