Secret takeaways:

-

Ethereum ETF inflows reveal relentless need from organizations.

-

Cost gains are supported by record network activity.

-

ETH acquired 195% on BTC because April, which bodes well for “altseason.”

-

Bullish technicals recommend that ETH rate can reach $12,000 this cycle.

After rallying to brand-new all-time highs above $4,950 on Sunday, Ether’s (ETH) rate has actually backtracked by over 12% to $4,300. In spite of this slump, several information points recommend that ETH rate still has more space to run in 2025.

Strong area Ethereum ETF streams, treasury need

Institutional interest in ETH has actually risen just recently, driven by record-breaking ETF inflows and business treasury adoption.

US-based area Ethereum ETFs have actually seen extraordinary need, with single-day inflows reaching a record $1.02 billion on Aug. 11 and cumulative net inflows surpassing $13.7 billion because their July 2024 launch.

Related: Ethereum exit line strikes record $5B ETH, raising sell pressure issues

These financial investment items continue to draw in capital, drawing $39.1 million in net inflows on Thursday and extending their inflow streak to 6 successive trading days, according to information from Farside Investors.

Inflows into ETH ETFs have actually likewise exceeded Bitcoin ETFs, drawing in 10x more capital than BTC ETFs, and showing the existing capital rotation into Ether items.

Ether likewise continues to grow as a business treasury reserve possession, with BitMine Immersion Technologies purchasing 78,791 more ETH worth $354.6 million. With the most recent acquisition, the business holds roughly $8 billion worth of ETH, making it the biggest business holder.

UPDATE: Bitmine includes another 78,791 $ETH($ 354.6 M), now holding an overall of 1,792,690 $ETH worth over $8B. pic.twitter.com/s2kXW9YYxP

— Cointelegraph (@Cointelegraph) August 29, 2025

Part of Ether’s possible to increase greater originates from expectations that institutional adoption will continue to grow, as traders eye the $7,000 target as the next substantial turning point for ETH rate.

Strong network activity

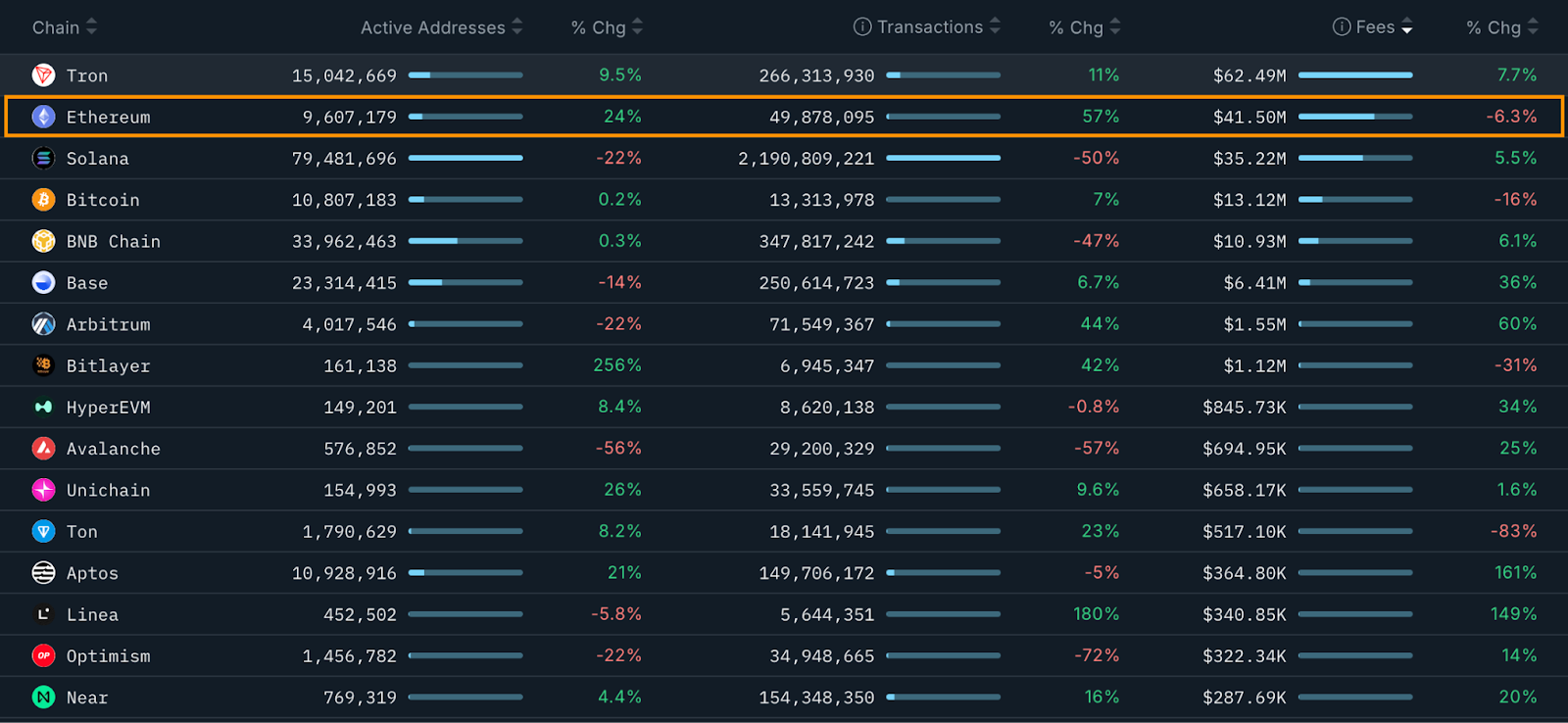

Ethereum’s network principles appear more powerful than ever, with month-to-month typical deals reaching 49.8 million from 31.7 million in July, representing a 57% boost, per information from Nansen.

Active addresses increased by 24% to 9.6 million over the exact same duration.

Weekly DEX volumes increased to an all-time high of $39.2 billion in the 2nd week of August, information from DefiLlama programs.

Increasing deal activity, a rise in active addresses and record DEX volumes all recommend that need for Ethereum is increasing.

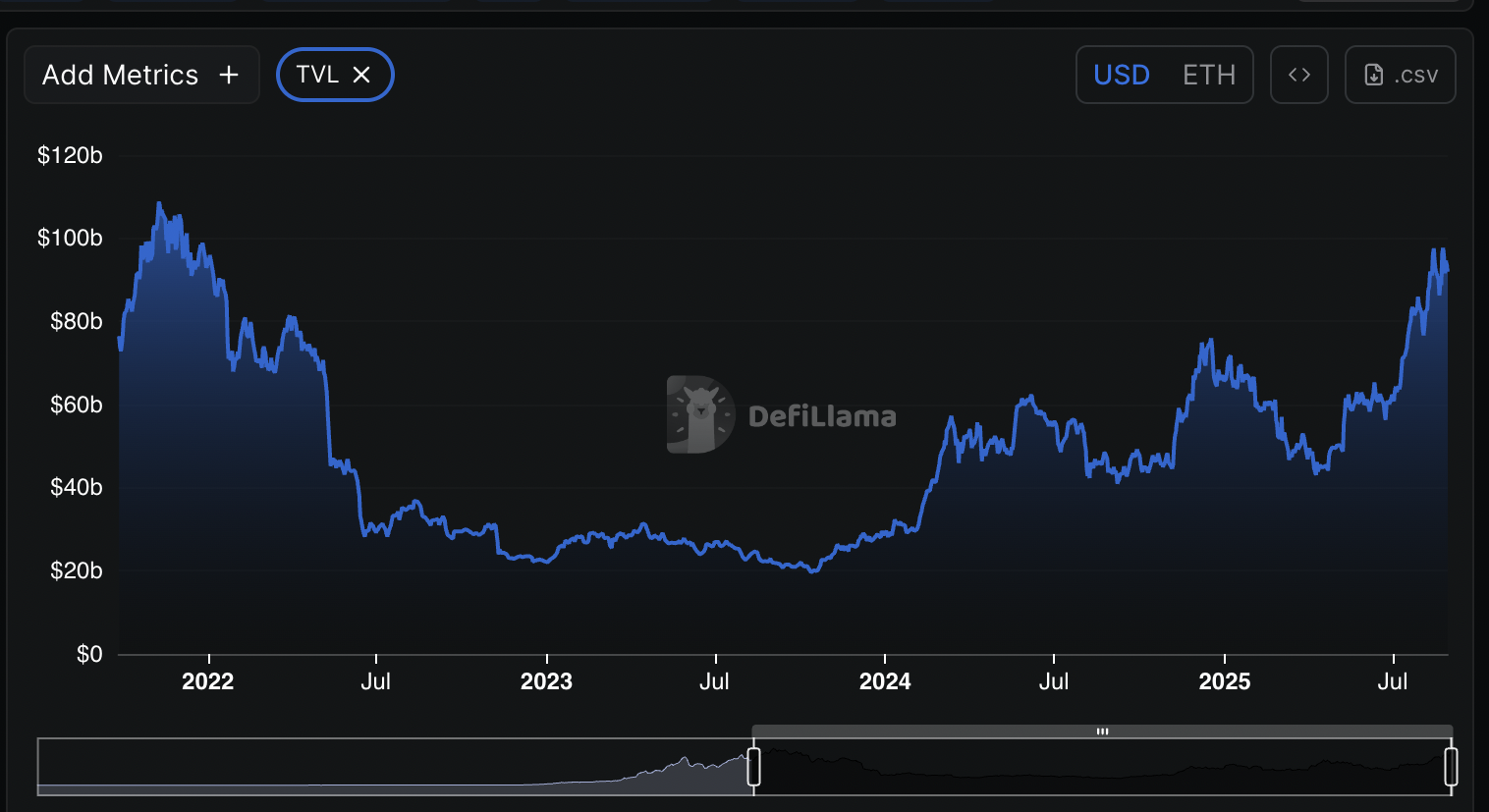

While the overall worth locked (TVL) in Ethereum’s DeFi procedures controls at $92 billion, representing 60% of the marketplace share.

ETH rate gains on BTC

Ether has actually been up 195% because April, however it has likewise more than doubled in rate in Bitcoin (BTC) terms.

BTC rate has actually rallied 47% over the exact same duration, while other top-cap layer 1 tokens, such as BNB Chain’s BNB and Solana’s SOL, have actually rallied 55% and 98%, respectively.

The ETH/BTC set likewise rose because April, reaching a 12-month high of 0.043 BTC on Aug. 24.

This rally has actually led to the MACD flashing a bullish cross on the ETH/BTC month-to-month chart for the very first time in 5 years.

The last time this took place remained in June 2020, preceding a 270% increase in the ETH/BTC trading set and culminating in a 2,300% rally in ETH/USD to an all-time high of $4,867 in November 2021.

MACD BULLISH CROSS SIMPLY FLASHED ON $ETH/ $BTC FOR THE VERY FIRST TIME IN 5 YEARS. #ALTSEASON HISTORIC SIGNAL pic.twitter.com/gToF4UHMOE

— Mikybull Crypto (@MikybullCrypto) August 28, 2025

A comparable situation might now play out with a parabolic rally, ushering a so-called altcoin season, with numerous experts anticipating a normally bullish Q4.

ETH rate technicals target brand-new all-time highs

Ether’s technical setups on several timespan are leaning bullish, too.

ETH showed strength after breaking above a rounded bottom chart pattern on the everyday chart. The rate still traded above the neck line of the pattern at $4,100, a verification that the breakout was still in play.

The determined target of the rounded bottom chart pattern is at $12,130, or a 180% increase from the existing rate.

Others, such as Trader Jelle, state that a bullish “loudspeaker” on the weekly chart indicate ETH resuming its bull pattern towards $10,000.

This bullish loudspeaker has a target of approximately $10,000.

However you would not think it.$ETH pic.twitter.com/0F8Yq9qnl6

— Jelle (@CryptoJelleNL) August 29, 2025

This lines up with targets formerly flagged by other market experts, consisting of Requirement Chartered’s Geoffrey Kendrick, who prepares for ETH to strike a minimum of $7,500 by year’s end.

Other technical setups recommend ETH’s rate might reach as high as $20,000 in the coming months.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.