Bitcoin (BTC) circled around $83,000 on March 30 after weekend volatility brought brand-new ten-day lows.

BTC/USD 4-hour chart. Source: Cointelegraph/TradingView

BTC rate action offers snap weekend drawback

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD slowly recuperating after a journey to $81,600 the day prior.

Without any included selling pressure from the continuous thrashing in United States stock exchange, Bitcoin handled to remove the majority of the drawback to come cycle versus the last Wall Street close.

” Rather the volatility for a weekend certainly,” popular trader Daan Crypto Trades summed up in part of his newest material on X.

” Appearing like it may wind up opening on Monday where it closed on Friday as the majority of the dump has actually been backtracked now.”

BTC/USDT 15-minute chart with CME futures information. Source: Daan Crypto Trades/X

Daan Crypto Trades considered the capacity for a brand-new space in CME Group’s Bitcoin futures markets to be developed thanks to the unpredictable market relocations.

” Would be great to not open with a space for when so we can concentrate on whatever else rather,” he argued, including that a “huge week” lay ahead.

Others had little wish for a short-term turn-around in Bitcoin’s fortunes. Veteran trader Peter Brandt even questioned the stability of the multimonth lows seen previously this month.

I am not a huge fan of inverted H&S patterns with down slanting neck lines. H&S patterns with horizontal neck lines are even more dependable $BTC pic.twitter.com/GKGUZbrab8

— Peter Brandt (@PeterLBrandt) March 29, 2025

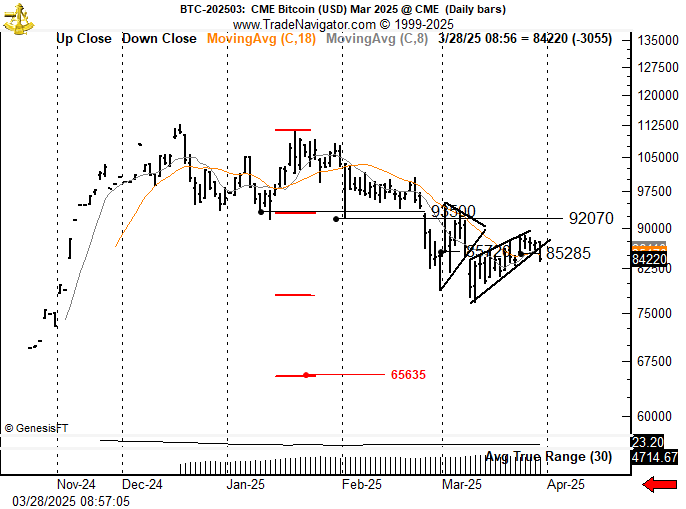

” Do not shoot the messenger. Simply reporting on what the chart states till it states something various,” he informed X fans today, offering a brand-new lower BTC rate target.

” Bear wedge finished with 2X target from the double leading at 65,635.”

BTC/USD 1-day chart. Source: Peter Brandt/X

Brandt’s is not the just $65,000 BTC rate forecast presently in force.

Can “spoofy” $78,000 Bitcoin quotes be relied on?

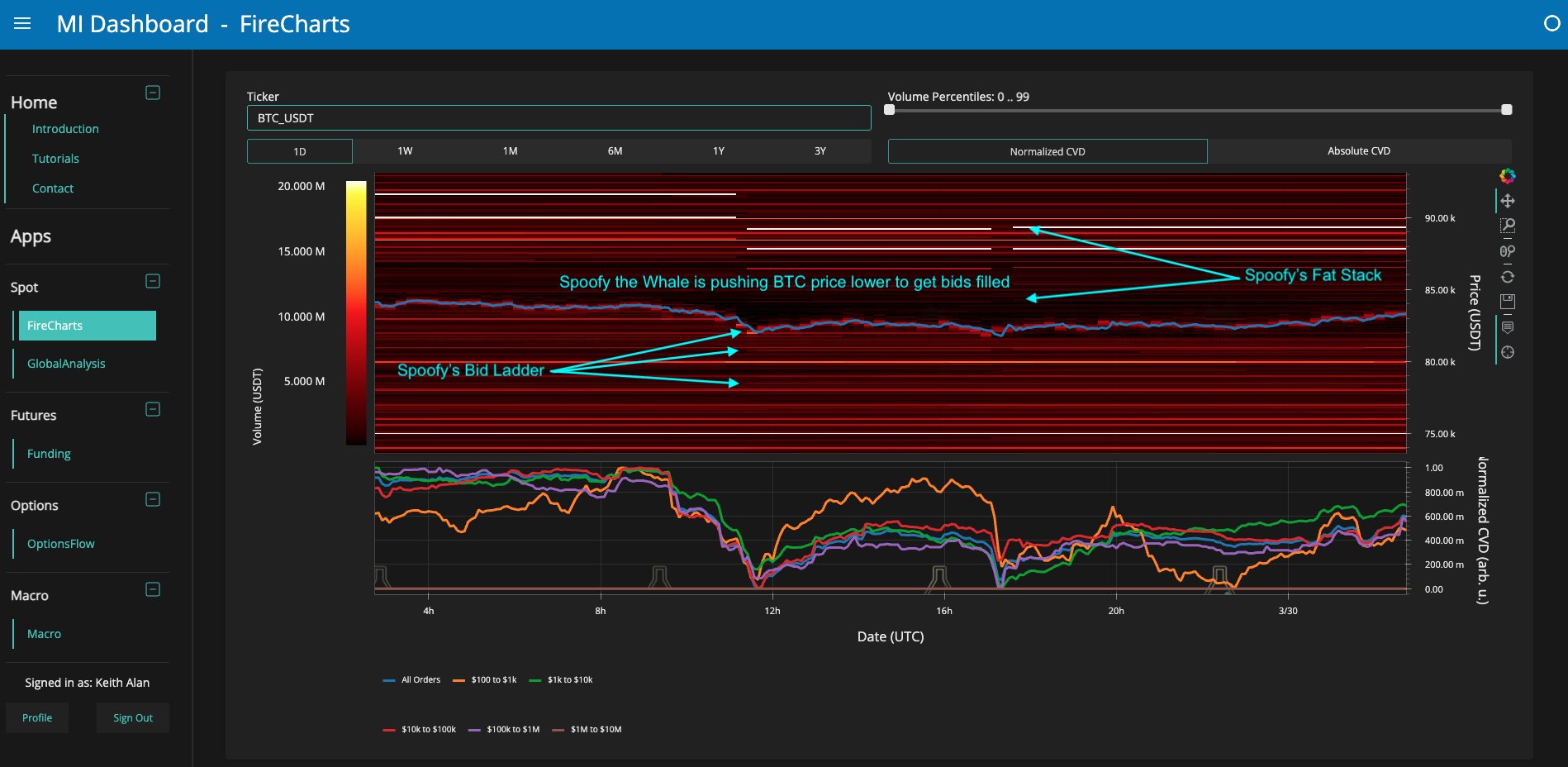

Upgrading his market observations, on the other hand, Keith Alan, co-founder of trading resource Product Indicators, doubled down on his suspicions that a large-volume entity had actually been controling BTC rate action lower in current weeks.

Related: ‘ Bitcoin Macro Index’ bear signal puts $110K BTC rate return in doubt

As Cointelegraph reported, the entity, which Alan called “Spoofy, The Whale,” had actually utilized overhead liquidity to push the rate lower and stop it from getting traction above $87,500.

This type of order book control, called “spoofing,” is a typical function in crypto and can include both quote and ask liquidity.

” While I have no genuine method of validating that it is the very same entity utilizing ask liquidity to herd rate into their own quotes, it definitely appears that Spoofy has actually been purchasing this dip and has quotes laddered to $78k,” he concluded on the day.

An annotated chart revealed all crucial liquidity clusters believed to be of suspicious origin, with Alan now offering factor for optimism.

He concluded:

” In the grand plan of things, none of this indicates BTC rate can’t go lower, however it does suggest that the whale that has actually been reducing BTC rate for the last 3 weeks is utilizing a DCA technique to purchase this dip … therefore am I.”

BTC/USDT order book information for Binance. Source: Keith Alan/X

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.