Altcoins, leaving out Ether (ETH), have actually tape-recorded $209 billion in net selling volume given that January 2025, marking among the steepest decreases in speculative need for crypto properties this cycle.

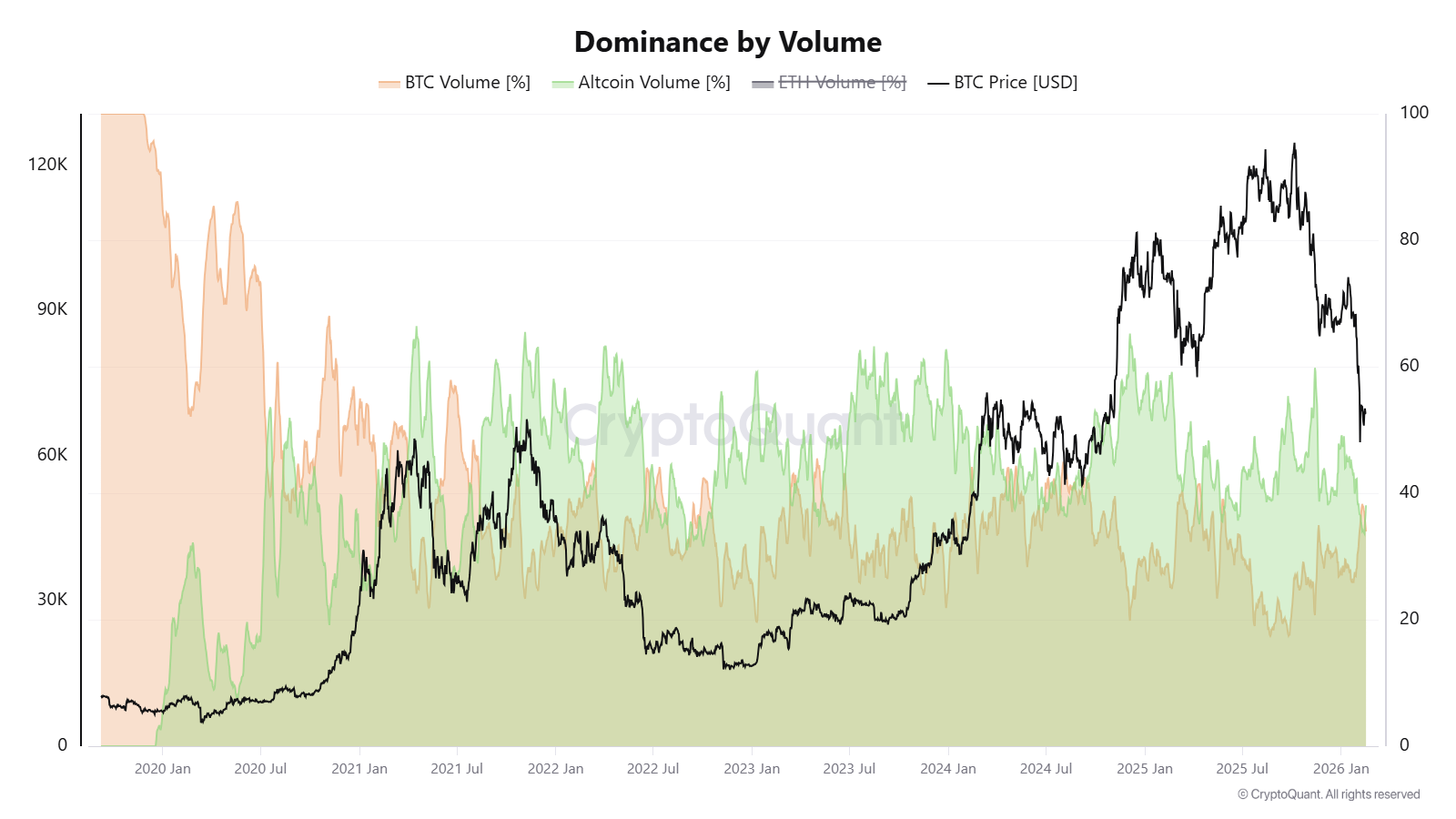

On Binance, altcoin trading volumes dropped approximately 50% given that November 2025, showing a constant dip in activity. The reduction likewise accompanies a boost in Bitcoin’s volume share on the exchange.

Experts stated that the contraction in altcoin need, along with raised stablecoin supremacy, signals that the more comprehensive market is moving its capital towards BTC throughout the existing drop.

Altcoin area volume imbalance deepens versus Bitcoin

Crypto expert IT Tech kept in mind that the cumulative buy and offer distinction for altcoins, leaving out BTC and Ether (ETH), reached -$ 209 billion. The metric steps net area need throughout central exchanges for altcoin trading sets. A favorable reading suggests increasing area need, which was briefly observed back in January 2025.

An unfavorable cumulative delta at this scale signifies the lack of constant area purchasers. The expert kept in mind that the metric tracks net circulation imbalance instead of rate evaluation, so it does not show a market bottom. Over the previous 13 months, capital has actually left the altcoin markets without considerable counterflows.

Volume information from Binance strengthens the shift. As BTC evaluated the $60,000 level in early February, the overall trading volume was rearranged. On Feb. 7, Bitcoin volumes increased to 36.8% of overall activity. Altcoin volumes dropped to 33.6% by mid-February, from a high of 59.2% in November.

According to crypto expert Darkfost, comparable rotations appeared in April 2025, August 2024, and October 2022. Throughout these restorative stages, capital combined into Bitcoin while altcoin volumes contracted.

Related: New Bitcoin whales are caught undersea, however for for how long?

Tether supremacy increases to its all-time high level

Tether’s USDt (USDT) market cap supremacy reached the 8% level on the one-week chart, lining up with previous highs which lasted in between June 2022 and October 2023. The increasing stablecoin supremacy generally accompanies capital moving into dollar-pegged properties instead of releasing into tokens like BTC (BTC) and Ether (ETH).

As observed, the raised USDT supremacy accompanied Bitcoin combining near bearishness lows, as observed in 2022 and 2023. A decrease in supremacy has frequently significant among the earliest signals of a restored bullish pattern.

Formerly, the USDT supremacy chart formed lows around 3.80-4% in March 2024, December 2024, and October 2025. These durations accompanied Bitcoin setting brand-new all-time highs near $72,000, $104,000, and $126,000, respectively.

Related: Wells Fargo sees ‘YOLO’ trade driving $150B into Bitcoin and run the risk of properties

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we make every effort to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage developing from your dependence on this info.