Secret takeaways:

-

Ether combined around $4,000 as the absence of futures need and weak ETF circulations recommend the lack of bullishness.

-

Decreasing Ethereum network costs and activity recommend lower onchain need.

-

Experts caution of a drop to $3,500 if the assistance at $4,000 is not recovered quickly.

Ether (ETH) has actually oscillated around $4,000 for the previous 2 weeks, a combination duration following its flash crash listed below $3,500 on Oct. 11.

Ether traders are now examining the probability of more bullish momentum after the United States Federal Reserve validated a 0.25% rates of interest cut and completion of quantitative tightening up.

Ether cost does not have continual bullish belief

Ether futures are presently trading at a 5% premium relative to basic ETH area markets, showing low need from purchasers utilizing utilize.

Related: Early Ethereum whales stirring? Information reveals old Ether is moving

In neutral market conditions, futures premiums generally vary in between 5% and 10% to represent the longer settlement duration. More concerningly, even the current healing to $4,250 did not bring back continual bullish belief amongst traders.

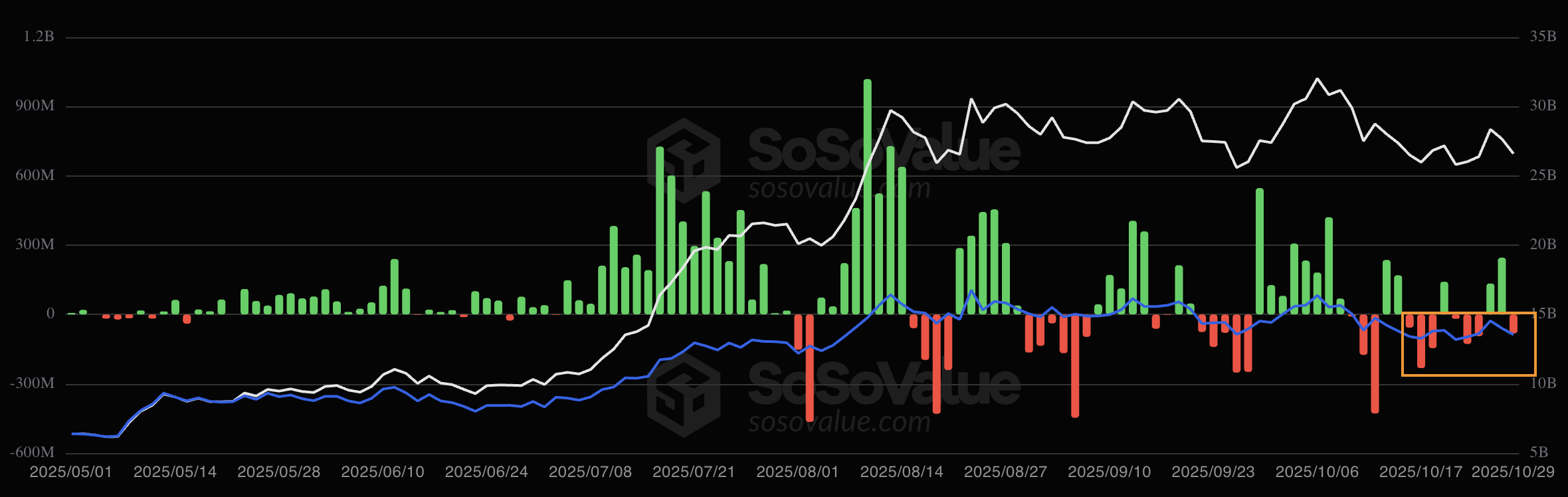

The bearish pattern in Ether futures accompanied outflows from US-based Ethereum area exchange-traded funds (ETFs) that have actually controlled considering that mid-October.

The $380 million in ETF net inflows on Monday and Tuesday did little to produce any bullish momentum, leaving traders questioning whether a $10,000 ETH cost target stays reasonable for this cycle.

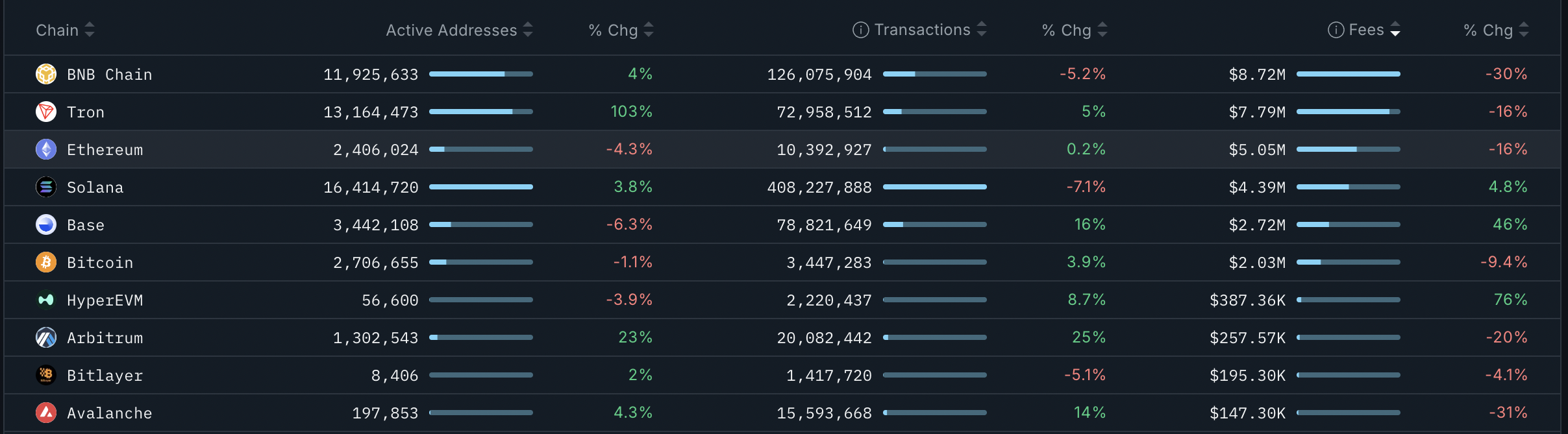

Ether’s failure to remain above $4,000 can likewise be credited to the decrease in Ethereum network costs, although this problem has actually impacted the whole cryptocurrency market.

Ethereum chain costs amounted to $5 million over the previous 7 days, representing a 16% reduction from the previous week. By contrast, costs on BNB Chain dropped 30%, and Tron experienced a 16% decrease. The variety of active addresses on Ethereum’s base layer visited 4% over the very same duration, while Tron saw an over 100% boost.

A “timeless bear trap” or is ETH cost going lower?

Information from Cointelegraph Markets Pro and TradingView reveal that the Ether cost is printing a 3rd successive red candlestick on the everyday chart.

A number of efforts at healing have actually been turned down at the $4,000 resistance level, triggering traders to question whether Ether’s benefit is over or if the altcoin is going through a technical correction.

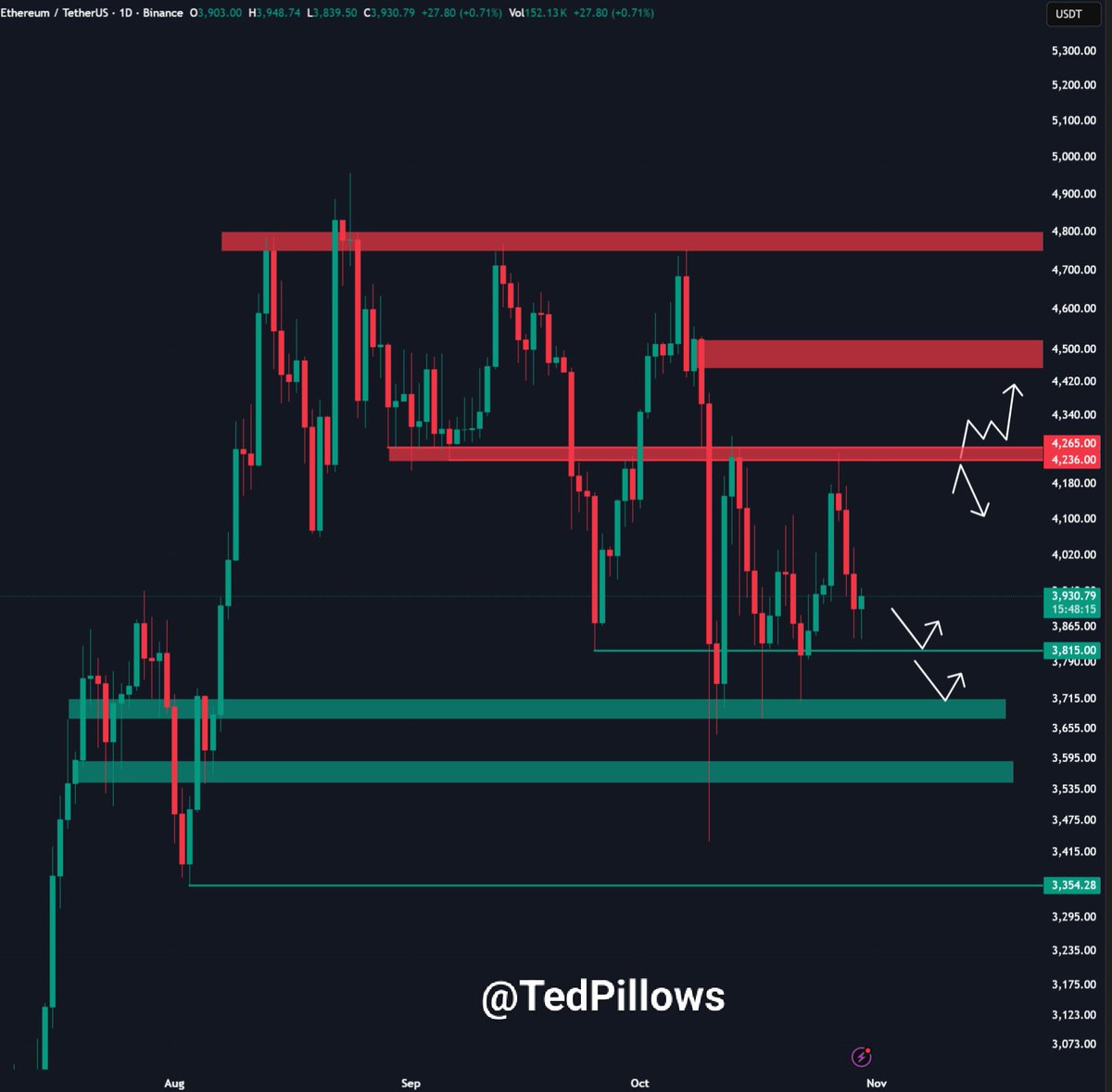

“$ ETH has actually lost its $4,000 assistance level once again,” stated expert Ted Pillows in an X post on Thursday.

Pillows explained that regardless of the “Fed’s 0.25% rate cut, QT ending in a month, and US-China trade talks” all taking place within the previous 24 hr, Ethereum stays down.

An accompanying chart reveals that the next line of defense for ETH was $3,800, and losing it would set off another sell-off, initially towards the $3,500-$ 3,700 need zone and later on to the $3,354 low reached on Aug. 3.

On the benefit, recovering $4,000 would strengthen the bulls to concentrate on the barriers at $4,200 and $4,500, before going back to all-time highs above $5,000.

Ted Pillows included:

” Either this is a timeless bear trap, or the crypto market is going way lower.”

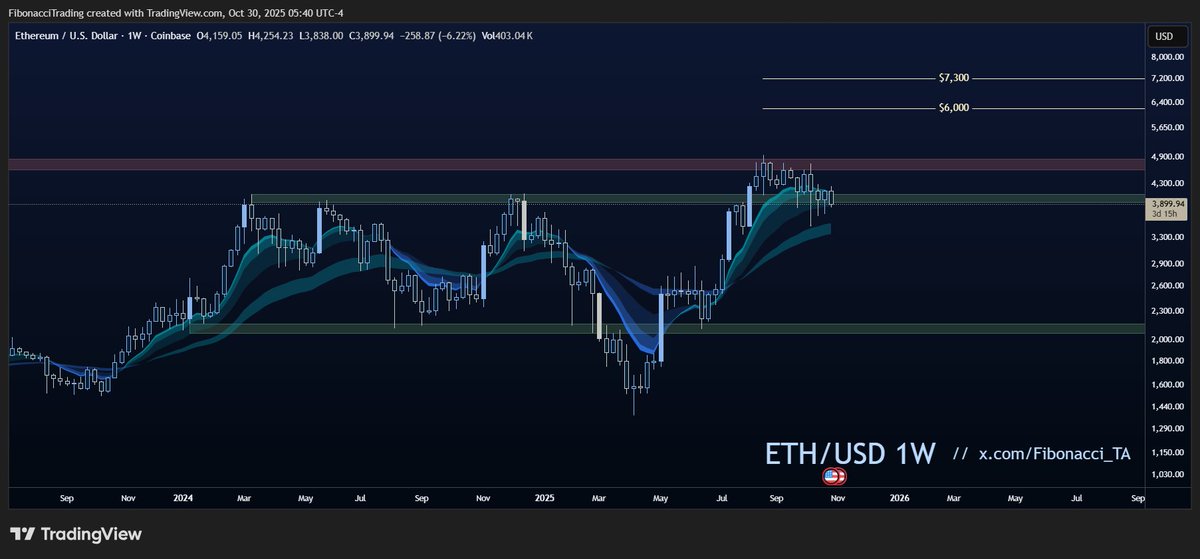

Fellow expert FibonacciTrading stated a “dip towards $3,300 would still count as a healthy pullback within the uptrend, held by the EMA cloud,” as displayed in the weekly chart listed below.

” It will be a genuine program of strength if the bulls can protect assistance here and establish for the next attack on resistance.”

For pseudonymous expert Cactus, Ether’s benefit stays on track with a “strong Q4 still on the cards” as long as bulls hold the $3,800-$ 4,200 assistance area.

As Cointelegraph reported, bulls should press the cost above the 50-day SMA at $4,200 to signify strength and validate the start of the next leg of the upward relocation.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.