Secret takeaways:

-

The introduction of a bear flag on the four-hour chart tasks a Bitcoin rate drop to $97,000.

-

Traders state BTC rate might drop as low as $85,000 if essential assistance levels are broken, consisting of the $100,000 mental level and the annual opening at around $92,000.

Bitcoin’s (BTC) rate is forming a timeless bearish pattern on lower timespan, setting off worries that a breakdown might result in a drop towards $97,000.

Breakout indicate $97K target

Bitcoin’s rate action has actually formed a book bear flag pattern on the four-hour chart, a bearish extension setup formed when the rate combines up in a parallel channel after a sharp down relocation.

In Bitcoin’s case, the flag started forming after BTC bottomed at almost $103,100 on Might 31. The combination continued over the weekend, with the rate continually retesting the assistance line of the flag.

The bearish extension will be validated once the rate breaks listed below the lower limit of the flag at $104,800. The pattern’s predicted disadvantage target is now sitting near $97,690, determined after including the height of the preliminary flagpole to the breakout point.

Momentum signs, consisting of the relative strength index (RSI), are likewise encouraging, with the RSI presently at 44, recommending that the marketplace conditions still favour the disadvantage.

Enjoy these Bitcoin rate levels in June– Traders

Information from Cointelegraph Markets Pro and TradingView reveals that the BTC/USD set has actually dropped 6.3% from its all-time highs above $111,000.

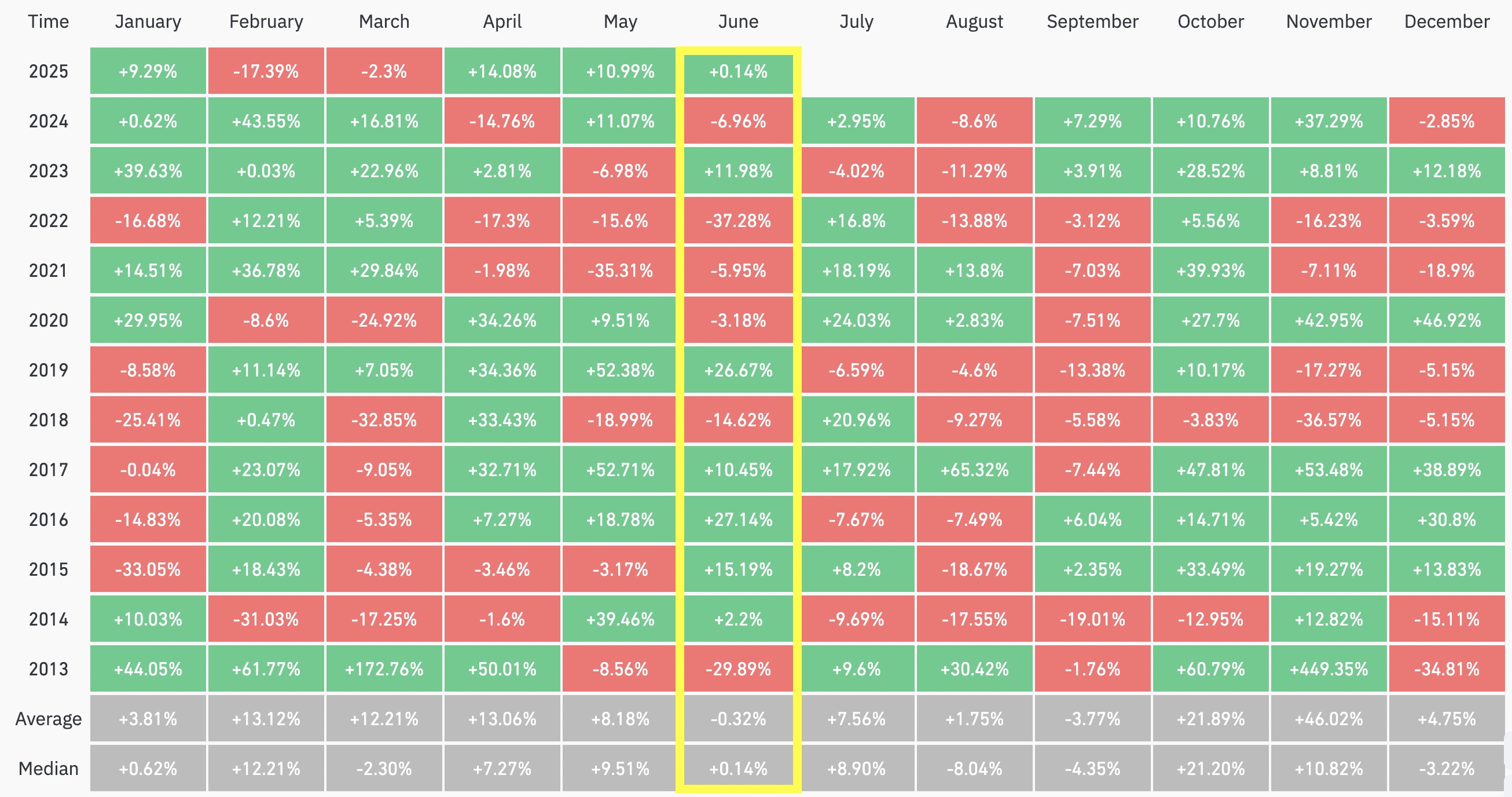

While BTC rate closed 11% greater in Might, traders are questioning which instructions the rate may take progressing. The month of June has actually traditionally produced combined outcomes with approximately 0.3% losses.

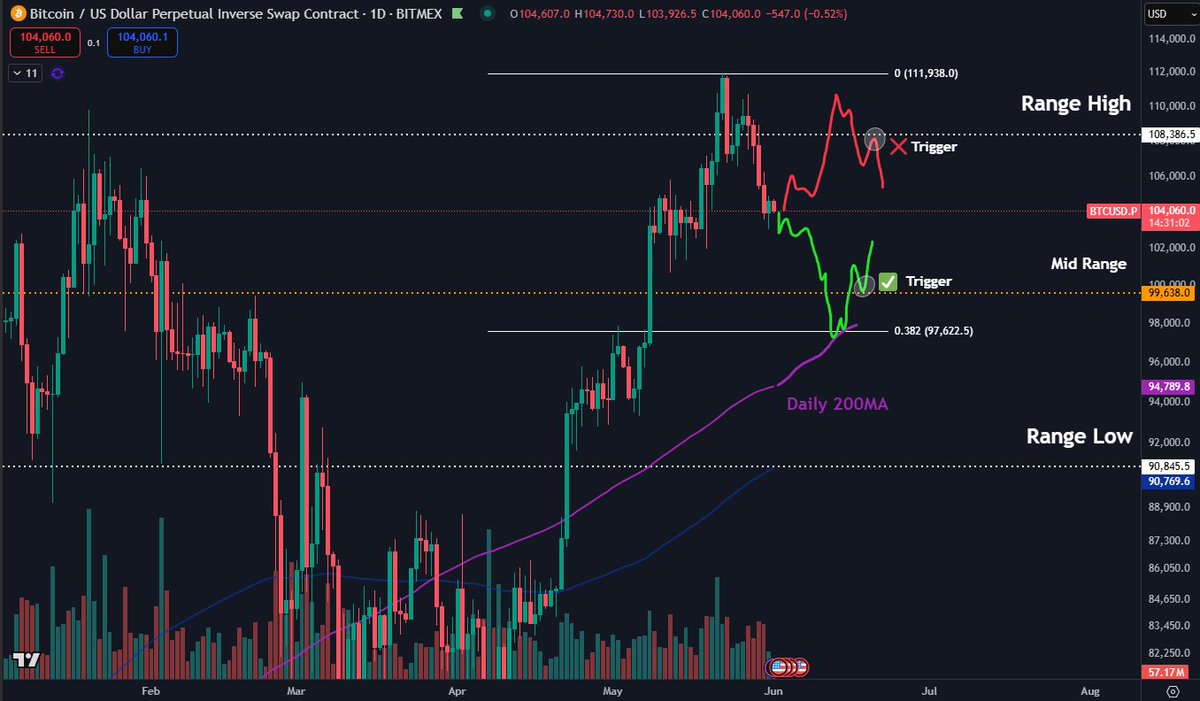

For crypto expert Daan Crypto Trades, the mid-range at $99,600 and the previous all-time high at $108,000 are essential levels to enjoy throughout the very first week of June.

” I believe there’s a great chance that the very first week is likely a relocation that can be faded upon seeing the very first indications of regional turnarounds” at either of these points, the trader stated in a June 1 post on X.

Related: Bitcoin $200K ‘apparent’ breakout, GameStop’s very first BTC buy: Hodler’s Digest, May 25– 31

An accompanying chart revealed that a break above $108,000 would see the BTC/USD set increase towards its $111,900 all-time high, where it would likely satisfy strong resistance, occasioning a hang back into the variety.

Likewise, a break listed below $99,600 would see the set drop lower before discovering solace from the 200-day easy moving average at $97,600.

” No strong predisposition towards either instructions here, so will simply stay active and have fun with what I get.”

” BTC appears like it has actually begun a bigger correction, which is most likely to take it into the second week of June,” stated fellow expert AlphaBTC in a June 2 post on X.

According to the expert, a breakdown of the bear flag in the four-hour timeframe might see Bitcoin’s rate drop towards the $102,000 need zone. Losing this assistance would bring the annual open above $92,000 into the photo.

” The concern will be what takes place at around 92K?” AlphaBTC asked, including that if it offers a purchasing chance, BTC might rebound from here to start a continual healing into rate discovery.

Alternatively, if tariff stress continue, BTC might drop even more towards $85,000, as displayed in the chart below.

As Cointelegraph reported, Bitcoin traders are evaluating the weekly and regular monthly closes for hints regarding where BTC rate action might be headed next, with the mental levels at $100,000 and $97,000 staying essential locations of interest.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.