Bottom line:

-

Bitcoin profit-taking remains in full speed, however this can wind up sustaining the booming market, Santiment research study argues.

-

Coins are investing progressively less time in wallets, however the marketplace is not experiencing “short-term speculation.”

-

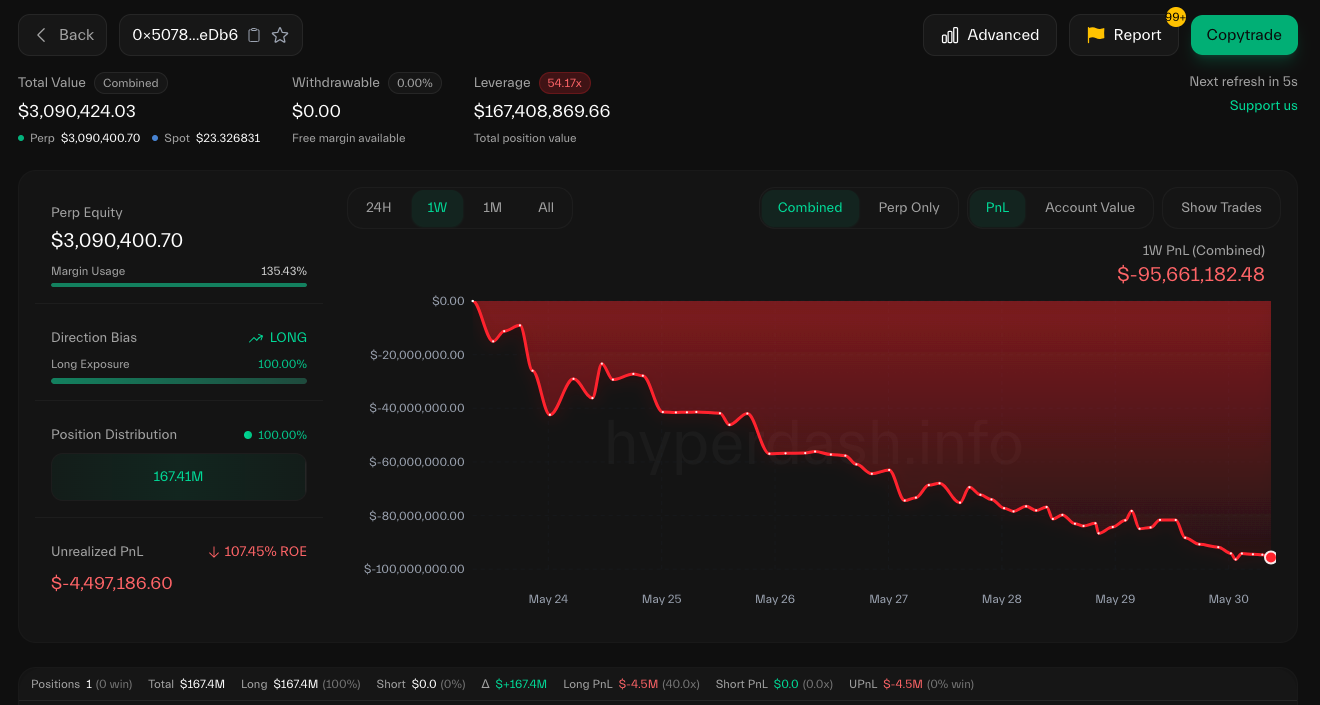

One whale not able to take revenues is Hyperliquid’s James Wynn, liquidated for $99 million.

Bitcoin (BTC) must delight in ongoing upside regardless of hodlers taking revenues on their holdings, states brand-new research study.

In its most current Biweekly Report on May 29, research study company Santiment remained bullish on the marketplace outlook as BTC/USD dropped 10%.

Bitcoin profit-taking can “assist keep rally alive”

Bitcoin profit-taking need not be an indication that the booming market is nearing its end, Santiment states.

Evaluating the Mean Dollar-Invested Age (MDIA) metric– length of time coins invest in wallets without moving– it exposed that the supply has actually started to trigger considering that mid-April.

” Throughout a lot of bull cycles, a falling MDIA (significance average holding wallets are getting more youthful) is a fantastic validator that bullish momentum will continue,” it describes.

” More technically, a falling line suggests that old coins are being revived into blood circulation, permitting energy to increase and a possession’s network to grow and grow. Considering that mid-April, when stress started to relieve over the preliminary tariff statements, Bitcoin’s MDIA has actually been dropping gradually.”

The typical time coins are kept in a wallet has actually reduced decently over the previous 6 weeks, from 443 to 426 days.

While this signals that their owners look for to secure revenues, Santiment argues that such habits is “needed to assist keep a rally alive.”

” This includes weight to the argument that the marketplace remains in an active stage, and not simply being driven by short-term speculation,” it includes.

Hyperliquid whale pays a high cost at $105,000

BTC cost debt consolidation saw a return listed below $105,000 after the May 29 day-to-day close, marking a 10% correction versus its most current all-time highs.

Related: Bitcoin can reach $200K in 2025 after ‘apparent’ cost breakout signal

Regardless of this, belief stays notably bullish, with agreement seeing a “healthy” assistance retest before advantage extension.

#Bitcoin – picture being bearish on this bullish retest pic.twitter.com/2cyKvmhz8n

— Mags (@thescalpingpro) May 30, 2025

Others keep in mind continued big tranches of BTC leaving exchanges, consisting of a 7,000 BTC deal on May 30, which trader Merlijn credited to a single whale entity.

Santiment was on the other hand amongst those talking about the fate of one whale in specific, Hyperliquid’s James Wynn, whose long BTC position was liquidated for $99 million as the cost dropped listed below the $105,000 mark.

” When significant longs get liquidated, costs normally move down dramatically due to the fact that the significant capital is no longer propping up cost,” it alerted prior to the occasion.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.