Bottom line:

-

Shorts looked primed to be gotten, analysis argues, with a long-lasting resistance pattern line in focus.

-

Fed Chair Jerome Powell is due for replacement, causing hyper-bullish bets on danger possessions.

Bitcoin (BTC) dipped towards $107,000 after the June 30 Wall Street open as analysis considered a significant brand-new “brief capture.”

BTC cost brows liquidity into crunch candle light closes

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD reversing gains made into the weekly close, down 1.1% on the day at the time of composing.

With hours to go up until the month-to-month and quarterly closes, traders anticipated volatility, while exchange order-book liquidity grew.

” With BTC area edging towards $108k, we’re starting to see an accumulation in leveraged longs as continuous financing rates turn from flat to favorable throughout significant exchanges,” trading company QCP Capital kept in mind in its most current publication to Telegram channel customers.

” Positioning seems going after the relocation, as individuals lean into directional bets ahead of quarter-end.”

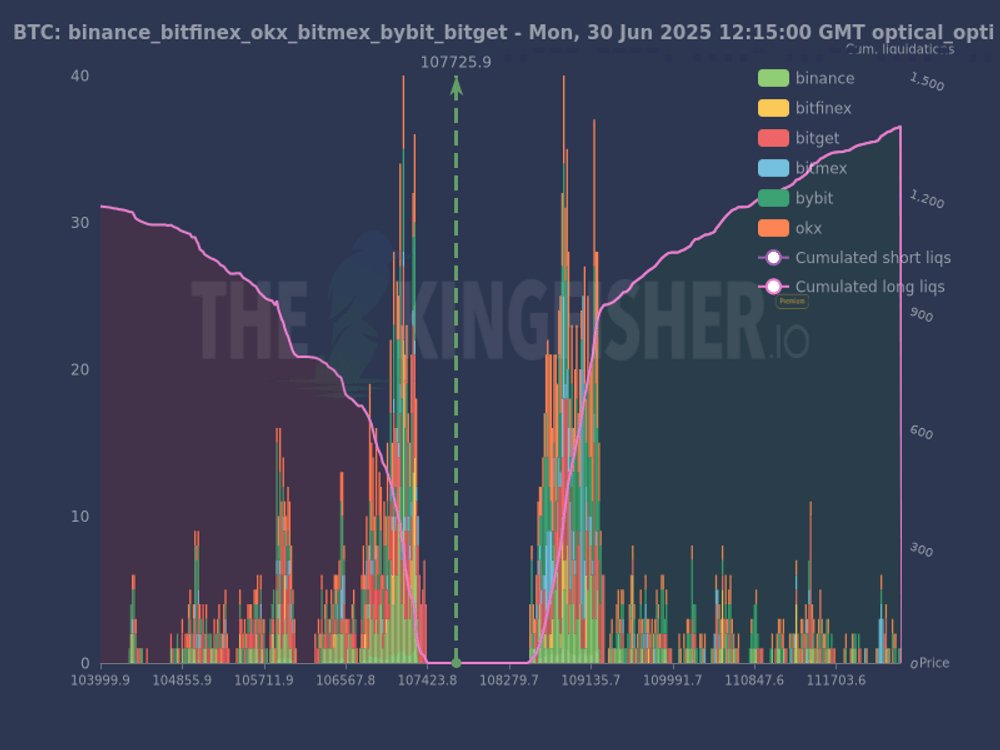

Going over most likely BTC cost responses, popular X trading account TheKingisher preferred shorts feeling the heat– something which would occur with only small advantage.

” Listed below us, a cluster of long liqs around 106k-107k. However above? A HUGE wall of brief liquidations right away above present cost, peaking increasingly around 108k-108.5 k!” part of a post summed up together with cross-exchange liquidity information.

” That’s a strong magnet. Brief squeezes can be ruthless if cost presses through 107.5 k.”

Continuing, popular trader and expert Rekt Capital had actually blended news for bulls. BTC/USD, now dealt with a crucial last resistance fight to unlock to cost discovery.

” After having actually introduced from this regional green location of assistance … Rate is now drawing back into this area for another retest,” he included about the everyday chart.

” Continued stability here would allow another difficulty of the Main Drop going back to late Might (black).”

Fed’s Powell replacement might activate “among the most significant runs” for stocks

Ahead of a peaceful four-day TradFi week in the United States, bullish crypto hints nevertheless came thick and quick on the day.

Related: Record Q2, month-to-month close next? 5 things to understand in Bitcoin today

A suggestion of a 40% crypto allotment by Ric Edelman, creator of $300 billion fund Edelman Financial Providers, integrated with news that Washington was set to look for a replacement for Jerome Powell, Chair of the Federal Reserve.

As Cointelegraph reported, Powell continues to field public criticism from United States President Donald Trump over his rejection to lower rate of interest, with the latter requiring that these fall from the present 4.25% to simply 1%.

” If the brand-new Fed Chair really cuts rates to 1%, we are going to witness possibly among the most significant runs of perpetuity in stocks and property,” trading resource The Kobeissi Letter anticipated on the day.

” There has actually never ever been a time in history where the Fed cut rates to 1% with the stock exchange and home costs at all time highs.”

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.