Bottom line:

-

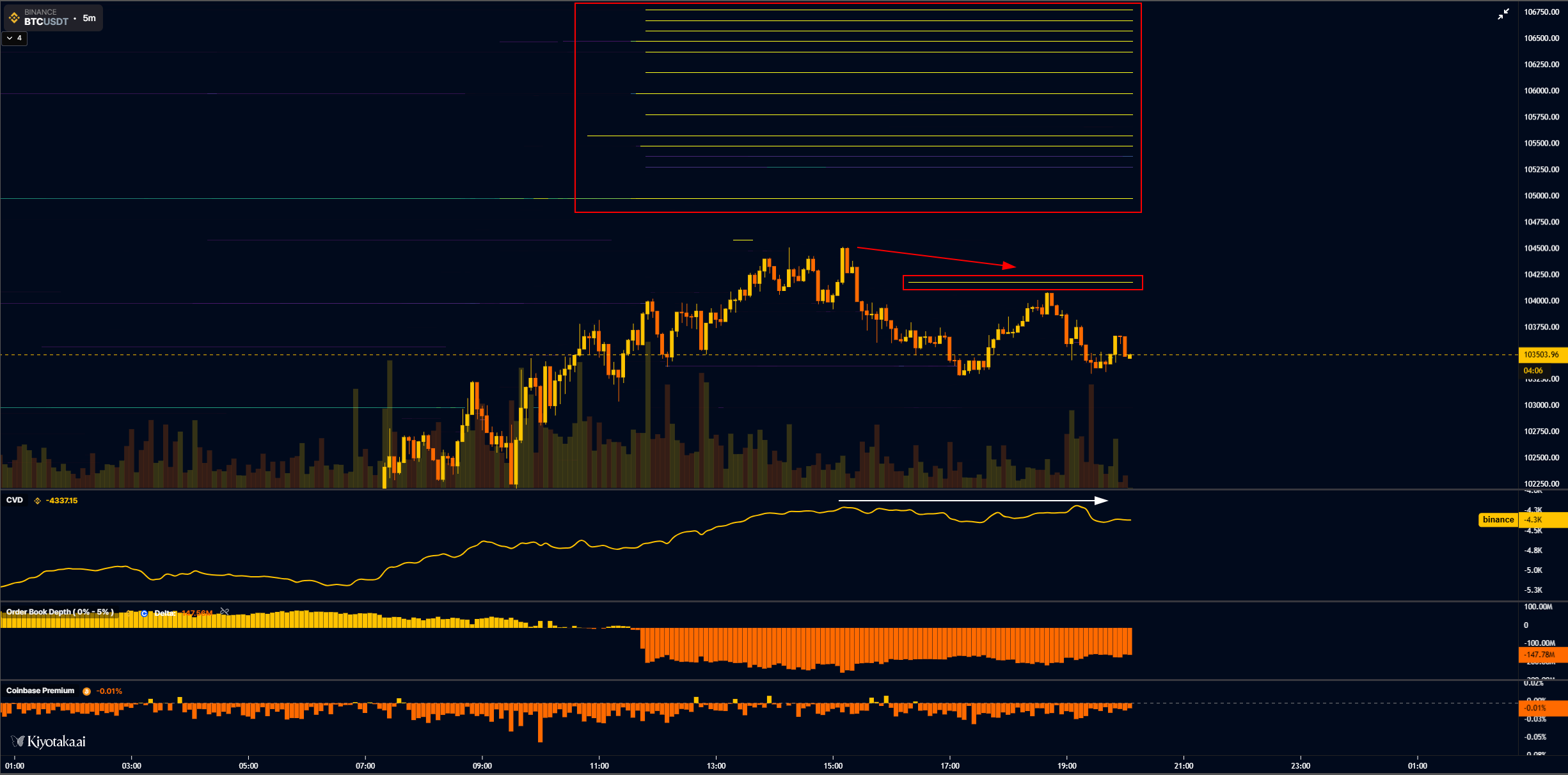

Bitcoin deals with a huge wall of ask positions above $105,000, with cost pinned listed below.

-

Traders alert of another dip thanks to a big quantity of purchaser interest around $100,000.

-

The United States trade tariffs come in for a Supreme Court barbecuing, with significant ramifications for stocks.

Bitcoin (BTC) kept traders worried Thursday as sellers lay in wait at $105,000.

BTC cost deals with brand-new liquidity video games

Information from Cointelegraph Markets Pro and TradingView revealed the BTC cost rebound flagging after the day-to-day open.

Bulls dealt with a difficult task throughout Wednesday’s Wall Street trading session, and exchange order-book information verified a wall of asks placed straight above cost.

” Pretty clear cost has actually been topped with the cluster of asks (sell orders) above $105K,” trader Skew stated, calling the scenario “not unexpected.”

Alter cautioned that there were indications of sell-side pressure increasing as the cost tried a resurgence.

” Frequently this strategy is utilized to drive cost lower throughout asia hours,” he included, about the $105,000 asks.

Trading resource Product Indicators raised the stakes, arguing that it was “intriguing” that the ask liquidity had not currently triggered a brand-new market flush.

The owner of the positions, it recommended, “might be attempting to reduce cost to the $98k – $93k variety.”

” If cost strikes $105k, I ‘d anticipate part if not all of those asks to get pulled,” an X post projection.

” Before you worry sell, remember we have a bounce from the 50 Week SMA which, if it holds, has macro bullish ramifications.”

Analyst Exitpump called the ask wall “crazy” and also indicated that the liquidity might not be real.

$BTC What the hell is going on in orderbook on binance area, crazy quantity of asks were included above cost, can be spoof orders. pic.twitter.com/9aG0VB8ktT

— exitpump (@exitpumpBTC) November 5, 2025

Tariff buzz puts traders on notification

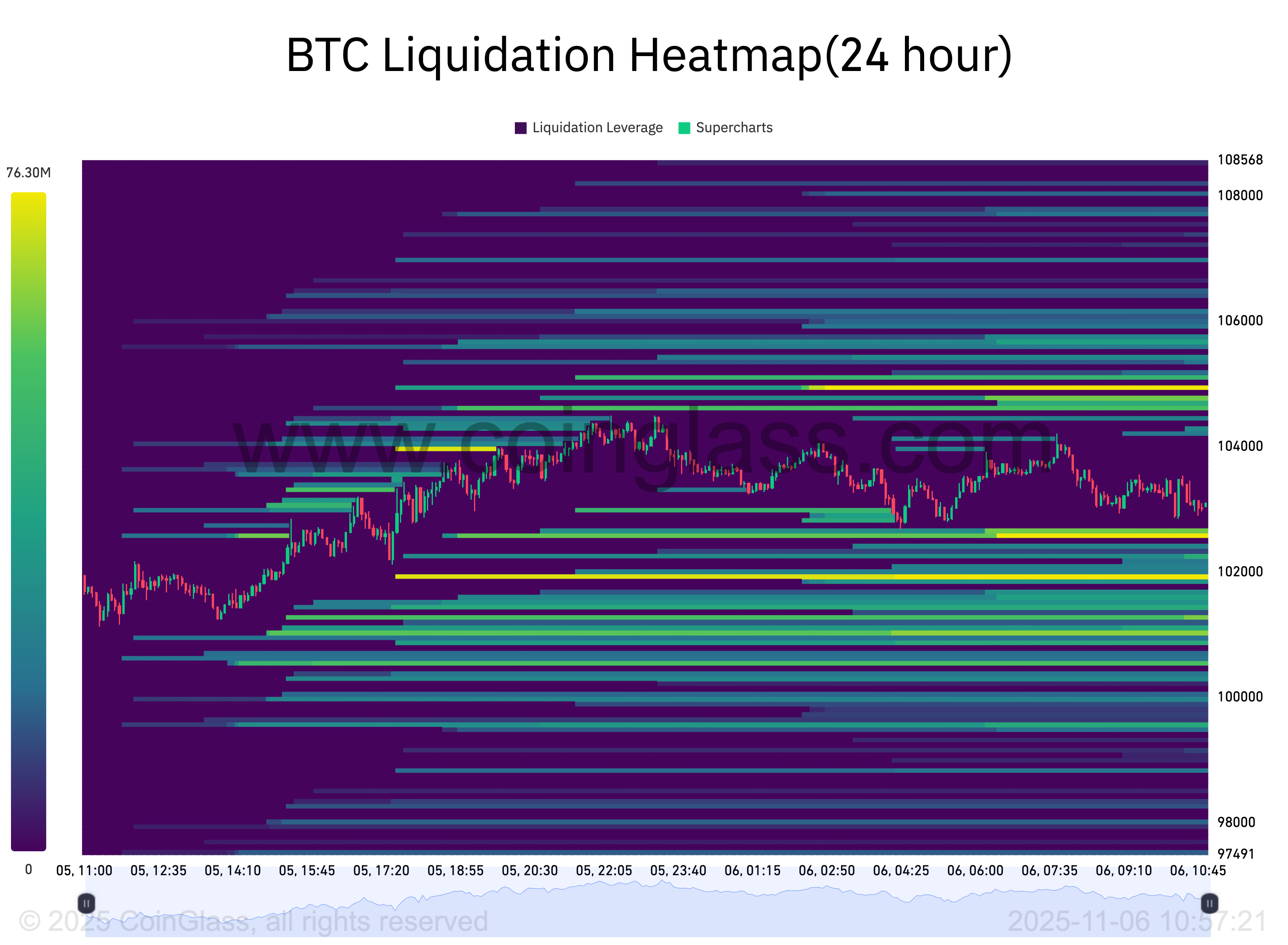

Bitcoin OG Kyle Chasse saw the capacity for another BTC cost dip thanks to bid liquidity structure listed below the cost.

Related: Bitcoin cost 21% dip ‘typical’ as accumulator wallets purchase 50K BTC in day

” Self-confidence might get cleaned in a heart beat,” he informed X fans Thursday, together with information from keeping an eye on resource CoinGlass.

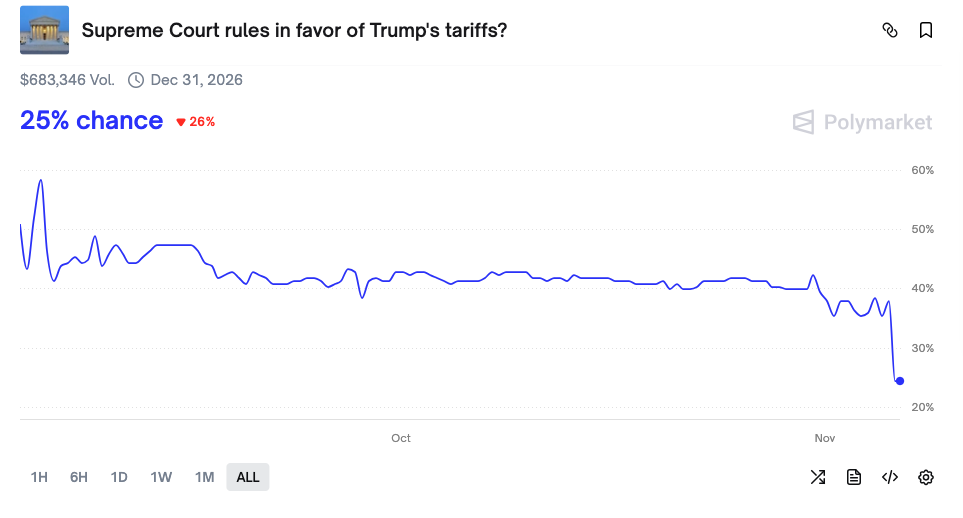

With United States stocks cooling their climb to brand-new all-time highs, the capacity for the Supreme Court to overrule blanket worldwide trade tariffs was of essential significance.

Reports started distributing that such a circumstance would offer equities throughout the board a significant increase.

Forecast markets had little faith in tariffs staying after mainstream media reports that judges were “doubtful” of their legality.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.