Bitcoin (BTC) cost continues to compress under $70,000 on Tuesday, and information recommends that the danger of brand-new year-to-date lows stays a threat if bulls stop working to turn the level into assistance.

The whipsaw nature of Bitcoin’s cost rose as United States market volatility climbed up back above a vital level, and Treasury yields saw their sharpest weekly drop in months.

Experts recommend this macro background might mean a prolonged downturn stage for BTC cost, while onchain information reveals traders still waiting on a more powerful bullish driver.

Secret takeaways:

-

The CBOE Volatility Index at 22.50 signals an increasing market volatility and risk-off positioning for financiers.

-

The United States 10-year yield is at 4.02%, down 3.75% recently, nearing its 200-day moving typical pattern for the very first time considering that March 2022.

Why Bitcoin might stay a “risk-off” possession in the meantime

The CBOE Volatility Index (VIX), which determines the 30-day volatility expectations in United States equities, has actually reached 22.50 in 2026 and is approaching its greatest level considering that November 21, 2025.

An increasing VIX normally shows the growing unpredictability and decreased cravings for danger properties, a “risk-off” setup that has traditionally forced Bitcoin.

For context, the chart reveals a duplicated inverted pattern in between Bitcoin and the VIX around the 20 level. When the VIX increased above 20 in December 2024, BTC formed a leading at $104,000. A more powerful rise above 25 in March through April 2025 lined up with a sharp BTC correction to $80,000.

Another relocation above 20 in Q4 lined up with Bitcoin’s cycle high near $126,000, and BTC’s drop listed below $100,000 likewise came as the VIX increased above the limit.

At the very same time, the United States 10-year Treasury yield fell 3.75% recently, its steepest weekly decrease considering that September 2025. Now at 4.02%, the yield is set to retest its 200-period easy moving average (SMA) for the very first time considering that March 2022.

Falling yields show protective placing throughout conventional markets, enhancing the mindful tone.

The Crypto Worry & & Greed Index dropped to 7 recently, among its least expensive readings on record. Property management business Bitwise described in its weekly newsletter that while severe worry has actually lined up with cycle bottoms, BTC’s onchain supply in revenue just quickly touched the 50% throughout the current sell-off. This level has actually marked much deeper bearishness resets in the past.

Related: Bitcoin build-up wave puts $80K back in play: Expert

Stablecoin liquidity development decreases

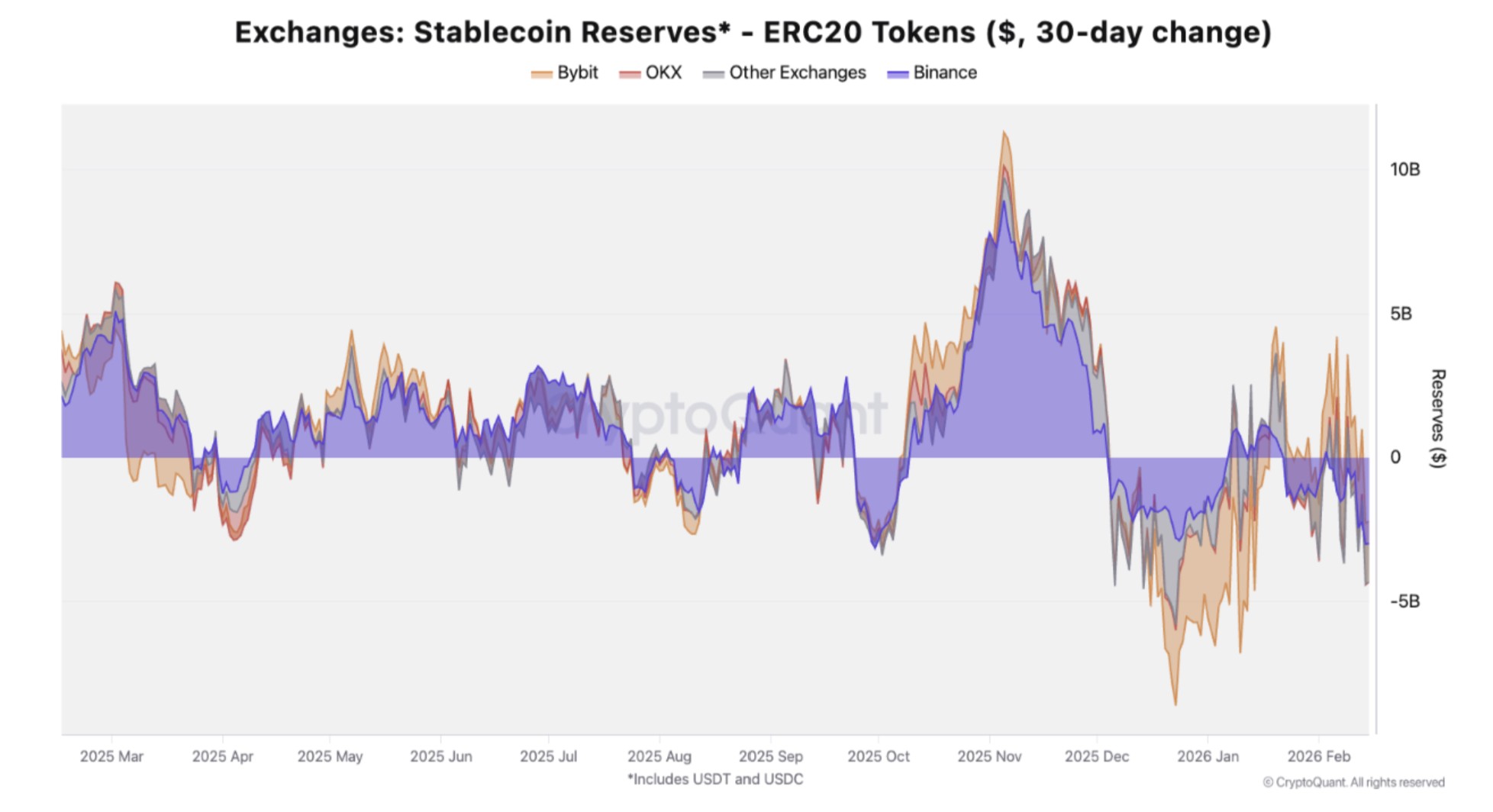

CryptoQuant information reveals that the stablecoin reserves increased by $11.4 billion in the thirty days leading up to November 5, 2025, showing strong purchasing power getting in the marketplace.

Nevertheless, as the bearish stage broadened, stablecoin reserves fell $8.4 billion by December 23, 2025, indicating that capital was vacating.

Over the previous month, the reserves throughout numerous exchanges have actually decreased by a modest $2 billion. This marked a downturn compared to the sharp outflows in Q4, however an absence of considerable inflows indicated restrained liquidity conditions.

Binance controlled exchange liquidity, holding $47.5 billion in USDT and USDC reserves, approximately 65% of overall central exchange balances, consisting of $42.3 billion in USDT, which is up 36%, year-over-year.

Relating to stablecoin inflows and reserves, crypto expert Maartunn stated USDC inflows to exchanges are trending lower once again, showing that brand-new liquidity has yet to return at scale.

Related: Crypto belief strikes severe worry as Matrixport flags possible bottom

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this details.