Bottom line:

-

Bitcoin’s most recently-moved supply section is increasing as greater rates see an increase of “speculative capital.”

-

” Hot supply” has actually doubled in simply 5 weeks versus regional lows in March.

-

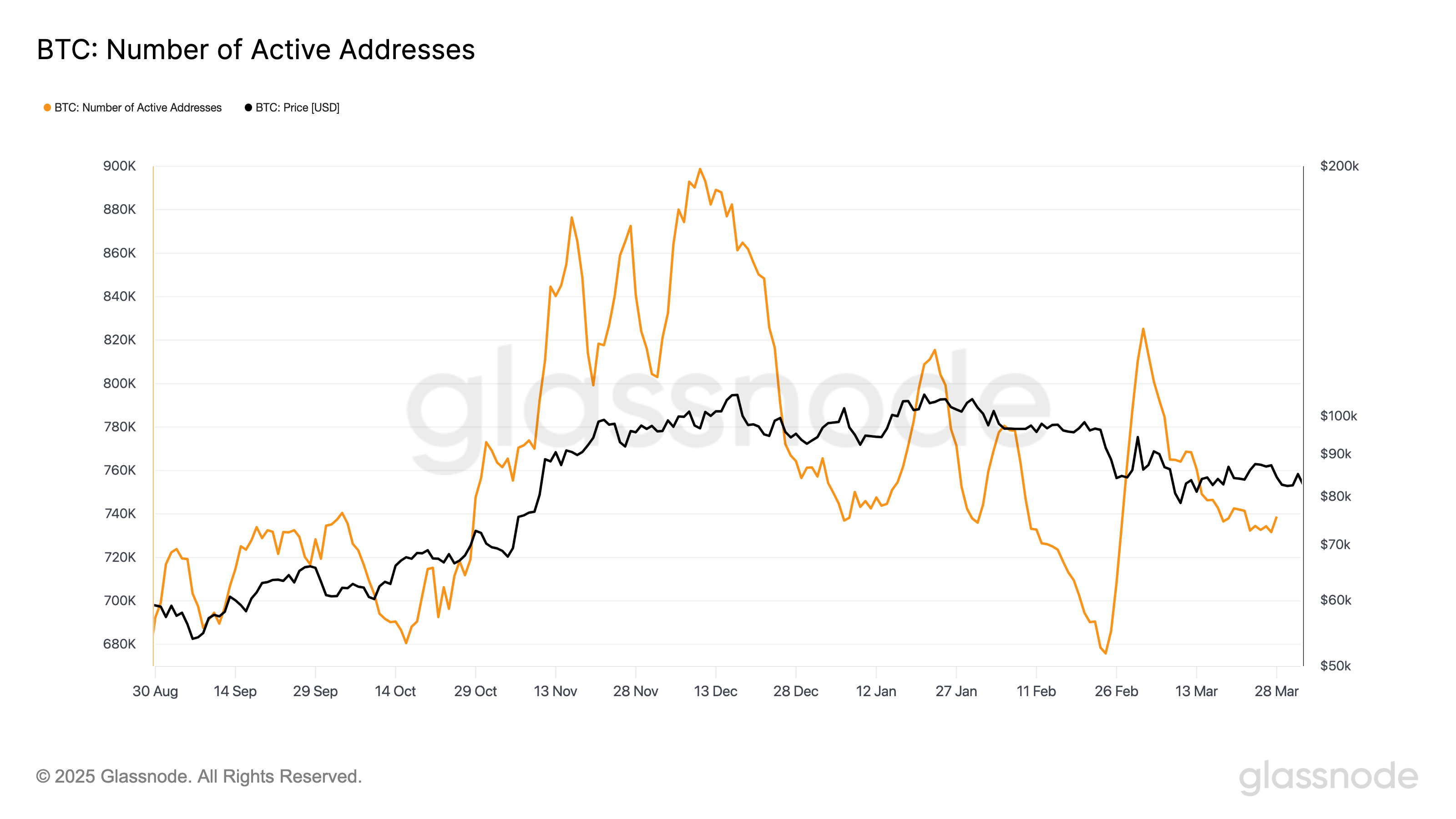

Active address numbers have yet to imitate a traditional booming market resurgence.

Bitcoin (BTC) short-term holders (STHs) are back in the video game as a “speculative capital” goes into the marketplace.

In an X thread on April 29, onchain analytics firm Glassnode reported a rise in Bitcoin’s so-called “hot capital.”

Bitcoin sees “rise in capital turnover”

Brand-new financiers are going into the marketplace as BTC cost action circles its greatest levels in a number of months.

Glassnode exposes that the amount of coins which last went up to a week back has actually reached its biggest figure considering that early February.

” This metric captures short-term holder activity and is a proxy for speculative capital going into the marketplace,” it describes.

In the previous week alone, hot capital has actually soared by over 90% to near $40 billion. Given that regional lows in late March, hot capital has actually increased by $21.5 billion, a “rise in capital turnover” which highlights a transformation in market belief.

” BTC hot capital bottomed at $17.5 B on 23 Mar – its least expensive level considering that Dec,” Glassnode sums up.

” In simply 5 weeks, it has actually included over $21.5 B, recommending a quick shift from inactivity to speculation amongst more recent market entrants.”

BTC booming market resurgence in development

As Cointelegraph continues to report, STH financiers have actually just recently gone back to aggregate revenue as cost hovers near $95,000.

Related: Bitcoin in ‘crucial zone’ as triple breakout satisfies $93.5 K assistance fight

Examining general network involvement, nevertheless, Glassnode recommended that a complete booming market resurgence has actually not yet happened.

” Indications of early FOMO are emerging, with the Hot Capital Share ticking greater and success metrics like Percent Supply in Revenue (86%) and NUPL (0.53) broadening significantly,” it composed in an intro to its most current “Market Pulse” analysis piece launched on April 28.

” Nevertheless, while on-chain activity such as transfer volume and charges are recuperating, daily active addresses stay reduced, recommending that complete natural network engagement is still reconstructing.”

Previously today, other sources reported on the prospective risks of “FOMO” when it concerns a long-lasting BTC cost healing.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.

Brand-new analysis on April 29 from Axel Adler Jr., a factor to onchain analytics platform CryptoQuant, reveals