Bottom line:

-

Bitcoin is tipped to acquire as the S&P 500 begins a month that has actually been green for the previous years.

-

Optimum July losses for BTC/USD are presently under 10%.

-

Weak cost action at the start of the month is absolutely nothing to stress over, traders recommend.

Bitcoin (BTC) traders anticipate among its best-performing months, even as July begins in the red.

The most recent BTC cost projections see BTC/USD copying United States stock exchange to take pleasure in fresh gains over the coming month.

Bitcoin traders see BTC cost tracking stocks

Bitcoin must end July securely bullish as historic information prefers strong risk-asset returns over the coming 1 month.

As kept in mind by trader Mikybull Crypto, the seventh month of the year has actually shown to be a success for United States stocks, with the S&P 500 seeing 10 straight “green” July months in a row.

IT HASN’T BEEN A RED JULY FOR THE PAST YEARS

GREAT FOR ALTS AND BITCOIN pic.twitter.com/xfthRExpcY

— Mikybull Crypto (@MikybullCrypto) July 1, 2025

July has actually been much more financially rewarding than Might and June, both of which have actually just ended “red” for the S&P 500 one or two times given that 2015.

For BTC/USD, the photo is rather more blended. Information from keeping track of resource CoinGlass reveals that Might and June have actually experienced large variations in cost efficiency, while July has actually fared much better, with optimal losses under 10%.

” Bitcoin on the edge of breaking out and most likely to match the S&P for brand-new ATHs in July,” fellow trader Crypto Fella informed X fans over the weekend.

Double leading and double bottom for Bitcoin

Regardless of the optimism, BTC/USD started July in an uninspired design, dropping to month-to-date lows under $106,500 at the time of composing.

Related: Record Q2, month-to-month close next? 5 things to understand in Bitcoin today

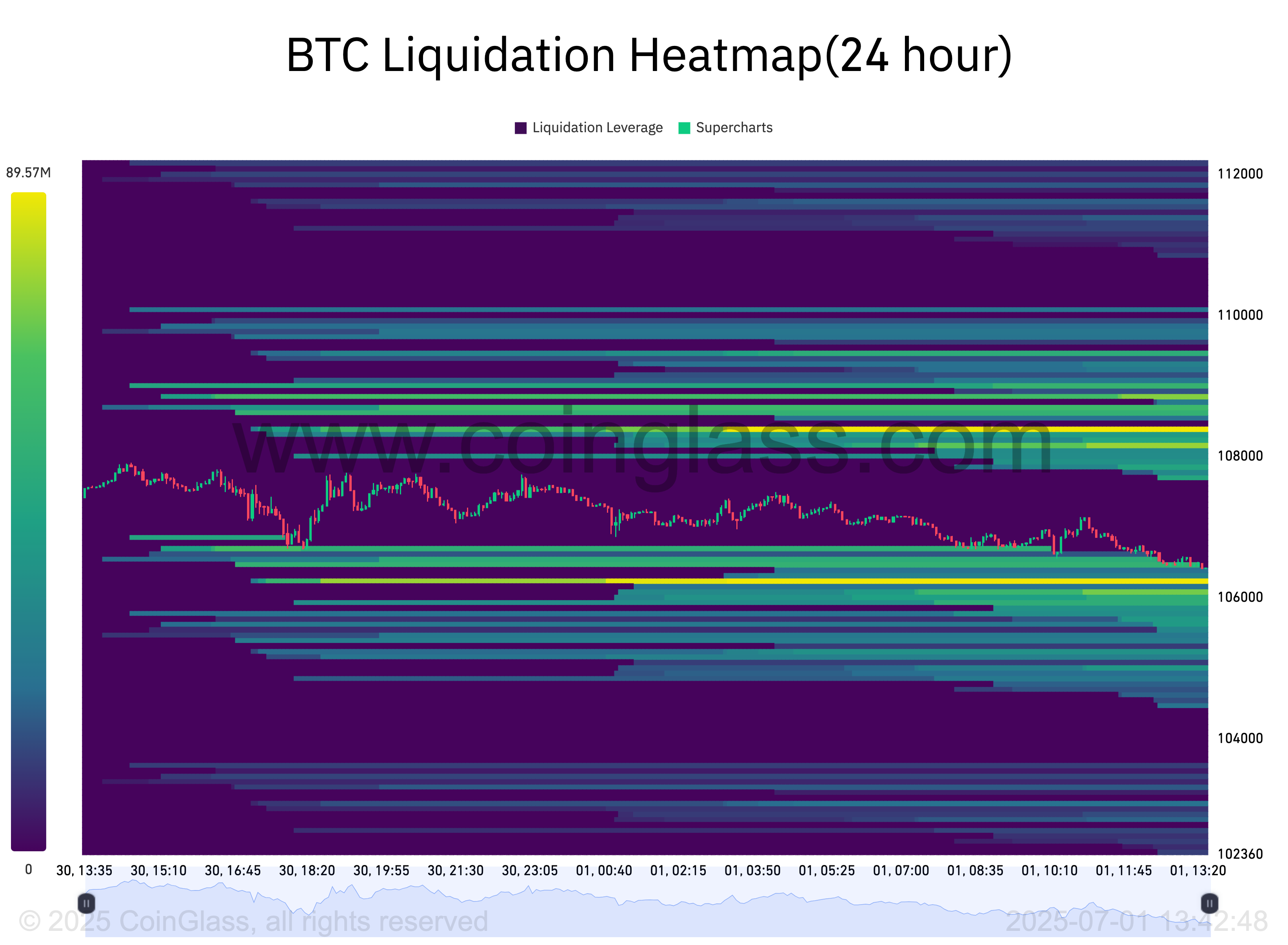

CoinGlass validated a band of quote assistance in location beginning at $106,200, with shorts above $108,000 still unblemished.

Talking about the existing setup, trader Daan Crypto Trades was amongst those unfazed by the lack of brand-new attacks on all-time highs.

” Still combining in this existing variety and channel,” he composed on X.

” With a brand-new month and quarter, we frequently see a choppy start after which cost picks an instructions in the future. Offer it a long time to play out and expect verifications.”

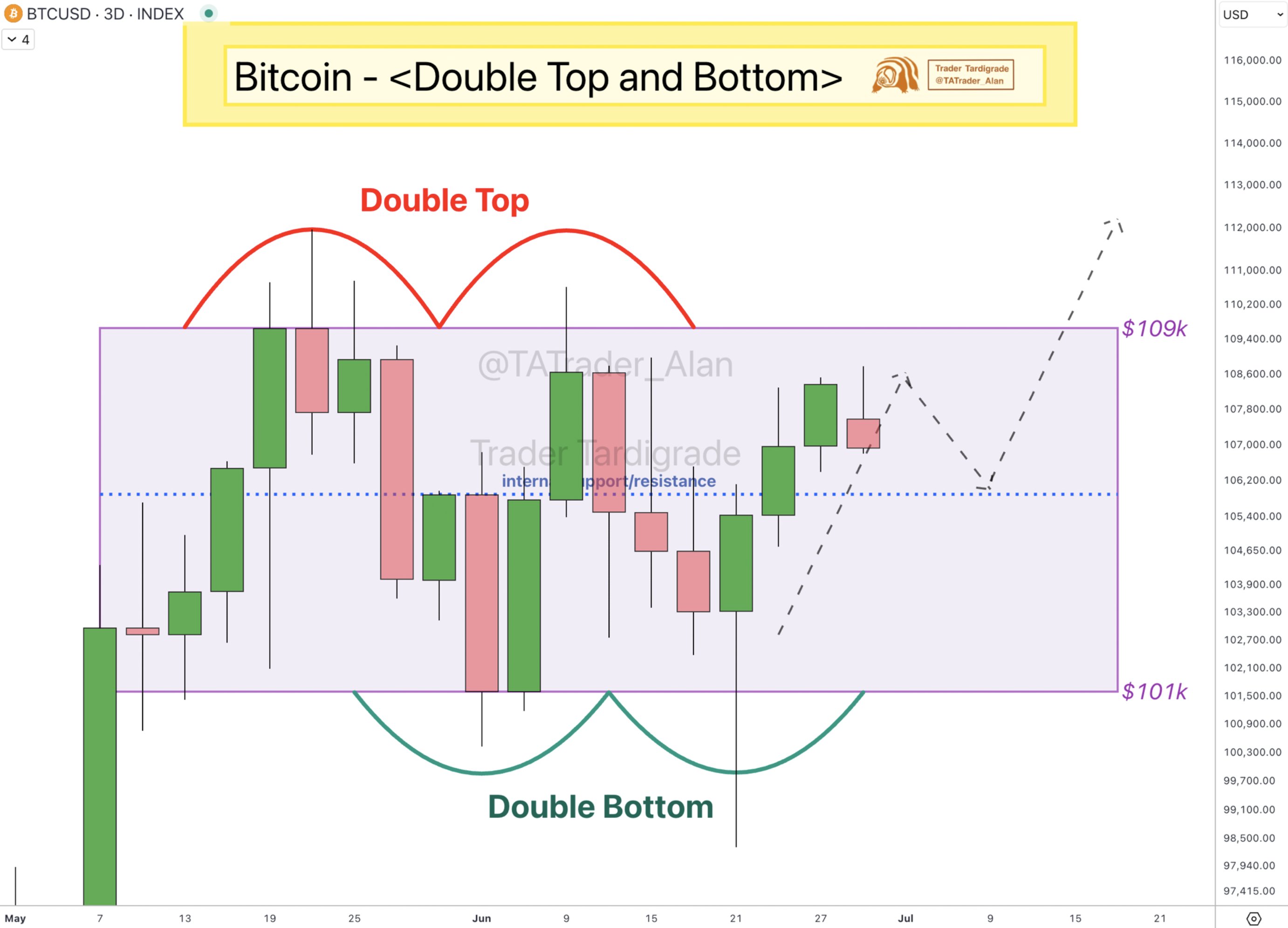

Continuing, trader and analyst Trader Tardigrade saw the capacity for additional assistance retests before resolution greater.

” Bitcoin has actually formed a Double Leading and a Double Bottom pattern within the combining series of $101k to $109k,” he kept in mind together with the 3-day BTC/USD chart.

” The internal support/resistance might be checked once again before breaking $109k variety high.”

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.