A Bitcoin (BTC) metric tracking the electrical power expense to mine one coin is flashing a caution for the bulls, with a so-called “miner exodus” contributing to the bearish outlook.

Secret takeaways:

-

BTC might fall towards the $59,000–$ 74,000 miner expense zone.

-

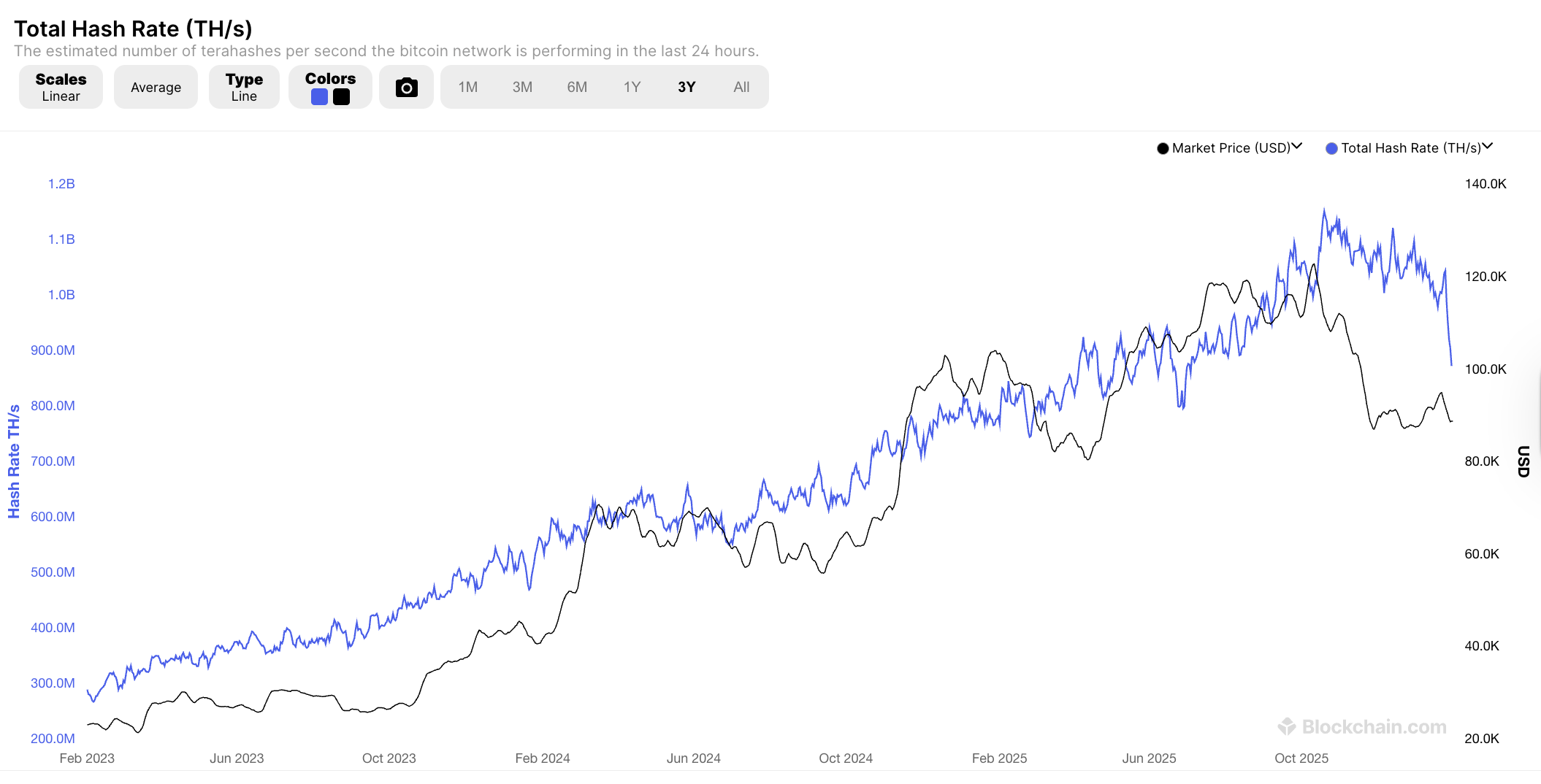

Huge hash rate drops frequently precede rebounds towards Bitcoin’s energy worth at $121,000.

Mining information tips BTC might decrease listed below $60,000

Since January, the approximated average in electrical power expenses to mine a single Bitcoin is $59,450, while the net production expense has to do with $74,300, according to information from crypto-focused hedge fund Capriole Investments.

Bitcoin was trading at around $82,500 on Friday, still above the miners’ approximated expenses.

Lots of miners can keep running even if the cost decreases listed below the typical expense. The marketplace has space to fall towards the $74,300–$ 59,450 zone before they feel genuine discomfort, according to Charles Edwards, the creator of Capriole Investments.

” This has actually broadened the prospective variety for near-term drawback,” he stated, even more mentioning a continuous “Bitcoin miner exodus” behind the bearish outlook.

Related: Bitcoin loses vital $84K assistance: How low can BTC cost go?

Bitcoin’s hash rate dropped to mid-2025 levels at completion of January, with some experts hypothesizing that BTC miners reallocated their resources to power AI operations rather. On the other hand, others blamed the United States winter season storm for the drop in BTC hash rates.

Hash rate dips might be bullish for Bitcoin

Bitcoin has actually seen hash rate drops before and recovered, according to Jeff Feng, co-founder of Sei Labs.

When some miners closed down, the network reduces mining trouble in time. That makes it much easier and less expensive for the staying miners to make BTC, which supports the network.

After China’s 2021 mining restriction, for instance, the hash rate fell about 50%, and BTC moved from around $64,000 to $29,000. However the cost recuperated to $69,000 within 5 months.

Bitcoin’s reasonable cost was around $120,950 since Friday, according to its energy worth, a metric that approximates Bitcoin’s reasonable worth based upon the network’s energy and production inputs.

Historically, BTC climbs up back towards its energy worth after an extended sag.

For Bitcoin, that recommends that the cost might bottom around anywhere from $74,300 to $59,450, and any rebound can activate a mean-reversion approach the energy worth cost.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding. While we make every effort to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might consist of positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this info.