Secret Takeaways:

-

Bitcoin rate dropped together with falling Treasury yields, signifying financiers’ flight to much safer possessions.

-

Method’s $4.28 B Bitcoin purchases and stock exchange strength have actually supported BTC above $90,000.

-

A real breakout towards $100,000 will need Bitcoin to decouple from equities and more powerful liquidity signals.

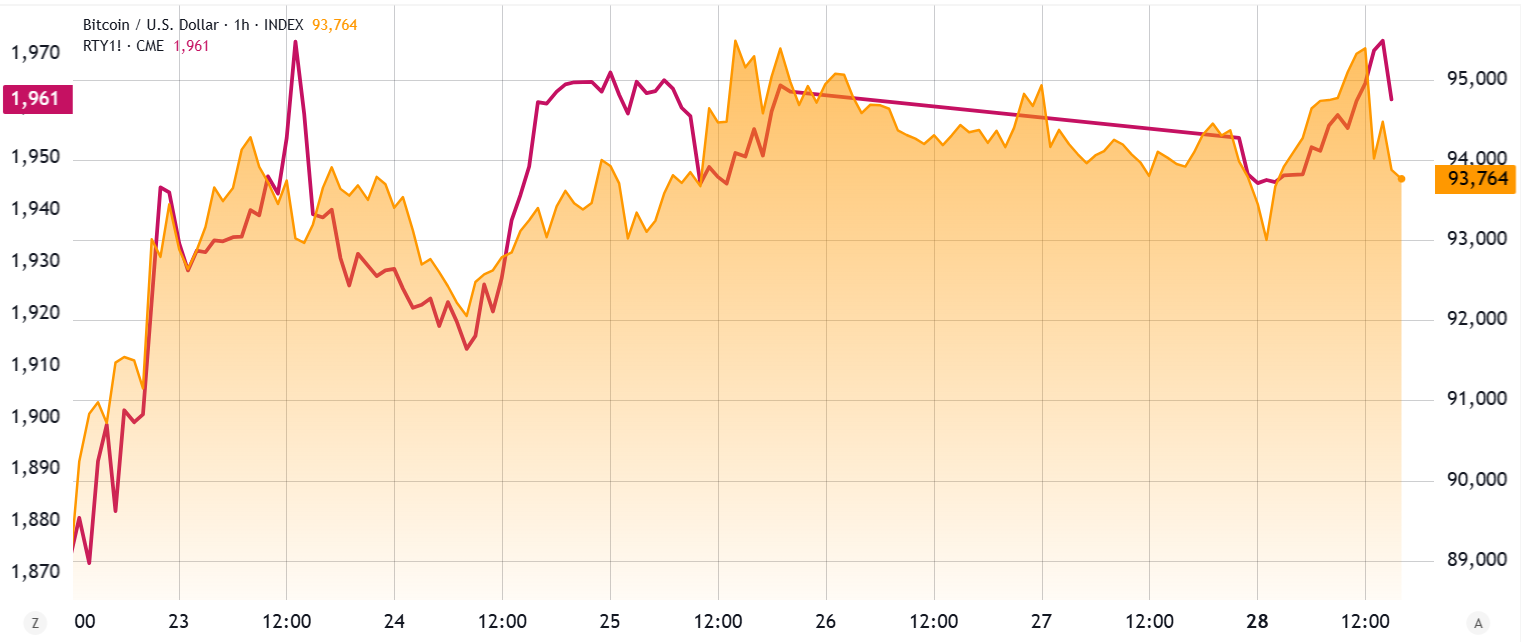

Bitcoin (BTC) experienced a sharp $2,000 correction to $93,500 on April 28. This rate motion carefully tracked the decrease in United States Treasury yields, recommending that traders were looking for the relative security of more safe and secure possessions.

While Bitcoin traders are reasonably pleased with the 6% gains attained over the previous week, there is continuous unpredictability regarding why BTC has actually been not able to preserve levels above $95,000.

The abrupt correction in Bitcoin’s rate after reaching $95,500 mirrored the intraday efficiency of United States Treasury yields. A decline in yields suggests that financiers want to accept lower returns for holding bonds, which signifies increased need for much safer financial investments. This pattern recommends an abrupt decrease in danger cravings throughout significant monetary markets.

China’s tariff cuts sustained optimism, however United States trade issues reversed belief

Financiers’ optimism increased over the weekend as news that China had actually silently decreased tariffs to zero on chosen United States semiconductor and circuit board imports was reported by Newsweek on April 25. Significantly, the United States Russell 2000 small-cap index kept favorable momentum on April 28, staying near its greatest level in over 3 weeks.

Nevertheless, this belief reversed following an interview with United States Treasury Secretary Scott Bessent on CNBC, in which he positioned the duty for a trade arrangement on China.

Although economic downturn dangers have actually increased in the middle of intensifying trade stress, lots of United States business are presently reporting strong first-quarter outcomes. According to a FactSet report, 73% of these business have actually published revenues that went beyond experts’ expectations.

Bitcoin’s repetitive failure to sustain levels above $95,000 seems connected to wider macroeconomic issues. In addition, the cryptocurrency’s failure to decouple from stock exchange patterns suggests that financiers are not yet persuaded of Bitcoin’s efficiency as a hedge throughout possible financial declines.

There are likewise worries that much of the current bullish momentum, which has actually kept Bitcoin’s rate above $90,000, has actually been driven by $4.28 billion in BTC acquisitions by Method considering that mid-March. In addition, 97% of the formerly authorized typical share issuance has actually currently been used, raising concerns about the long-lasting sustainability of Michael Saylor’s build-up method.

Bitcoin has a hard time as strong stock revenues contrast with macroeconomic issues

While the stock exchange is gaining from a robust revenues season, Bitcoin’s rate is being weighed down by understandings of weakening macroeconomic conditions.

United States existing home sales in March tape-recorded their biggest regular monthly decrease in over 2 years, falling 5.9% compared to the previous month. On the other hand, China has actually described strategies to support work and help exporters after factories decreased production due to weak customer need, according to CNBC.

Related: Crypto ETPs struck 3rd-largest inflows on record at $3.4 B– CoinShares

Provided the existing international financial unpredictability, a continual rally in BTC above $100,000 will need more than a single week of strong inflows into area Bitcoin exchange-traded funds (ETFs), especially as this accompanies substantial purchasing activity from Method.

For financiers to believe in a brand-new Bitcoin all-time high in 2025, the cryptocurrency needs to show a clearer divergence from United States stock exchange patterns and offer additional proof that reserve banks will inject liquidity to avoid a crisis.

At present, traders are concentrated on the trajectory of United States rate of interest and the possibility of a turnaround in the Federal Reserve’s balance sheet, which might end a duration of financial tightening up that has actually lasted for more than 2 years.

This short article is for basic details functions and is not planned to be and must not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.