Bitcoin (BTC) looked for a regional bottom on March 28 while United States inflation information was available in greater than anticipated.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

Bitcoin wobbles as PCE is available in hot

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD heading to $85,500 at the Wall Street open before reversing.

Down over 3% on the day, the set saw lows under $84,500 on Bitstamp, marking its most affordable levels given that March 23.

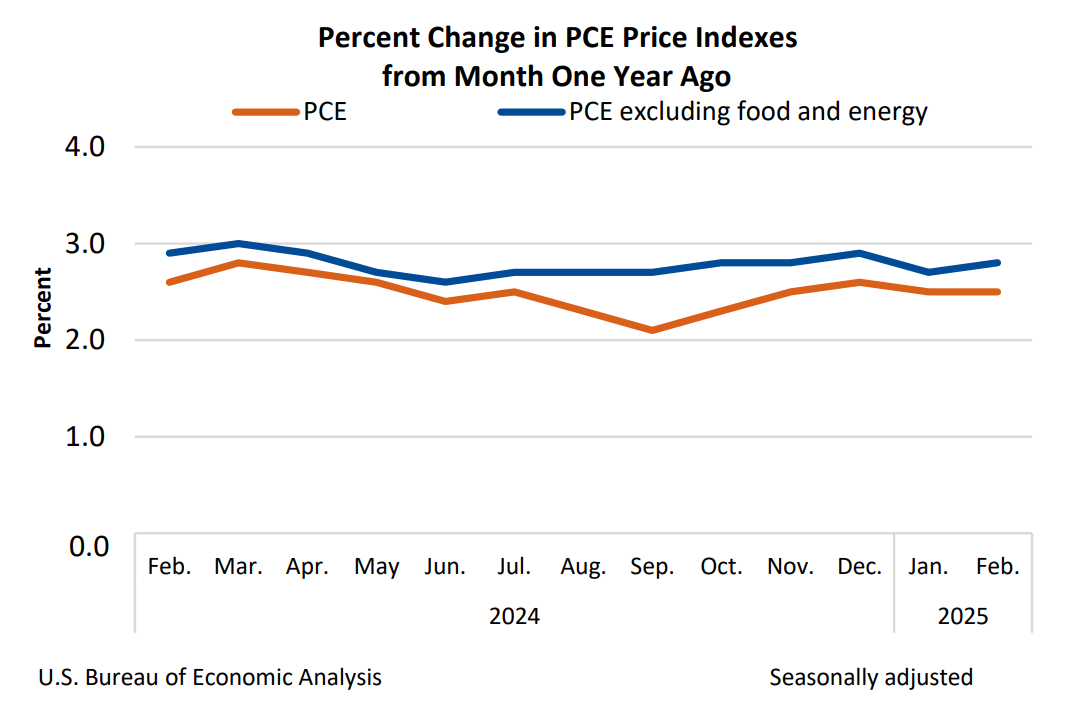

The February print of the United States Personal Intake Expenses (PCE) Index consequently revealed inflation speeding up– in contrast to the arise from a month prior.

While the month-on-month and year-on-year PCE tally complied with market projections at 0.3% and 2.5%, respectively, their core PCE equivalents were both 0.1% greater than prepared for.

” Core inflation is back rising,” trading resource The Kobeissi Letter concluded in part of an action on X, keeping in mind that the January numbers had actually likewise been modified greater.

Kobeissi argued that the existing macroeconomic trajectory types “the ideal dish for stagflation in 2025.”

” March inflation information will be much more informing as the trade war raves on,” it composed.

United States PCE % modification (screenshot). Source: Bureau of Economic Analysis

BTC cost analysis sees “normal market cooldown”

While BTC cost action appeared to get rid of the inflation caution, market individuals were all set for surprises.

Related: ‘ Bitcoin Macro Index’ bear signal puts $110K BTC cost return in doubt

” PCE information showing up so it’s going to be an unstable day in the markets I reckon,” popular trader Daan Crypto Trades hence composed in part of his own X response.

Others kept doubts over wider crypto market strength, concurring that Bitcoin was not yet out of the woods regardless of holding above $80,000 for a number of weeks.

” Pattern stays to be upwards for $BTC, however it begins to look a little less excellent,” trader, expert and business owner Michaël van de Poppe informed X fans on the day.

” It’s shaking. Drop sub $84K and I believe we’ll see a test at $78-80K and possibly lower before we’ll get better up.”

BTC/USDT 12-hour chart with relative strength index (RSI) information. Source: Michaël van de Poppe/X

Fellow trader TheKingfisher similarly saw long shot of a complete bullish return on brief timeframes.

” BTC While the short-term cost action might recommend a localized capture, the wider outlook does not yet support the story of a continual bull run,” he summed up.

” With volatility continuing to decrease, existing conditions appear more in line with a normal market cooldown. We might be approaching a seasonal reset, possibly front-running the familiar ‘offer in Might and disappear’ vibrant.”

BTC/USDT 4-hour chart with volume information. Source: TheKingfisher/X

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.