Bitcoin (BTC) might deal with an ongoing correction towards the $70,000 level if the Bank of Japan (BoJ) continues with an anticipated interest-rate walking on Dec. 19, according to numerous macro-focused experts.

Secret takeaways:

-

BoJ tightening up might push Bitcoin by draining pipes international liquidity.

-

Macro and technical signals line up around a $70,000 drawback target.

BOJ walkings preceded 20-30% BTC rate corrections

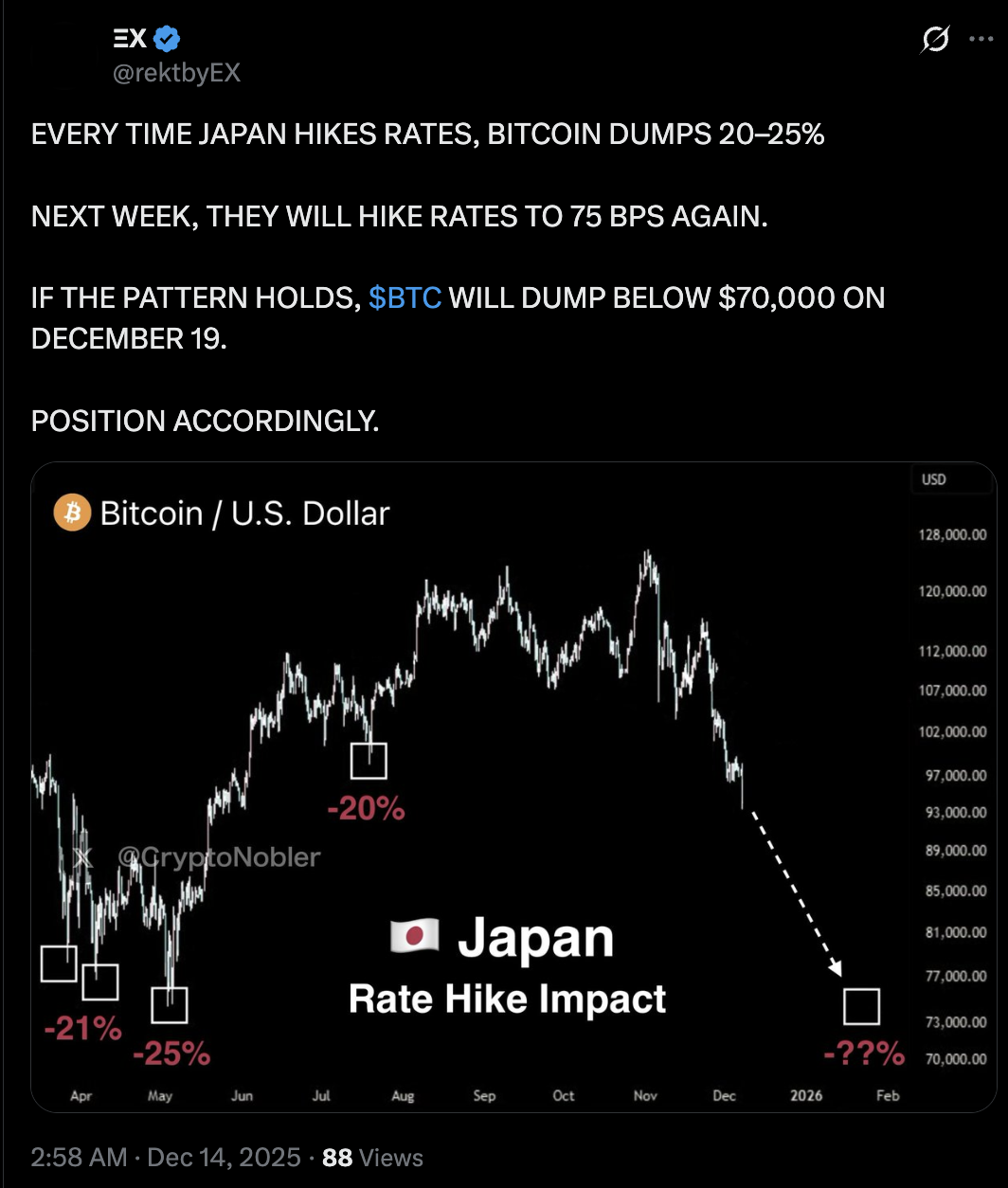

Every BOJ rate trek given that 2024 accompanied Bitcoin rate drawdowns going beyond 20%, according to information highlighted by AndrewBTC.

In an X post on Saturday, the expert highlighted BTC decreases of approximately 23% in March 2024, 26% in July 2024, and 31% in January 2025.

AndrewBTC cautioned that comparable drawback dangers might emerge once again if the BOJ raises rates on Friday. A current Reuters survey revealed a bulk of economic experts anticipating another rate boost at the December policy conference.

The thesis fixated Japan’s function in international liquidity.

In the past, BOJ rate walkings enhanced the Japanese yen, making it more costly to obtain and buy riskier possessions. This typically forced traders to relax so-called “yen bring trades,” lowering liquidity throughout international markets.

As liquidity tightened up, Bitcoin came under pressure, as financiers cut take advantage of and minimized direct exposure throughout risk-off durations.

Expert EX stated BTC will “discard listed below $70,000” under these macroeconomic conditions.

Bitcoin bear flag targets exact same $70,000 location

Bitcoin’s day-to-day chart likewise flashed technical indication, with rate action combining inside a timeless bear flag development.

The pattern formed after BTC’s sharp breakdown from the $105,000–$ 110,000 area in November, followed by a narrow upward-sloping debt consolidation channel. Such structures normally indicate short-lived stops briefly before pattern extension.

Related: BTC OGs offering covered calls is the primary offender reducing rate: Expert

A verified breakdown listed below the flag’s lower trendline might set off another leg lower, with the determined relocation pointing towards the $70,000–$ 72,500 zone. Several experts, consisting of James Examine and Sellén, shared comparable drawback targets in the previous month.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might consist of positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this info.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might consist of positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this info.