Bottom line:

-

Bitcoin whales take the blame as “spoofy” deals send out BTC rate action listed below $110,000.

-

The Bitcoin “whale playbook” suggests that rate is duplicating habits from earlier in August.

-

United States PCE inflation information is under the microscopic lense as the next prospective market mover.

Bitcoin (BTC) fell almost 3% Friday as attention once again concentrated on whale selling.

” Spoofy” Bitcoin rate relocations raise suspicions

Information from Cointelegraph Markets Pro and TradingView revealed that BTC/USD fell by $3,000 in hours to regional lows of $109,436 on Bitstamp.

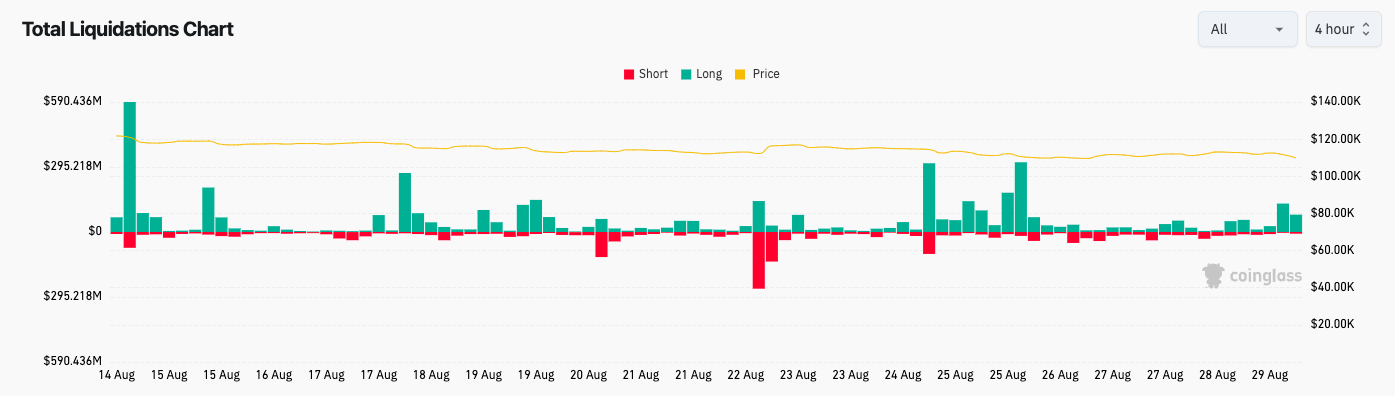

As crypto long liquidations struck $350 million over 24 hr, traders positioned the blame on whales.

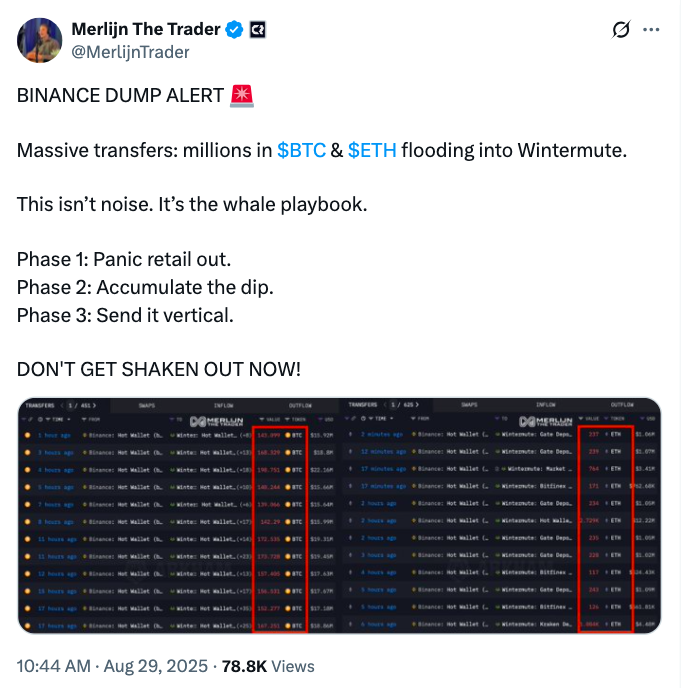

” This isn’t sound. It’s the whale playbook,” trader Merlijn composed in an X post on Friday.

Merlijn flagged big inflows into market maker Wintermute including BTC and the biggest altcoin, Ether (ETH).

As Cointelegraph continues to report, whale selling pressure has actually affected BTC rate habits throughout August, leading to a journey listed below $109,000 previously today.

“$ BTC has actually been doing the exact same thing once again and once again,” fellow trader BitBull continued, explaining a pattern of debt consolidation, capitulation, breakouts and rallies.

” Taking A Look At the BTC chart, we remain in the capitulation stage. This might last for a couple of weeks and will offer excellent entries. Watch on it,” he informed X fans.

Keith Alan, co-founder of trading resource Product Indicators, concurred that the actions of liquidity owners appeared manipulative.

Alan restored the entity he had actually formerly called “Spoofy The Whale,” describing intentional liquidity shifts to affect rate action and trap other traders.

” Appears Like ‘Spoofy’ depends on his typical video games, which includes some predictability to the short-term rate action,” he summed up in an X post.

Crypto markets unpredictable into United States PCE print

Other elements that play into BTC rate weak point consist of macroeconomic stress surrounding United States inflation information.

Related: Bitcoin can still strike $160K by Christmas with ‘typical’ Q4 return

The Federal Reserve’s “chosen” inflation gauge, the Personal Usage Expenses (PCE) Index, was due at 8:30 am Eastern Time.

Inflation information is of prime significance to crypto and threat possessions ahead of the Fed’s forecasted interest-rate cut in September.

” Fed’s preferred gauge might either sustain the dump … or light the relief rally,” crypto analysis host Kyle Doops argued, including that Bitcoin was “wobbling” ahead of the PCE print.

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.