Secret Takeaways:

-

Bitcoin shows a bearish breakout from a rising channel, with the danger of profit-taking near $106,000.

-

A lower-than-expected United States Customer Rate Index (CPI) print might increase Bitcoin, however a greater CPI might increase bearish pressure, resulting in a rate drop listed below $100,000.

Bitcoin (BTC) rate reached an intraday high of $105,800 on Might 12 however published a 3% dip to $101,400 throughout the New york city trading session. On the lower-time frame (LTF) chart, BTC oscillated in between a rising channel pattern before showing a bearish breakout listed below the bottom variety of the pattern.

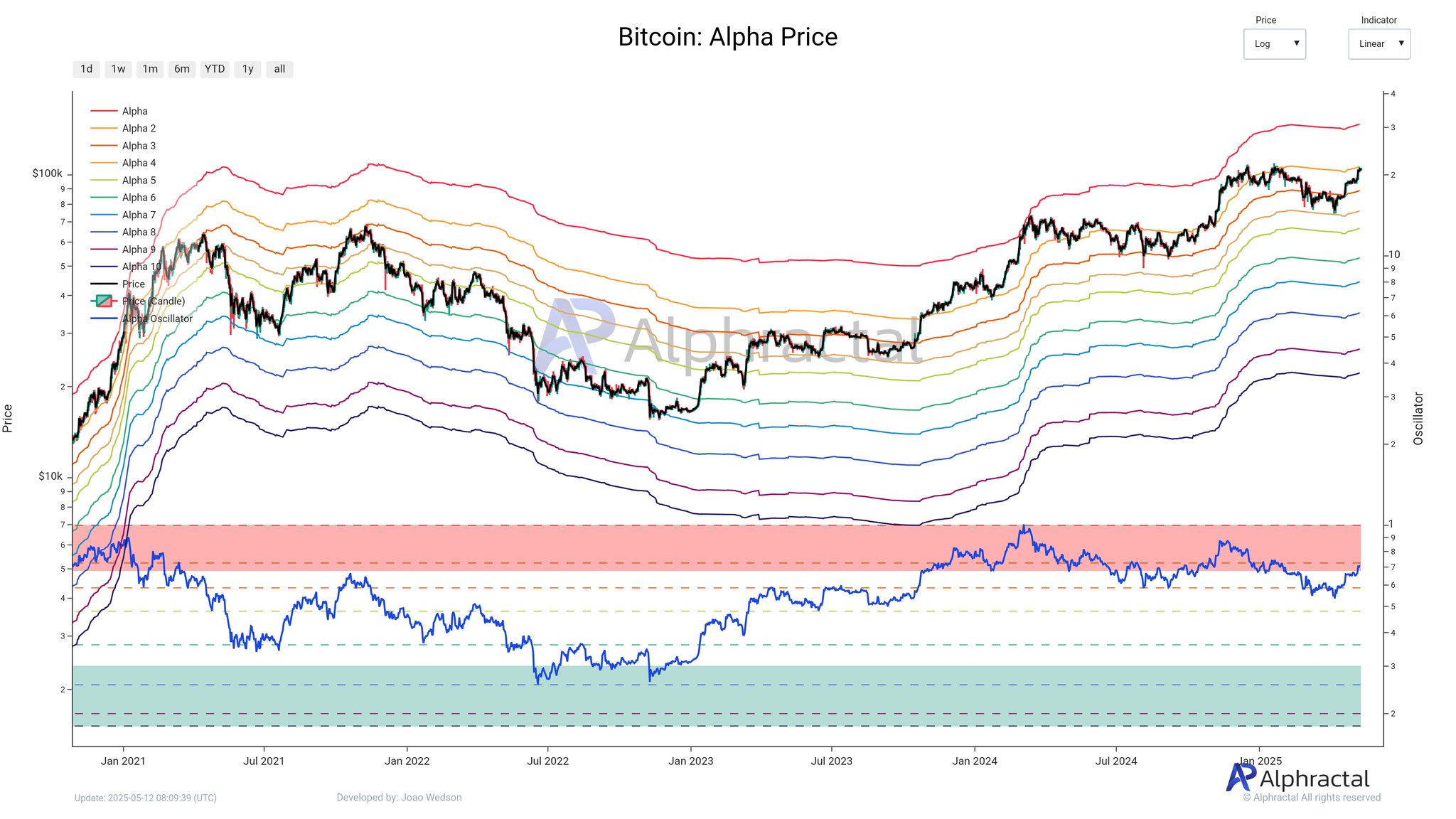

With regard to BTC’s stalling bullish momentum, information analytics platform Alphractal kept in mind that BTC re-testing nearing $106,000 resistance levels increased the possibility of profit-taking dangers. As highlighted in the chart, Bitcoin presently approaches the “Alpha Rate” zone, where long-lasting holders or whales might take earnings, according to Joao Wedson, CEO of Alphractal.

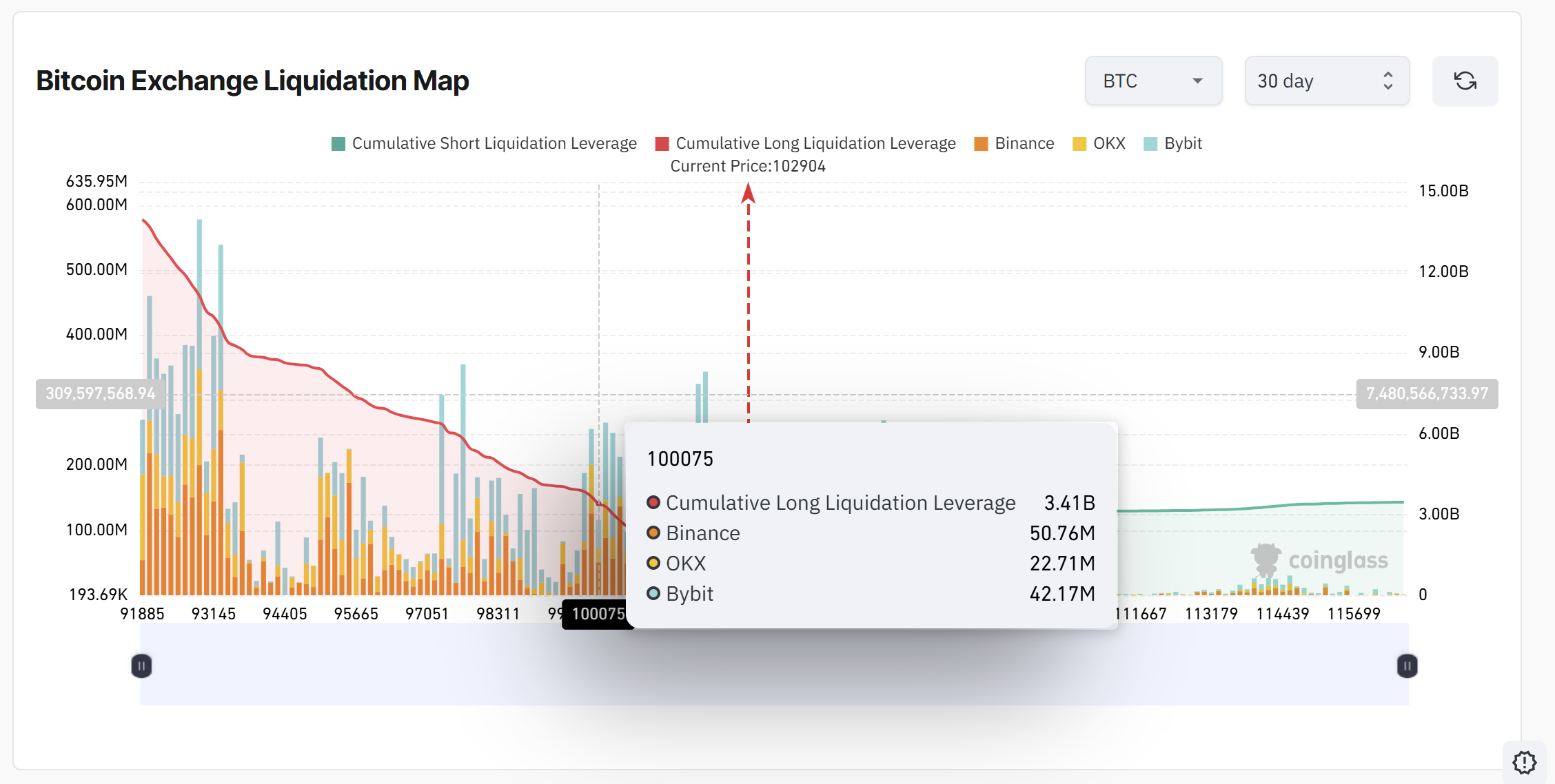

From a liquidation perspective, the danger of a “long” capture is likewise raised, with over $3.4 billion in leveraged long positions at danger of liquidation if costs drop to $100,000. This variety might function as a magnet for rate, resulting in a retest near the mental level.

Related: Bitcoin all-time high hints come as US-China offer sends out DXY to 1-month high

CPI information looms as Bitcoin traders de-risk

The existing BTC correction may show traders de-risking ahead of the United States Customer Rate Index (CPI) release on Might 13. Formerly, March’s CPI, launched April 10, was 2.4%, below February’s 2.8%, in spite of a projection of 2.5%. April’s CPI is anticipated to stay at 2.4%, due to constant energy costs in the middle of well balanced oil production and moderating wage development, alleviating pressure on rate boosts.

A lower-than-expected CPI (possibly 3rd in a row) might be bullish for Bitcoin, possibly signifying Federal Reserve rate cuts in 2025, increasing danger properties like equities and cryptocurrencies. On the other hand, a higher-than-expected CPI might be bearish, raising inflation worries and enhancing the dollar, pressing BTC.

If bearish pressure continues on BTC charts even after the CPI print, an instant essential location of interest stays in between $100,500 and $99,700, a reasonable worth space (FVG) on the four-hour chart.

Another FVG stays in between $98,680 and $97,363, which would represent an 8% correction from the current highs.

Related: Bitcoin, altcoins poised to rally on US-China tariff contract

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.