Secret takeaways:

-

Bitcoin bulls are assaulting the $95,000 level once again after today’s quick United States GDP-induced sell-off.

-

Traders are semi-agnostic to unfavorable United States financial information as they anticipate the Federal Reserve to resume relieving and rate cuts at some time in the future.

Bitcoin (BTC) cost knocks on the door of $95,000 after beginning the NY trading session with a minor sell-off to $92,910 following alarm-raising United States GDP information, which revealed the economy diminished in Q1 2025. The relocation mirrors a comparable healing seen in the DOW and S&P 500, which bounced 0.35% and 0.15% respectively at the closing bell.

The fast healing in Bitcoin cost highlights the strong quote by a range of market individuals, and it lines up with the view that the April 30 GDP information might be a one-off occasion arising from organizations increase their imports ahead of President Donald Trump’s tariffs on about 90 nations.

While a diminishing economy and record-low customer self-confidence stand issues for TradFi financiers, the risk of a United States economic crisis likewise plays into crypto traders financial investment thesis which anticipates that a range of unfavorable financial occasions will ultimately require the Federal Reserve to cut rates and release more dollars– a maneuver which traditionally has actually benefitted Bitcoin cost.

Present chances of a Fed rates of interest cut have actually increased today, from 59.8% on April 29 to 63.8% on April 30.

According to popular X trader Alter, the bounce in Bitcoin and United States stocks was partly driven by “quite strong profits beats from huge United States business up until now,” which might likewise “boost some self-confidence in danger.”

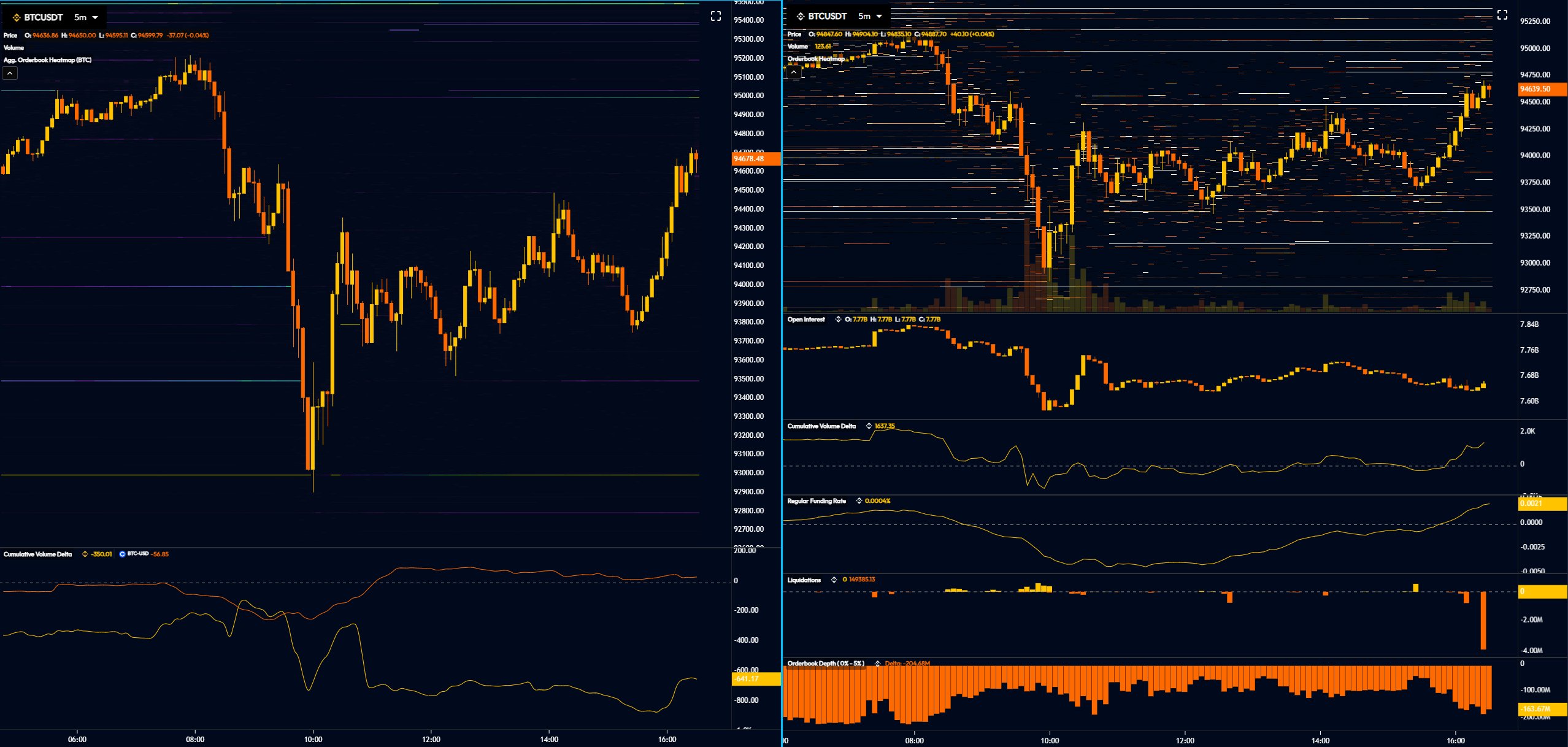

The trader likewise stated that Bitcoin’s,

” Area circulation [was] mainly driven by passive purchasers today, and cost raised with taker quote. Financing rate stabilizing now after some shorts liquidating.”

Related: Bitcoin cost combination likely as United States Core PCE, production, and tasks reports print today

Presently, $95,500 is the essential level traders are seeing, and numerous experts think that a continual push through the resistance zone unlocks for a speedy return to $100,000.

It’s possible that the May 2 tasks report, which will demonstrate how numerous tasks were contributed to the United States economy in April, might have a minor influence on the stock exchange and, in turn, cryptocurrencies.

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.