Secret takeaways:

-

Bitcoin ETF outflows of $2 billion because Oct. 29 heightened market pressure and removed optimism around institutional need.

-

Weak business incomes and macro threats recommend Bitcoin might fall listed below $100,000 before purchasers restore self-confidence.

Bitcoin (BTC) took an unforeseen turn on Thursday, retesting the $101,500 assistance and setting off over $135 million in liquidations from leveraged bullish BTC futures positions. Bitcoin derivatives show that bullish momentum has all however disappeared, leaving traders to question whether the $100,000 assistance can hold up against more pressure.

Bitcoin’s month-to-month futures premium relative to the area market briefly hovered near neutral levels on Thursday before slipping listed below the 5% limit, a signal of fading need for bullish direct exposure. The 2.5% decrease in BTC because Wednesday mirrored getting worse belief in equities, as the Nasdaq index dropped 1.6%, eliminating gains built up over the previous 2 weeks.

Without any significant crypto-specific news or drivers, experts state the dominating worry originates from wider macroeconomic aspects. They indicate extended appraisals and possible energy restrictions connected to expert system chip production, as evidenced by the 5% decrease in Qualcomm (QCOM) shares and a 7.5% drop in AMD (AMD) shares, in spite of the business publishing strong incomes development.

Contributing to the unpredictability, financiers fret that the continuous United States federal government shutdown has actually currently started to weigh on customer costs. Shares of DoorDash (DASH), Pinterest (PINS), and Duolingo (DUOL) toppled Thursday following weaker-than-expected quarterly outcomes. Belief weakened even more after the United States Supreme Court questioned President Donald Trump’s authority to enforce import tariffs.

Need for put (sell) Bitcoin choices rose, pressing the alter metric to 14%, an extremely uncommon level well above the 6% neutral mark. The weak hunger for neutral-to-bullish choices methods shows a more comprehensive worry of correction as international economies reveal increasing indications of pressure. As an outcome, it might take longer for Bitcoin bulls to restore the self-confidence required to press rates back towards $110,000 and beyond.

Bitcoin’s cost dip to $100,300 on Thursday did not cause a drop in BTC futures open interest, recommending that bullish traders likely included margin to prevent liquidation. This habits signifies a tentative vote of self-confidence that the $100,000 assistance will hold, relieving a few of the stress produced by severe positioning in the BTC choices market.

Traders prefer money over Bitcoin in the middle of equity market threats

Cryptocurrency traders, nevertheless, stay anxious that liquidity has actually been greatly lowered because the Oct. 10 crash, sustaining volatility spikes. Despite the fact that Bitcoin is distinctively placed to take advantage of capital outflows from equities, numerous traders choose to hold money as a secure versus an abrupt stock exchange sell-off.

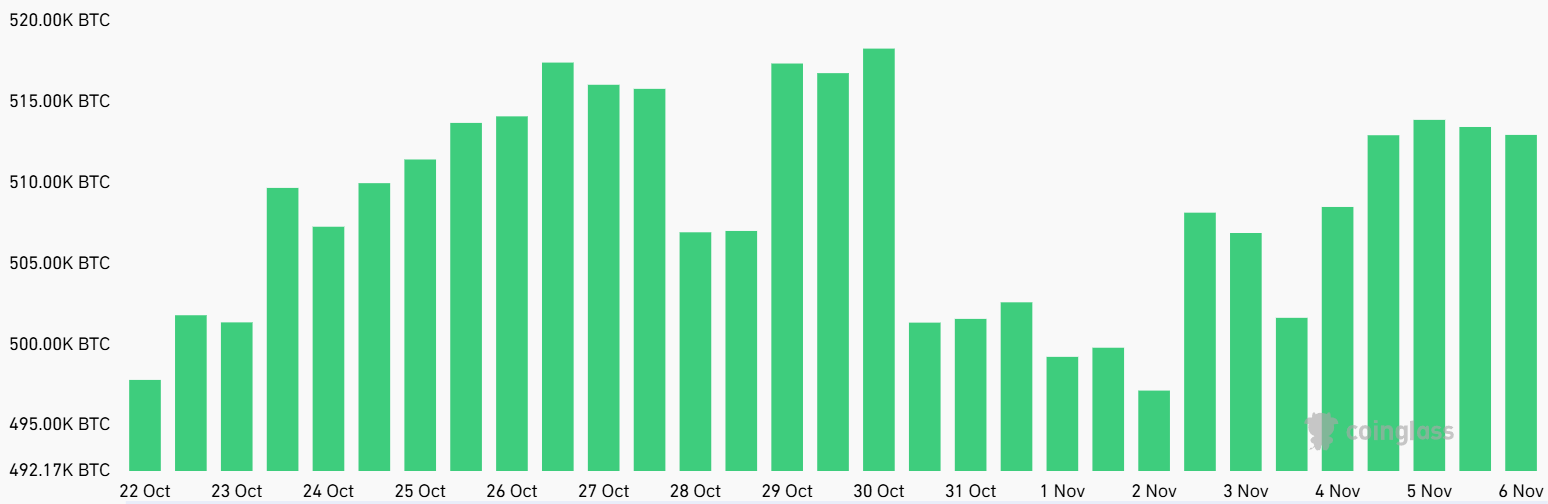

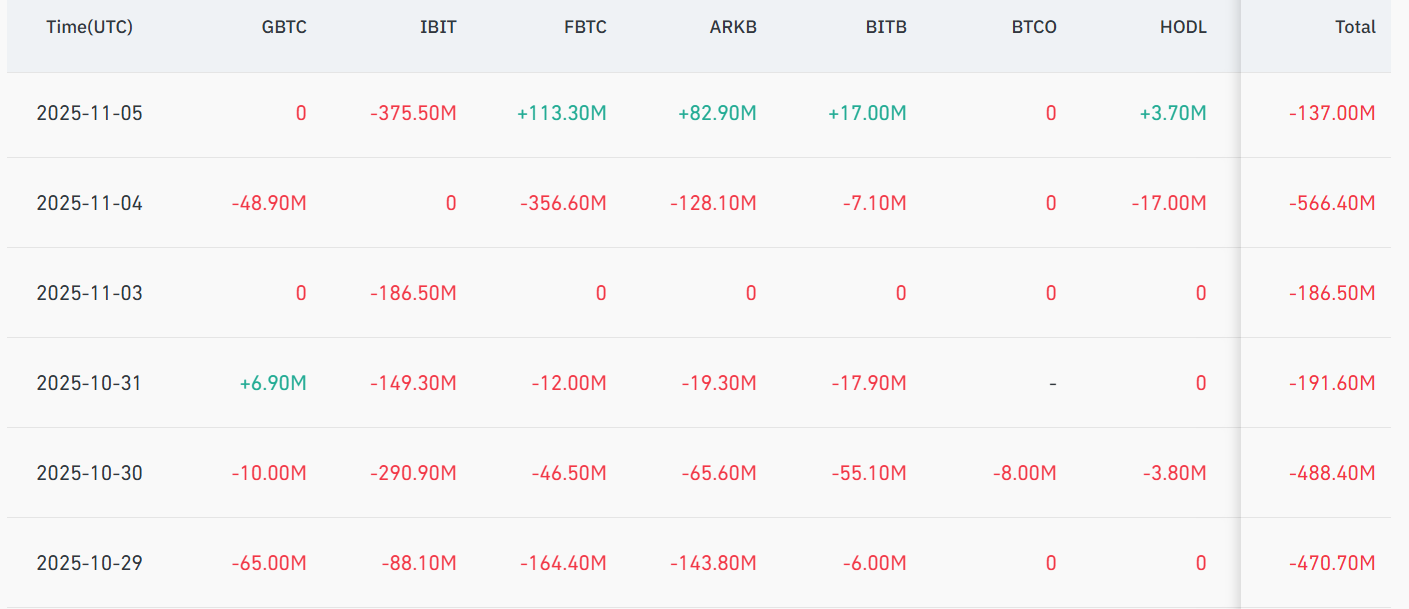

The enormous $2 billion outflows from Bitcoin exchange-traded funds (ETFs) because Oct. 29 have actually included even more down pressure. At the very same time, the net possession premium of openly noted business holding tactical Bitcoin reserves has actually collapsed, removing the reward to release brand-new shares at present appraisals.

It stays unsure whether the current wave of frustrating business incomes is connected to the United States federal government shutdown or signals the start of an economic downturn. Bitcoin bulls will likely await clearer indications from macroeconomic signs before going back in, leaving the possibility of a correction listed below $100,000 still on the table.

This short article is for basic info functions and is not planned to be and must not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.