Bitcoin (BTC) rate action turned bullish on March. 19 as markets grew distressed for the release of the Federal Free Market Committee (FOMC) minutes and an interview from Federal Reserve Chair Jerome Powell.

BTC/USDT 1-day chart. Source: TradingView

Normally, traders keep a close eye on FOMC minutes, in addition to Powell’s remarks, to get direct insights into the Fed’s take on United States financial health, in addition to their prepare for financial policy and rate of interest.

In the presser, Powell verified that the Fed means to leave rate of interest the same, in its target variety in between 4.25% to 4.5%, where they have actually been because December 2024.

Although the Fed devalued its outlook for financial development and highlighted that tamping inflation stays a sticking point, the Fed’s declarations mostly line up with market individuals’ expectations.

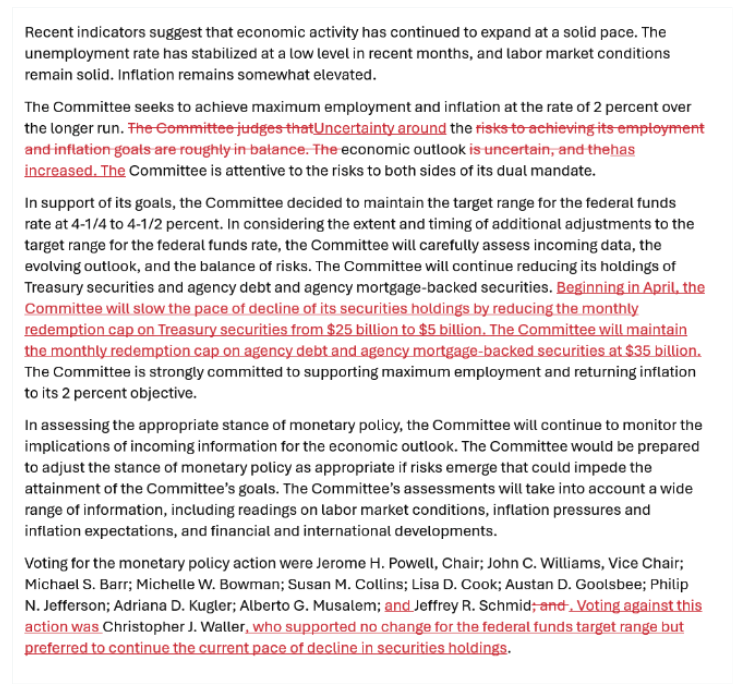

Crypto and equities traders have actually likewise been anticipating the decrease of the Fed’s financial policy of quantitative tightening up (QT), and the FOMC minutes verified that the reserve bank will lower “the regular monthly redemption cap on Treasury securities from $25 billion to $5 billion.”

Modifications to FOMC declaration (in red). Source: FederalReserve.gov

Related: Bitcoin rate volatility increases around FOMC days– Will this time be various?

In reaction to Fed declarations, Bitcoin rate contributed to its everyday gains, rallying to an intraday high at $85,950 at the time of composing.

The DOW likewise included 400 points, while the S&P 500 index included 77. Powell and Fed policymakers’ spoken dedication to 2 extra rate cuts in 2025 likewise lines up with crypto traders’ expectations and might even more buoy the present healing in Bitcoin rate.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.