Bitcoin (BTC) begins the 2nd week of December above $90,000 as “Santa rally” talk starts.

-

BTC rate action concentrates on a crucial resistance location in the low $90,000 area, however traders still see another dip coming.

-

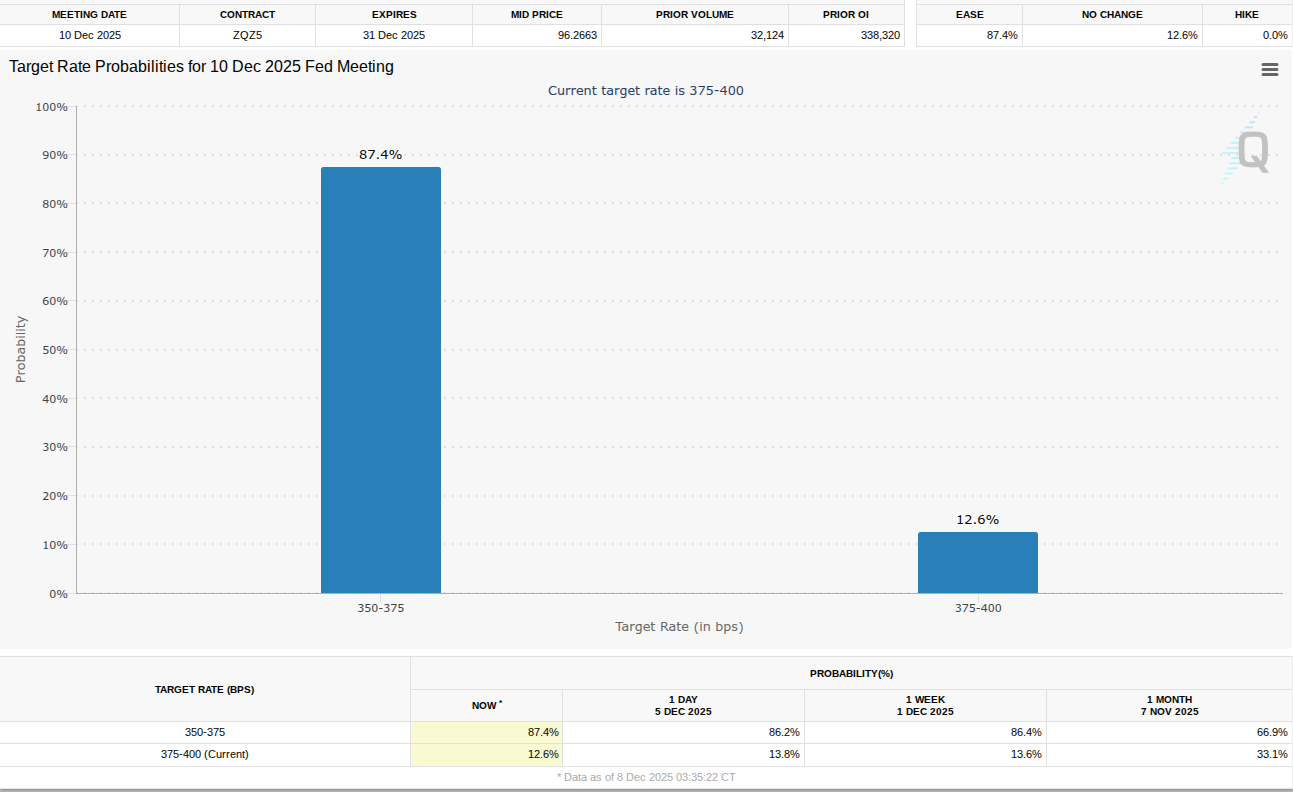

Federal interest-rate choice week hangs over threat properties regardless of broad agreement that a cut will result.

-

The Fed choice will choose the fate of a Santa rally for stocks, analysis concurs.

-

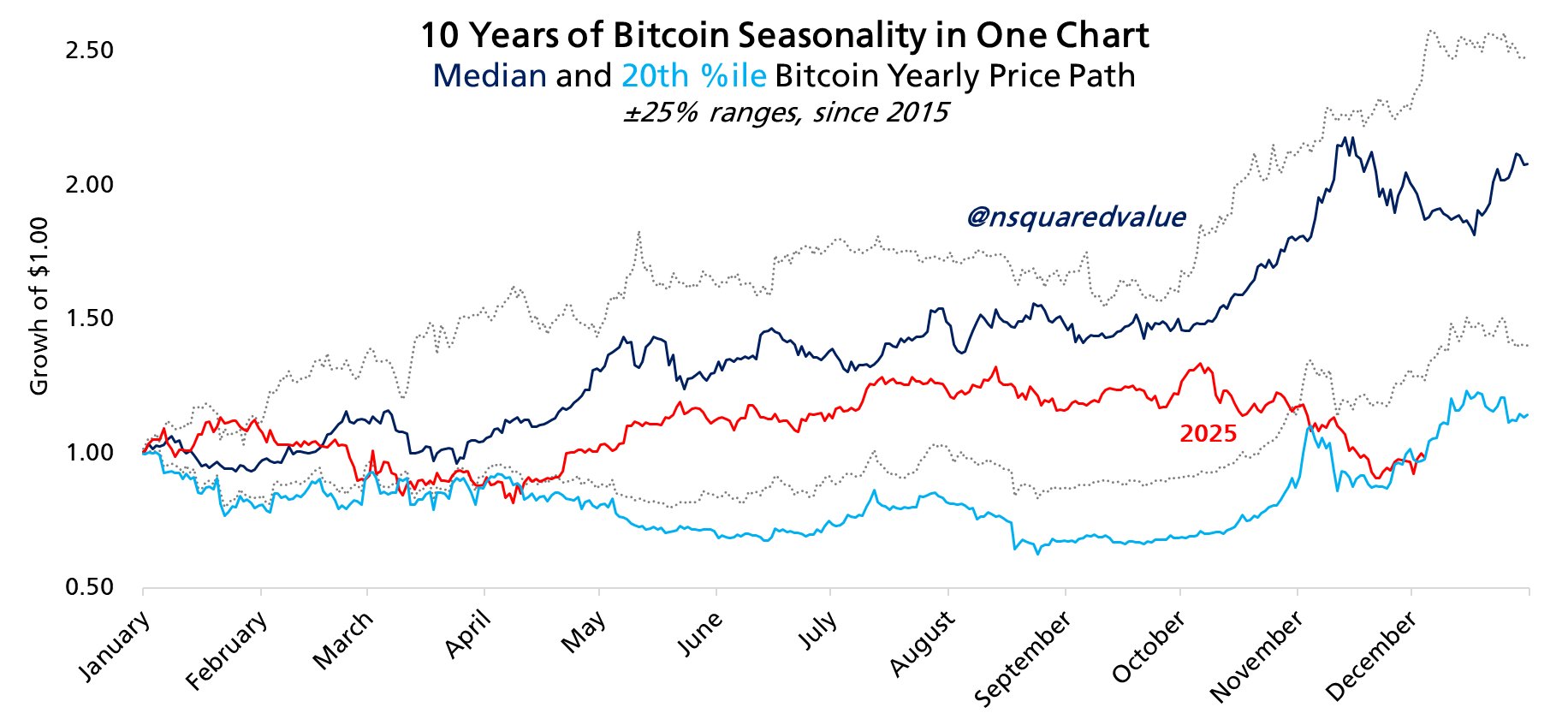

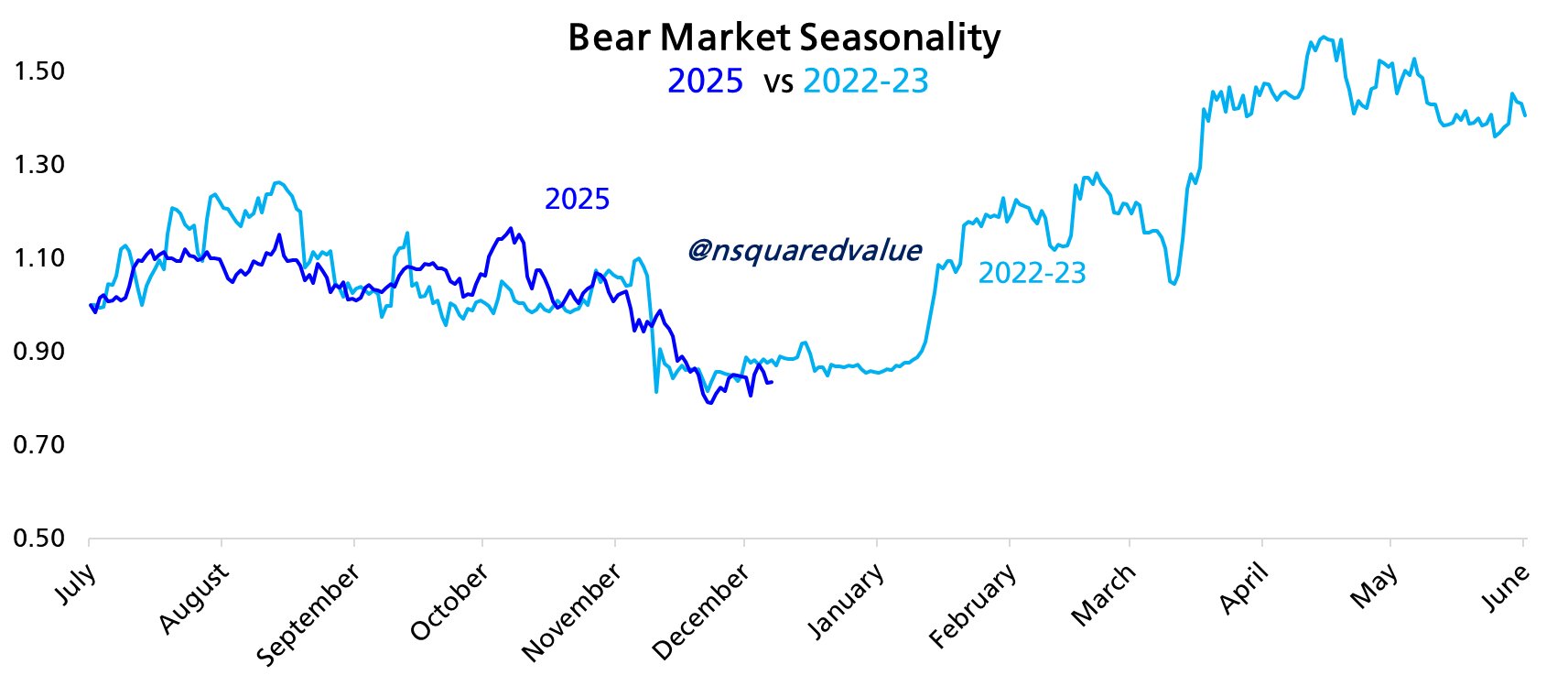

For Bitcoin, seasonality recommends that this year’s “bearishness” bottom timing might echo 2022.

-

Open interest and utilize remain silenced in what might be light at the end of the tunnel for the bulls.

Fibonacci level ends up being essential BTC rate flooring

Bitcoin rate volatility rebounded into the weekly close– a pattern seen progressively typically this quarter.

After dipping to near $87,000, BTC/USD handled a weekly surround the $90,000 mark before more irregular carry on lower amount of time, information from Cointelegraph Markets Pro and TradingView validates.

Traders hence remained cautious of fakeout relocations in both instructions.

In his newest X thread on BTC, trader CrypNuevo considered the 50-day rapid moving average (EMA) as a possible retest target.

” For shorts, I’m trying to find a 1D50EMA retest and I’m believing that it’ll change around $95.5 k and be the variety highs,” he anticipated.

CrypNuevo stated that Bitcoin did not have a “clear base” for going long, with the low $80,000 zone still on the table.

” Some liquidations in both instructions however somewhat more to the advantage in the zone in between $94.5 k-$ 95.3 k. If rate arrives initially, I’ll be trying to find brief signals to a possible low $80’s retest,” he included along with charts of exchange order-book liquidity information.

Crypto trader, expert and business owner Michaël van de Poppe was more confident, describing “extreme” pressure amongst Bitcoin purchasers at regional lows.

” Considered that there’s such an extreme purchasing pressure occurring, I would presume we’ll be breaking upwards and holding above $92K in the coming days,” he informed X fans Monday.

” That would lead to a rally towards $100K pre-2026.”

To the disadvantage, trader Daan Crypto Trades utilized Fibonacci retracement levels to flag bulls’ line in the sand. This stands at $84,000, a level that saw a retest to begin December.

” Still hanging on to that.382 location from the whole booming market up until now,” he composed in accompanying analysis.

” I believe this is a crucial location for the bulls to protect. It’s likewise basically the last significant assistance before evaluating the April lows once again, which would break this high timeframe market structure.”

FOMC week sees Fed captured brief on labor market

Little by method of United States macroeconomic information releases today indicates that the focus is simply on the Federal Reserve.

On Wednesday, the Federal Free Market Committee (FOMC) will fulfill to choose interest-rate modifications, and markets are banking on a 0.25% cut.

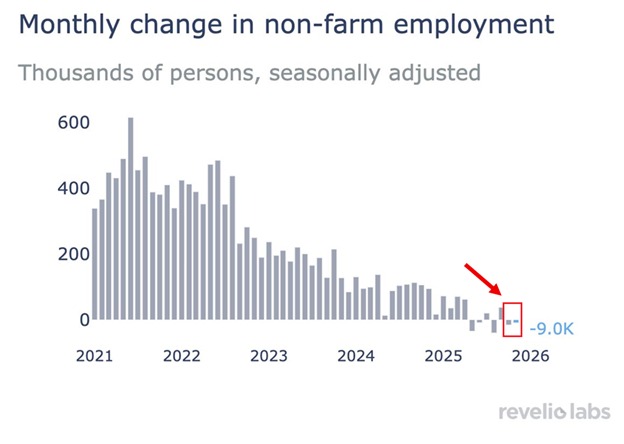

Current tasks information indicate degeneration in the labor market– and for this reason more of a requirement to lower rates. Analysis sees the Fed pinned in between a rock and a difficult location as inflation stays an issue that would be worsened by a cut.

” Nonfarm payrolls have actually now published 5 decreases over the last 7 months, the worst streak in a minimum of 5 years,” trading resource The Kobeissi Letter composed in part of a weekend X post on United States work information.

” Degeneration of the task market is speeding up.”

Analytics resource Mosaic Possession Business struck a more positive tone, seeing a perfect mix of tailwinds for threat properties.

” With inflation above target, the economy holding up fine, and the S&P 500 near all-time highs, the Fed looks set to cut rates for a 3rd successive conference,” it summed up in the current edition of its routine newsletter, “The marketplace Mosaic.”

Mosaic included that it “can’t think of more bullish conditions to assist drive the stock exchange than rate cuts into loose monetary conditions with the economy proving indications of ongoing development which supports the profits outlook.”

On FOMC day, on the other hand, markets will see Fed Chair Jerome Powell for signals over future policy trajectory as he talks and takes press concerns after the rate statement.

This weekend, Kobeissi explained Powell’s termination of “stagflation” dangers at the May 2024 FOMC interview as “the day the Fed lost control.”

Might fourth, 2024: The day the Fed lost control.

Fed Chair Powell reacts to issues about stagflation, “I do not see the stag or the flation.”

18 months later on, inflation is still at 3%+ and the labor market is at its weakest level considering that the pandemic.

Own properties. pic.twitter.com/gpBdXnfH7Y

— The Kobeissi Letter (@KobeissiLetter) December 6, 2025

Santa rally buzz gets Fed proviso

If stocks remain in for an ideal mixed drink of bullish drivers to complete the year, crypto analysts are currently talking about the chances of the “Santa rally” spilling over.

The Santa rally is genuine, however the timing is all over the location.

Will we get a Santa rally this year? pic.twitter.com/YnsAjXqBbx

— Mister Crypto (@misterrcrypto) December 6, 2025

As Cointelegraph reported, crypto has actually greatly underperformed stocks in Q4, with the S&P 500 simply inches from brand-new all-time highs.

Network economic expert Timothy Peterson keeps in mind that the stars tend to line up for Bitcoin most of the time into year end.

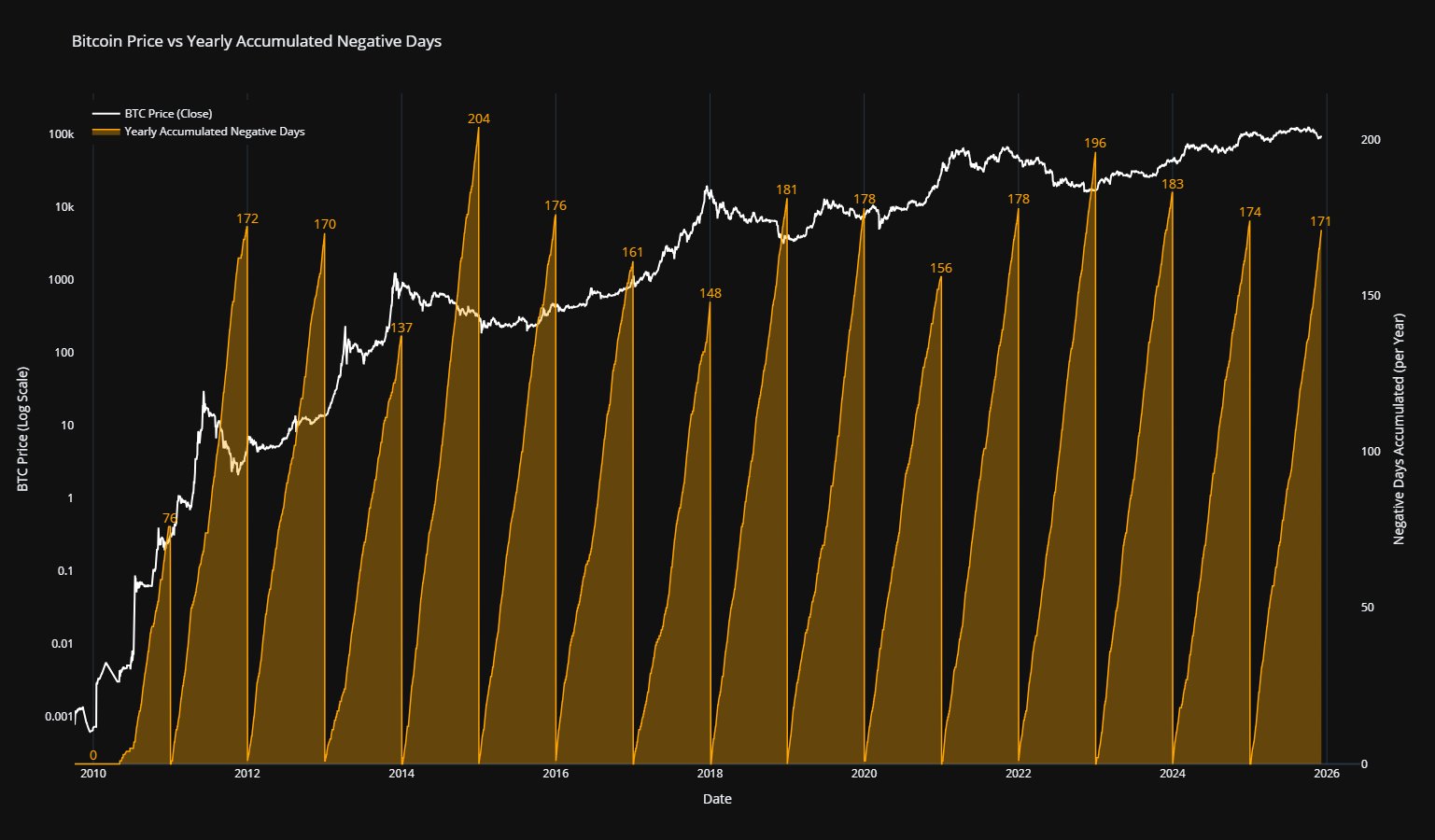

Amongst those taking the opposite side, nevertheless, is Joao Wedson, creator and CEO of crypto analytics platform Alphractal. BTC/USD, he argued, is due a “sideways” end to 2025.

” Every year, Bitcoin invests approximately 170 days in unfavorable area,” Wedson discussed along with a chart of collected unfavorable BTC rate trading days.

” In 2025, it has actually currently collected 171 unfavorable days– which highly recommends this year is most likely to close in a sideways rate variety. If a much deeper drop is coming, it will more than likely take place in 2026.”

Previously, Cointelegraph reported on the Santa result still being at the grace of the Fed.

” The pullback in the S&P 500 from late October into November took place along with falling chances for another rate cut this month. Current remarks from essential Fed authorities assisted drive chances for a cut down higher, which likewise stimulated a healing in the stock exchange,” Mosaic Possession Business concurred.

Is $89,000 the brand-new $16,000 for Bitcoin?

When it concerns Bitcoin rate cycles and seasonality, the current information provides bulls factor to remain positive on the outlook.

Submitted to X this weekend by Peterson, a contrast in between BTC/USD this year and in 2022-23 recommends that a long-lasting rate bottom need to be either total or around the corner.

In late 2022, Bitcoin put in a multiyear low of $15,600 as it bottomed out after a ruthless bearishness in which it lost 80% versus old all-time highs.

Its rebound embeded in as quickly as 2023 started, and if history were to repeat, hodlers might have simply weeks to wait till upward momentum returns.

“$ 89,000 is the brand-new $16,000,” Peterson summed up.

As Cointelegraph reported, contrasts to 2022 have actually ended up being more regular considering that October, when Bitcoin suddenly deserted its succeeding run of brand-new all-time highs to dive 36% over a six-week duration.

In late November, Peterson stated that the rate connection with 2022 had actually reached 98% on month-to-month timeframes.

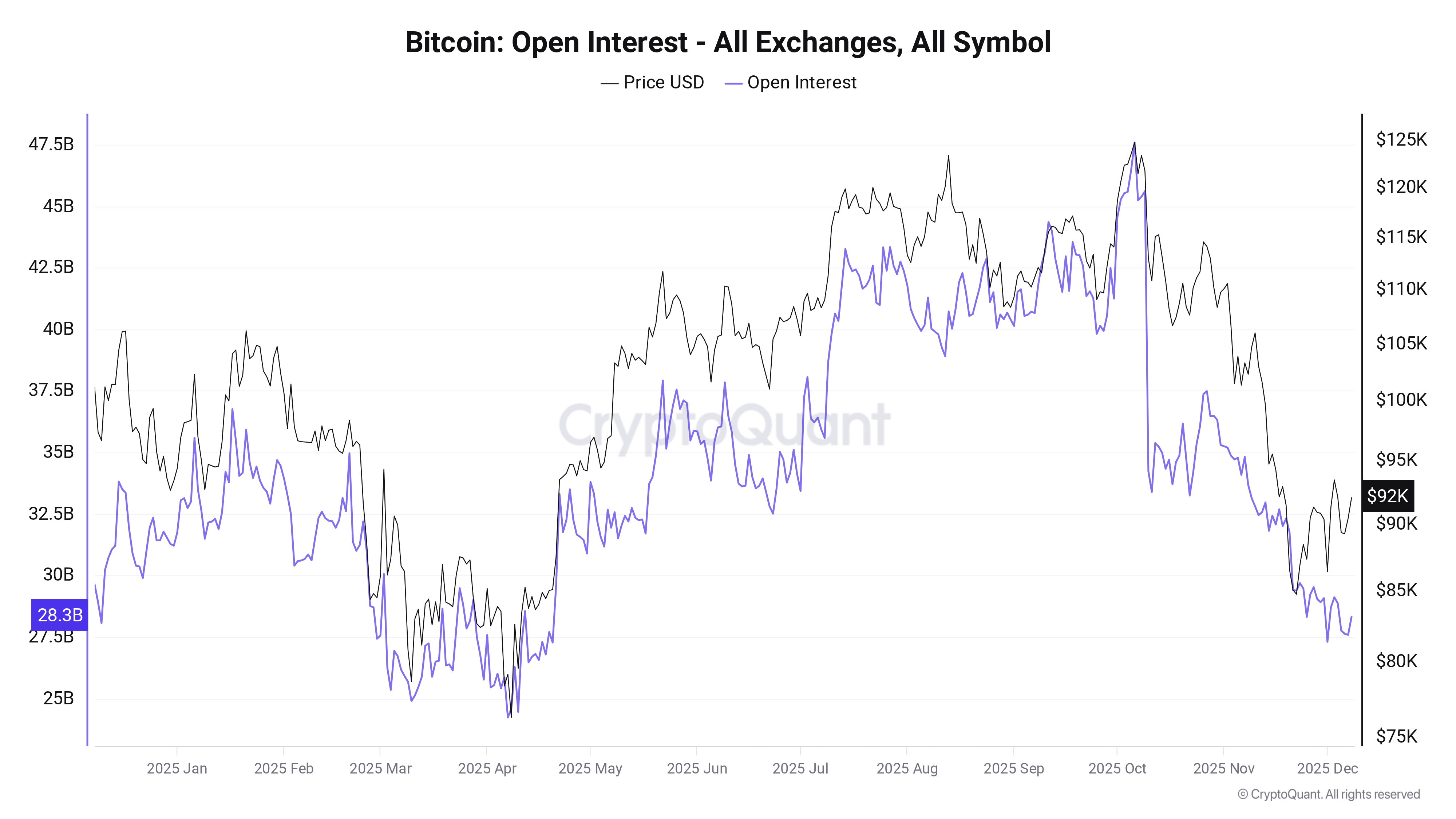

Open interest define Bitcoin “passiveness”

A motivating signal from Bitcoin derivatives markets is keeping a full-on market rally possible.

Related: Bitcoin revenue metric eyes 2-year lows in ‘total reset:’ BTC analysis

Brand-new information from onchain analytics platform CryptoQuant validates that open interest (OI) throughout Bitcoin exchanges has actually dropped to its least expensive levels considering that April, when BTC/USD traded at $75,000.

” This decrease usually shows 2 things: 1) financier capitulation, or 2) financier passiveness,” factor COINDREAM commented in among CryptoQuant’s “Quicktake” article Monday.

” Historically, durations of passiveness and low involvement have typically significant appealing buy-the-dip chances.”

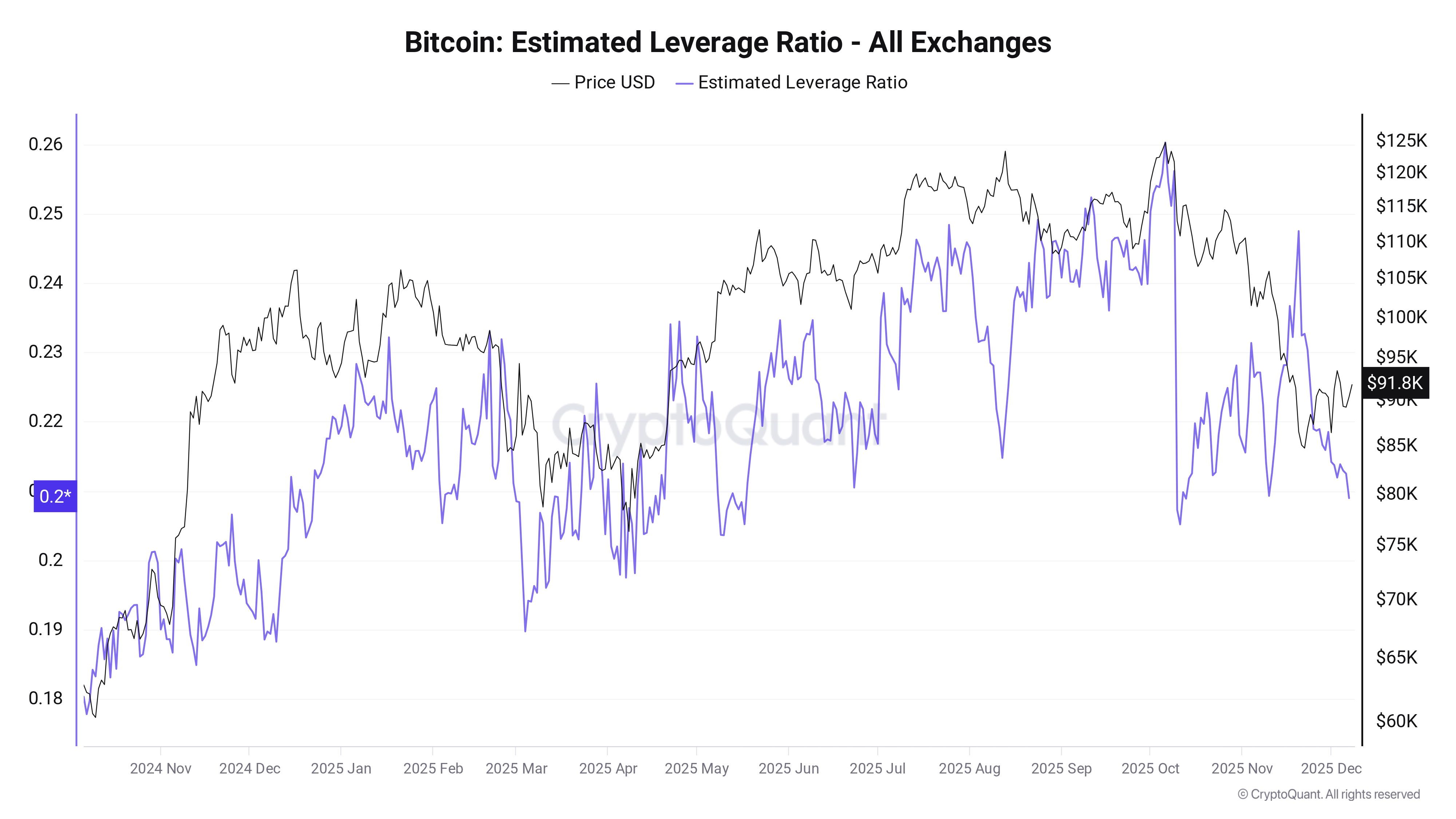

COINDREAM kept in mind that regardless of the modest BTC rate rebound versus current lows of $80,500, traders have actually not been lured to release utilize.

” Extreme utilize typically functions as a drag on market instructions. Nevertheless, as rates have actually just recently rebounded, utilize levels have actually stabilized, lowering systemic threat,” it continued.

CryptoQuant’s approximated utilize ratio metric, which divides OI by BTC reserves, has actually decreased considerably considering that mid-November.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.