Bitcoin offer pressure will have vaporized once it crosses the $130,000 mark, according to Bitwise CEO Hunter Horsley.

” I believe when Bitcoin breaks through, e.g., $130-150k, nobody is going to offer their Bitcoin,” Bitwise CEO Hunter Horsley stated in an X post on Wednesday.

Galaxy Digital creator Mike Novogratz just recently stated the cost variety is possible this year, mentioning strong institutional circulations and growing need for digital possessions.

Bitcoiners who purchased a “long time ago” are offering

Bitcoin (BTC) is presently hovering sideways around its all-time highs.

At the time of publication, Bitcoin is trading at $108,698, simply $3,272 shy of its Might 22 all-time high of $111,970, according to CoinMarketCap information.

Horsley stated that present sell pressure primarily originates from early purchasers who got Bitcoin at much lower costs and are now selecting to take earnings around the mentally crucial $100,000 level.

” Today at $100k, it appears people who hold a great deal of Bitcoin that was purchased a very long time earlier at extremely low costs are offering some,” Horsley stated. Nevertheless, Horsley stated this will be temporary. “As soon as Bitcoin breaks brand-new levels, this will peter off,” he stated.

Even before Bitcoin crossed over $100,000 on May 8, onchain analytics firm Glassnode alerted of a “significant boost” in older financiers offering when that level was reached.

Horsley states Bitcoiners will discover alternative methods of accessing liquidity

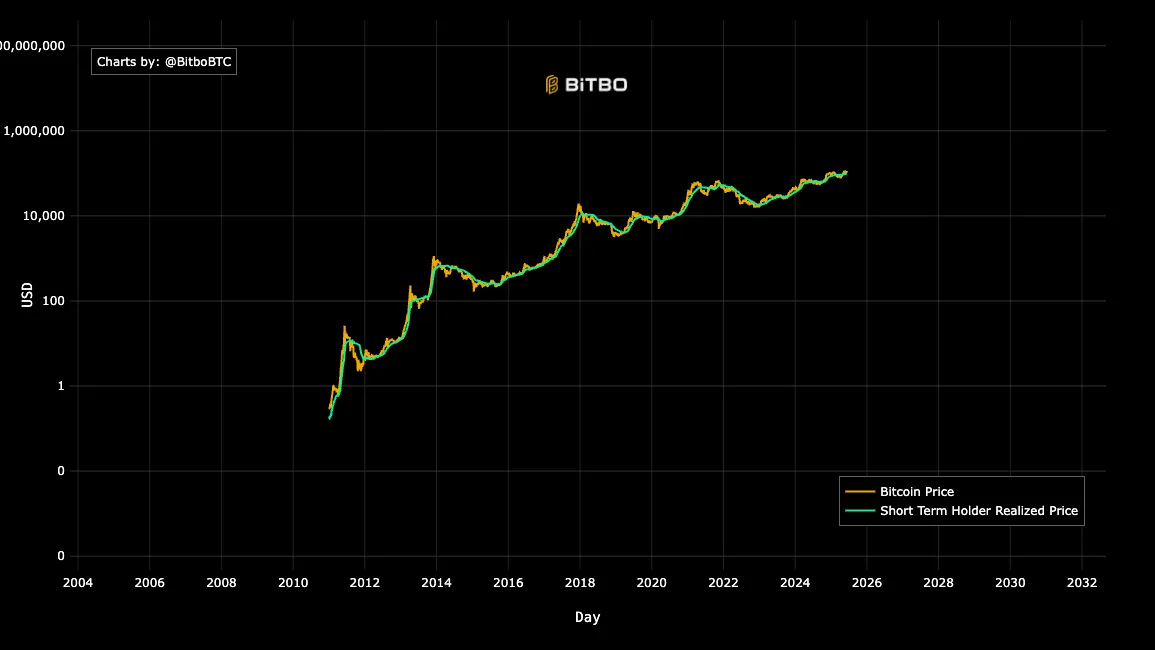

The typical Bitcoin long-lasting Bitcoin holder– those who have actually held for more than 155 days– is presently up around 215%, with a typical purchase cost of $34,414, according to crypto analytics platform Bitbo.

While the revenue margin is big now, Horsley stated that Bitcoin holders who require cash in the future will discover other methods to utilize their Bitcoin without offering it.

Tightening up Bitcoin supply is the talk amongst the market

” And from there on, when individuals require liquidity, they are going to obtain from an ever-growing set of loan providers,” he stated.

” All of which will even more move the cost … There’s merely not going to suffice Bitcoin.”

On the other hand, Cointelegraph just recently reported that OTC (non-prescription) desks, which assist in big, off-exchange trades, are revealing indications of tightening up supply.

Related: Bitcoin cost gets ready for volatility as area supply disappears

Technique’s Michael Saylor just recently echoed a comparable belief. On June 10, Saylor kept in mind that roughly 450 Bitcoin are readily available for sale every day by Bitcoin miners, totaling up to approximately $50 million at its present cost.

” If that $50 million is purchased, then the cost has actually got to go up,” Saylor stated.

” At the present cost level, it just takes $50 million to turn the whole driveshaft of the crypto economy in one turn,” Saylor included.

Publication: Elon Musk Dogecoin pump inbound? SOL tipped to strike $300 in 2025: Trade Tricks

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.