Bitcoin (BTC) passed $88,000 after the March 25 Wall Street open as danger properties remained extremely conscious United States trade tariffs.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

BTC rate gains expect timeless April resurgence

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD securely holding on to the day-to-day open.

United States stocks opened decently greater, developing on a resurgence that supplied traders some long-awaited cause for optimism.

An essential active ingredient in stemming the risk-asset thrashing were hints from the United States federal government and President Donald Trump over their prepared round of trade tariffs set to start on April 2.

” Threat properties staged among their greatest sessions of the year, assisted by a momentary easing of worries around the April second tariff due date,” trading company QCP Capital summed up in its newest publication to Telegram channel customers.

” Trump signified two times on Monday that trading partners may protect exemptions or decreases, using a reprieve that assisted relieve market jitters.”

BTC/USD vs. S&P 500 1-day chart. Source: Cointelegraph/TradingView

QCP kept in mind that others were pertaining to think that the worst of the equities obstacle had actually reoccured, consisting of JPMorgan.

” Q2, and April in specific, has actually traditionally been among the very best durations for danger properties, 2nd just to the joyful December rally,” it included.

” The S&P 500 has actually provided a typical annualised return of 19.6% in Q2, while Bitcoin has actually likewise tape-recorded its second-best mean efficiency throughout this stretch – once again, routing just Q4.”

BTC/USD regular monthly returns (screenshot). Source: CoinGlass

As Cointelegraph reported, expectations for April amongst Bitcoin market individuals are likewise high, offered historic propensities for strong rate efficiency.

Data from keeping an eye on resource CoinGlass put typical returns for BTC/USD for both March and April at simply under 13% over the previous eleven years.

Bitcoin gazes down significant seller liquidity

Evaluating short-timeframe BTC rate action, traders progressively concentrated on the $90,000 mark on the day.

Related: Bitcoin turns ‘macro bullish’ amidst very first Hash Ribbon purchase signal in 8 months

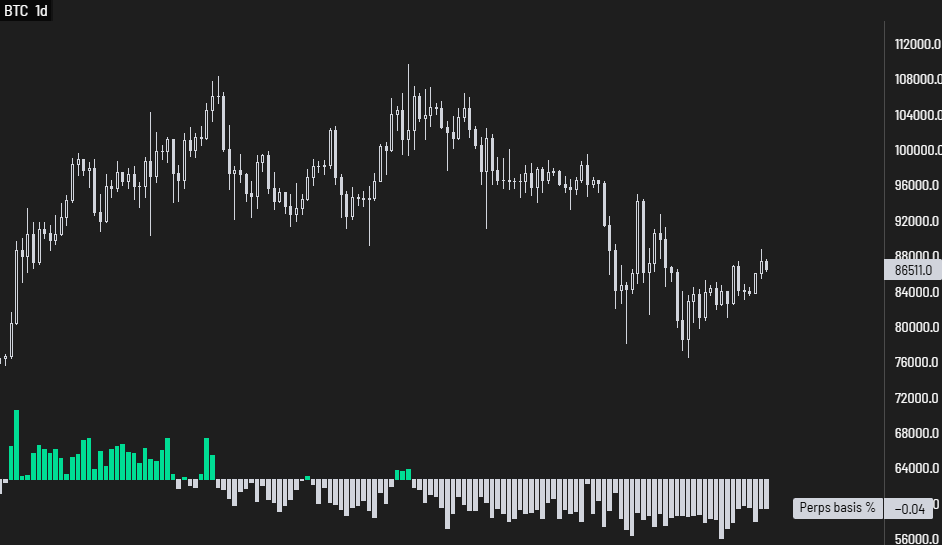

“$ BTC Is still trading at a strong area premium throughout this bounce,” popular trader Daan Crypto Trades acknowledged in among his newest X posts.

” If it can preserve that while gradually making its method back into the previous variety ($ 90K+), I ‘d be positive we’re due for a return to brand-new highs. In the meantime it still stays a huge resistance and rate has actually been associated to equities.”

BTC/USD 1-day chart with perps basis. Source: Daan Crypto Trades/X

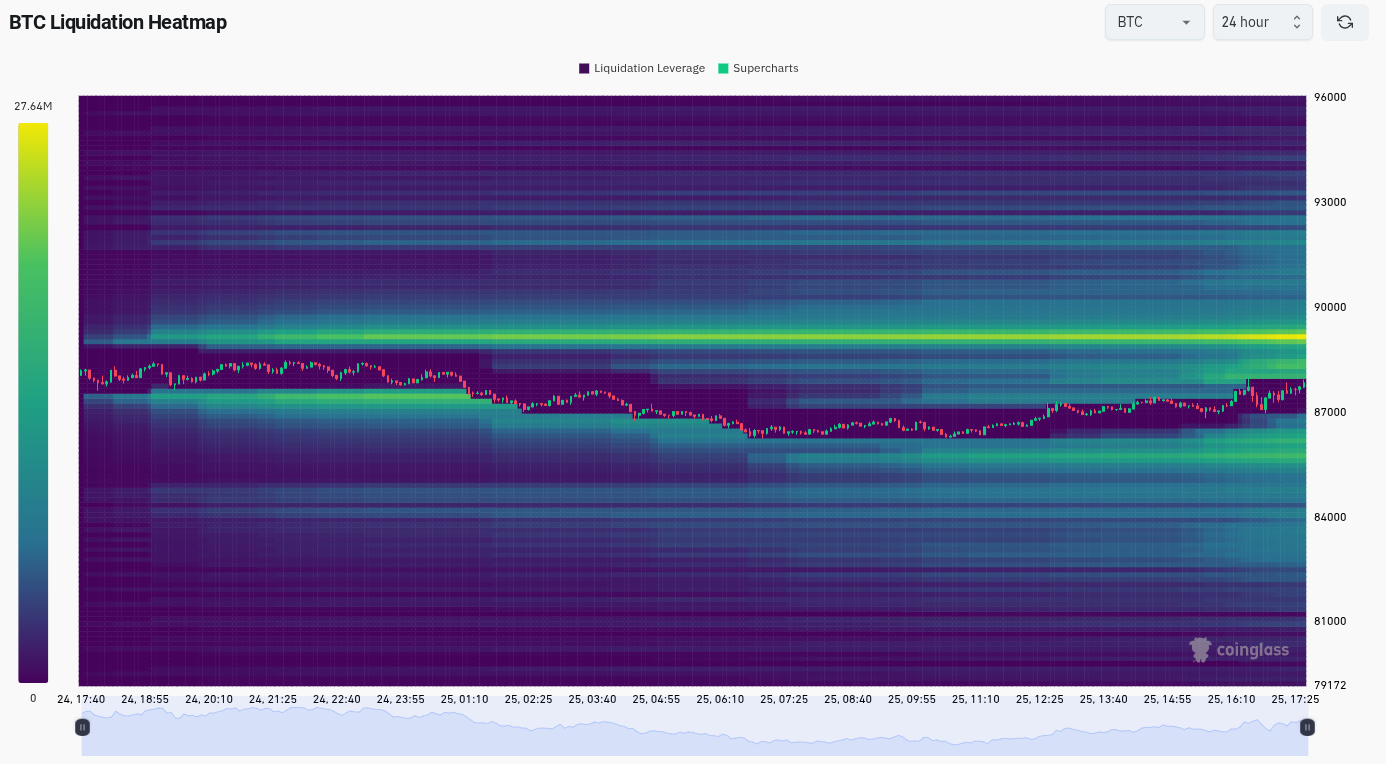

On the other hand, CoinGlass revealed continuous sell-side liquidity simply listed below $90,000– formerly credited to market control by a high-volume trader called “Spoofy the Whale.”

Keith Alan, co-founder of trading resource Product Indicators, who created the expression, stated that this entity alone would keep rate caught at around $87,500 moving forward.

BTC liquidation heatmap (screenshot). Source: CoinGlass

Today, Alan stated that another essential level to turn to assistance is the annual open at simply above $93,000. Failure to do so, he cautioned, might still set off a go back to multimonth lows.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.