Bitcoin (BTC) is revealing “indications of strength” even as stocks and the more comprehensive cryptocurrency market plunge in the middle of an international market sell-off after United States President Donald Trump enforced sweeping tariffs on United States imports recently, Binance Research study stated.

Since mid-day trading on April 7, Bitcoin is up nearly 1% to almost $79,000. On the other hand, the S&P 500– an index of big United States stocks– is basically flat and front-month gold futures are down around 1.5%, according to Google Financing.

” Even in the wake of current tariff statements, BTC has actually revealed some indications of strength, holding stable or rebounding on days when conventional threat possessions failed,” Binance, the world’s biggest cryptocurrency exchange, stated in an April 7 research study report.

Especially, Bitcoin’s supply of long-lasting holders continues to increase, “showing conviction and restricted capitulation throughout current volatility,” Binance stated.

On April 2, Trump stated he was putting tariffs of a minimum of 10% on a lot of imports into the United States and including extra “mutual” tariffs on products from 57 nations.

Ever since, significant United States stock indices– consisting of the S&P 500 and Nasdaq– come by more than 10% as traders braced for a looming trade war.

Bitcoin is still down more than stocks– about 12%– however has actually held up much better than crypto’s general market capitalization, which is down approximately 25% because April 2.

” Now, with mutual tariffs emerging and international markets adapting to the possibility of extended trade fragmentation, much might depend upon BTC’s capability to reassert its safe house story,” the report stated.

Source: Binance Research Study

Related: Crypto stocks down, IPOs punted in the middle of tariff tumult

Altering property connections

Bitcoin’s connection with gold– traditionally thought about the supreme safe house property throughout times of severe macroeconomic unpredictability– has actually been low, balancing around 0.12 over the previous 90 days, Binance stated.

The cryptocurrency has a more detailed connection with equities of 0.32. Nevertheless, “regardless of short-term swings, BTC might still have space to reassert a more independent macro identity,” according to the exchange.

” The essential concern is whether BTC can go back to its long-lasting pattern of low connection with equities,” kept in mind the report.

Source: Binance Research Study

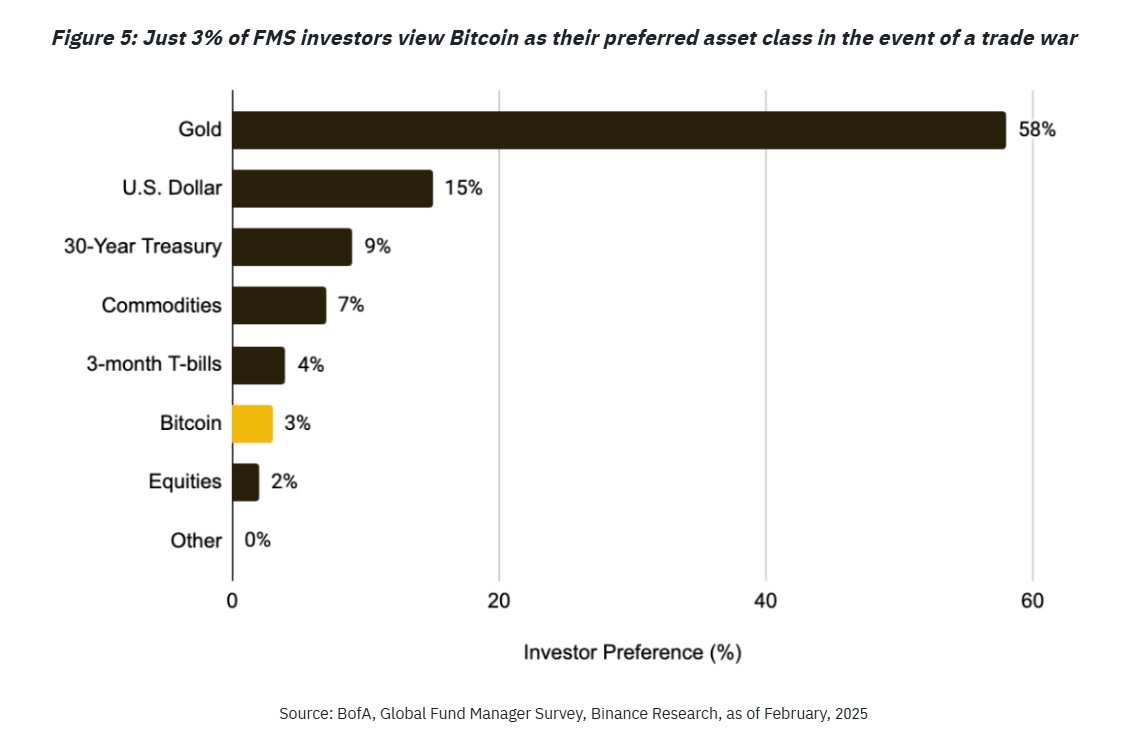

In the meantime, gold seems the favored safe house property amongst fund supervisors, Binance stated.

It pointed out a study in which 58% of participants stated they would choose to hold gold throughout a trade war versus just 3% for Bitcoin.

” Market individuals will be viewing carefully to see if BTC has the ability to maintain its appeal as a non-sovereign, permissionless property in a protectionist international economy,” Binance stated.

Publication: New ‘MemeStrategy’ Bitcoin company by 9GAG, imprisoned CEO’s $3.5 M reward: Asia Express