Bitcoin’s (BTC) cost stopped working another effort at breaking above resistance at $85,000 on March 17. Considering that March 12, BTC cost formed day-to-day candle light highs in between $84,000 and $85,200, however has actually been not able to close above $84,600.

Bitcoin 1-hour chart. Source: Cointelegraph/TradingView

Bitcoin stays in “no guy’s land” on the lower timespan (LTF) of the 1-hour chart. This term in trading markets is specified as a rate variety where motions are identified by unpredictability, considerable danger, and vibrant stress due to external occasions and contrasting market belief.

With the Federal Free Market Committee (FOMC) conference set to occur on March 18-19, markets might see unpredictable cost swings towards essential BTC cost levels over the next couple of days. The important statement on the rate of interest will be made on March 19 at 2 pm ET.

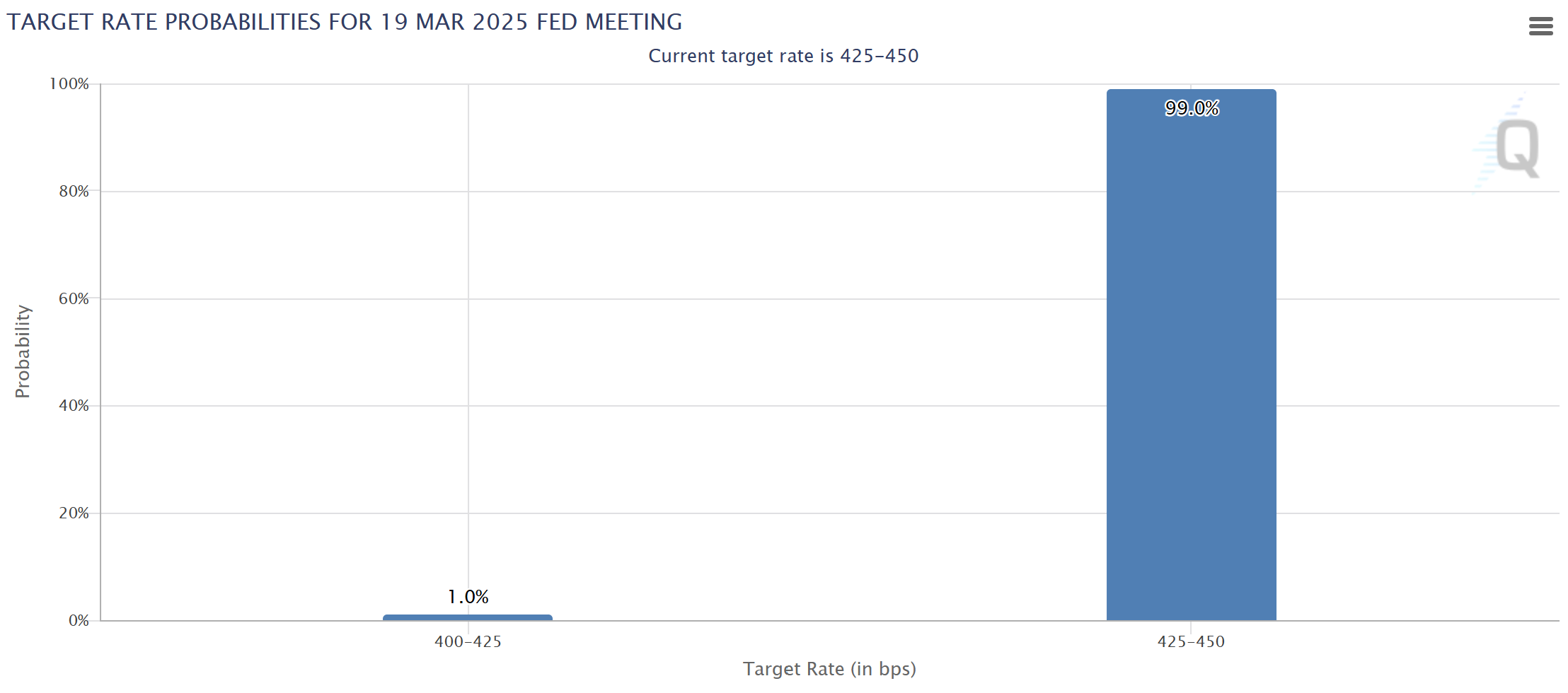

99% possibility rate of interest will not alter

According to CME’s FedWatch tool, there is a 99% possibility that the existing rate of interest will stay in between 4.25% and 4.50%, leaving simply a 1% likelihood of a 0.25% rate cut.

CME’s FedWatchtool rate of interest expectations. Source: CME Group

Nevertheless, a typical market belief is that any bearish cost action from the same rate of interest is currently priced in.

Related: Bitcoin cost stops working to go parabolic as the United States Dollar Index (DXY) falls– Why?

For that reason, the marketplace is concentrated on Jerome Powell, the United States Fed chair’s speech throughout the FOMC speech. With regard to the current information, Powell’s position is most likely to be hawkish. The evaluation is based upon the following points:

-

Customer Cost Index (CPI) stays at 2.8%, which is still above the Fed’s 2% main target and the Personal Usage Expenses (PCE) cost index stood at 2.5% -2.6%. While CPI can be found in lower than anticipated recently, it does not motivate instant rate cuts.

-

Joblessness information stays low at 4.1%, with a yearly GDP development of 2.3% in Q4 2024, suggesting the economy does not require instant stimulus.

On the other hand, Polymarket now states there’s a 100% possibility that the United States Federal Reserve will conclude quantitative tightening up (QT) by April 30, which would enhance the chances of a rate cut as early as this summer season.

Secret Bitcoin cost levels to enjoy

Bitcoin needs to turn the $85,000 resistance level into assistance to target greater highs at $90,000.

For this to take place, BTC/USD needs to initially restore its position above the 200-day rapid moving typical (orange line) on the 1-day chart. BTC cost dropped listed below the 200-day EMA on March 9 for the very first time because August 2024.

Bitcoin 1-day chart. Source: Cointelegraph/TradingView

One favorable driver for the bulls might be restored need from area Bitcoin ETFs. On March 17, Bitcoin ETFs signed up $274 million in inflows, the biggest because Feb. 4.

The bears, on the other hand, will try to keep $85,000 resistance in location, increasing the probability of brand-new lows under $78,000. The instant target listed below previous variety lows lies at $74,000, i.e., the previous all-time high from early 2024.

Bitcoin 1-day chart. Source: Cointelegraph/TradingView

Listed Below $74,000, the next essential location of interest stays in between $70,530 and $66,810, with an everyday order block. Reaching $69,272 would be a retest of the United States election day cost, removing all of the “Trump pump” gains.

SuperBitcoinBro, a confidential BTC expert, highlights that the “worst case” situation for Bitcoin lies at $71,300 and $73,800, which can be a possible assistance in every timeframe from day-to-day to quarterly.

Bitcoin 1-day chart analysis by Nebraskangooner. Source: X.com

Likewise, Nebraskangooner, another popular Bitcoin expert, states that the FOMC is a wildcard, describing that BTC needs to recover $86,250 to verify the bullish situation on the lower timespan.

Related: ‘Bitcoin bull cycle is over,’ CryptoQuant CEO alerts, pointing out onchain metrics

Nevertheless, as highlighted in the charts, he anticipates a possible retest near the $70,000 level over the next couple of weeks.

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.