Bitcoin (BTC) rate stopped working to hold its weekly open gains on April 10 as United States stocks neglected favorable inflation information.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

Information from Cointelegraph Markets Pro and TradingView revealed BTC rate volatility ticking greater around the release of the March Customer Rate Index (CPI) numbers.

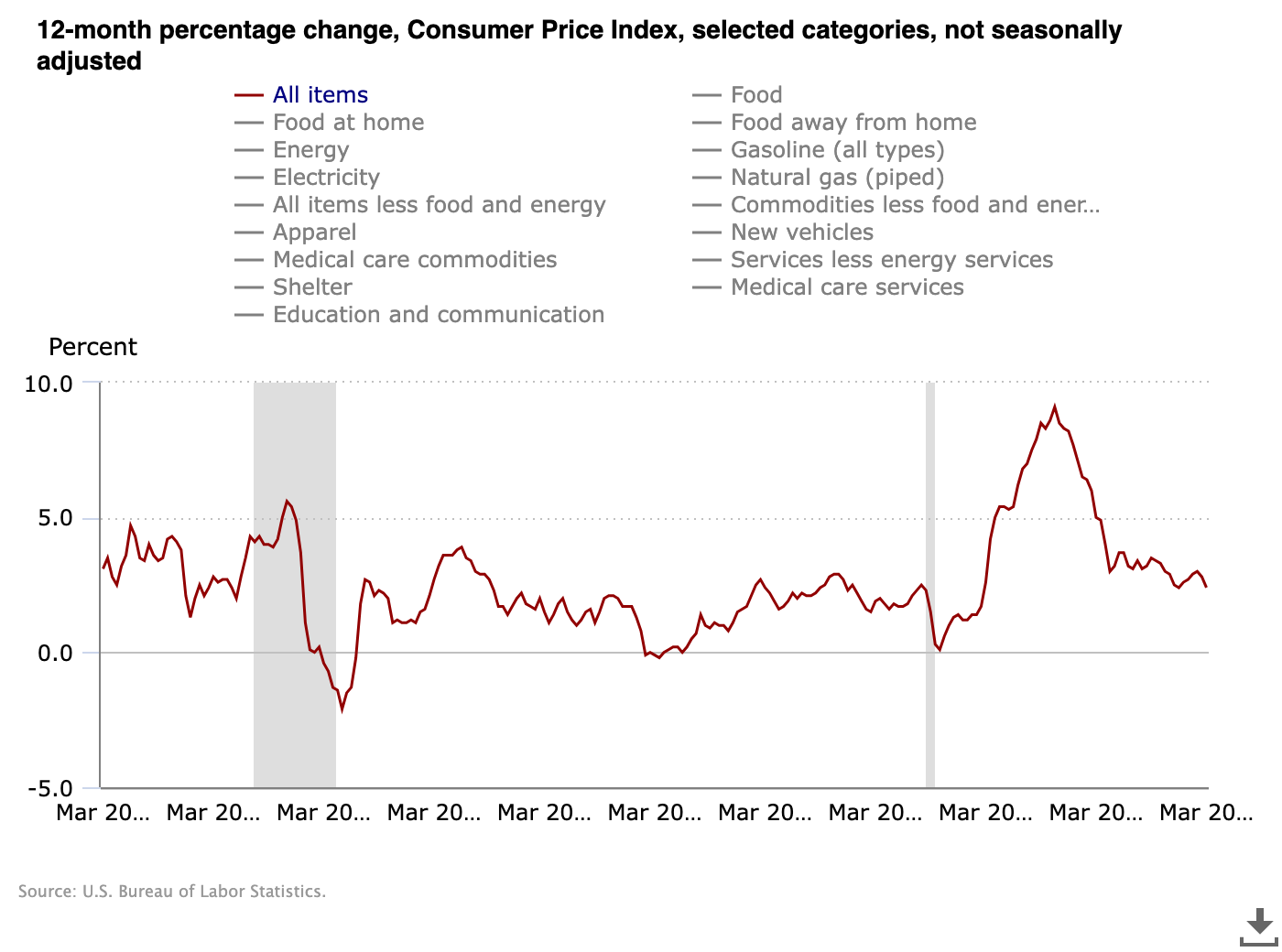

These numbers can be found in broadly listed below expectations, exposing slowing inflationary forces in spite of mass-market interruption due to United States trade tariffs.

A main news release from the United States Bureau of Labor Data (BLS) mentioned:

” The all products index increased 2.4 percent for the 12 months ending March, after increasing 2.8 percent over the 12 months ending February. The all products less food and energy index increased 2.8 percent over the last 12 months, the tiniest 12-month boost considering that March 2021.”

United States CPI 12-month % modification. Source: BLS

While notionally a tailwind for danger possessions, United States stocks remained in no state of mind for relief at the open. The S&P 500 and Nasdaq Composite Index were down 3% and 3.7%, respectively, at the time of composing.

” Markets believe the just recently strong tasks report and cool inflation information offers Trump the ‘thumbs-up’ to continue the trade war,” trading resource The Kobeissi Letter recommended in part of an action on X.

Kobeissi nevertheless acknowledged the ramifications of quickly decreasing inflation– something which tariffs had yet to affect.

” This marks the most affordable Core CPI inflation rate in 4 years,” it continued in a different X thread.

” It likewise puts Heading CPI inflation simply 40 basis points above the Fed’s 2% target. Inflation is down 60 basis points over the last 3 months alone.”

BTC rate rebound might rest with “Spoofy the Whale”

Turning to BTC rate action, market individuals remained in a wait-and-see mode after the United States stopped briefly most of its tariff executions for 90 days.

Related: Crypto trading company cautions of ‘traditional bull trap’ as Bitcoin tags $82.7 K

For popular trader Daan Crypto Trades, a recover of a minimum of $83,000 was required as a preliminary action for bulls.

“$ BTC Saw a strong relocation after the tariff time out was revealed,” he informed X fans.

” Where BTC was more durable on the drawback, we saw equities pump more on the back of this time out (that makes sense as those are straight affected by the tariffs).”

An accompanying chart revealed close-by crucial pattern lines around the area rate.

” BTC traded right back into the 4H 200MA (Purple) which has actually topped rate over the previous number of weeks. That $83-85K is an essential level to surpass for the bulls,” he continued.

” Right listed below we can see the ~$ 81.1 K horizontal being an essential level that sees rather a great deal of action. I believe it’s an excellent one to view in the short-term. Trading listed below that location might turn this into a nasty deviation/stop hunt.”

BTC/USDT continuous swaps 4-hour chart. Source: Daan Crypto Trades/X

Examining order book liquidity, Keith Alan, co-founder of trading resource Product Indicators, accentuated both the 21-day and 50-day basic moving averages (SMA) on the day-to-day chart.

” Very first effort at breaking resistance at the 21-Day MA was turned down, nevertheless BTC quote liquidity is moving greater so I believe we’ll see another effort,” he summed up previously on the day.

” If bulls can R/S Turn the 21-Day, there is even more powerful resistance where liquidity is stacked around the pattern line and the 50-Day MA.”

BTC/USD 1-day chart with 21, 50 SMA. Source: Cointelegraph/TradingView

Alan restated the function of large-volume traders moving liquidity above and listed below Bitcoin’s area rate to affect rate action. The actions of one entity in specific, which he formerly called “Spoofy the Whale,” stayed a point of factor to consider.

” If ‘Spoofy’ will offer us a roofing system pull, we’ll get a shot at the 100-Day and the 2025 open at $93.3 k, which is the entrance back to 6-figure Bitcoin,” he concluded.

BTC/USDT order book liquidity information. Source: Keith Alan/X

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.