Bitcoin (BTC) ticked greater at the March 31 Wall Street open as traders remained risk-averse on the short-term BTC cost outlook.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

Bitcoin RSI teases bearish extension

Information from Cointelegraph Markets Pro and TradingView revealed regional highs of $83,914 on Bitstamp, with BTC/USD up 1.5% on the day.

With hours to go till the quarterly candle light close, Bitcoin saw some much-needed relief, even as United States stocks opened lower.

Market momentum stayed connected to upcoming United States trade tariffs set to go reside on April 2, with gold likewise slipping after touching fresh all-time highs of $3,128 per ounce.

XAU/USD 1-hour chart. Source: Cointelegraph/TradingView

Discussing BTC cost action, numerous market individuals however preferred care.

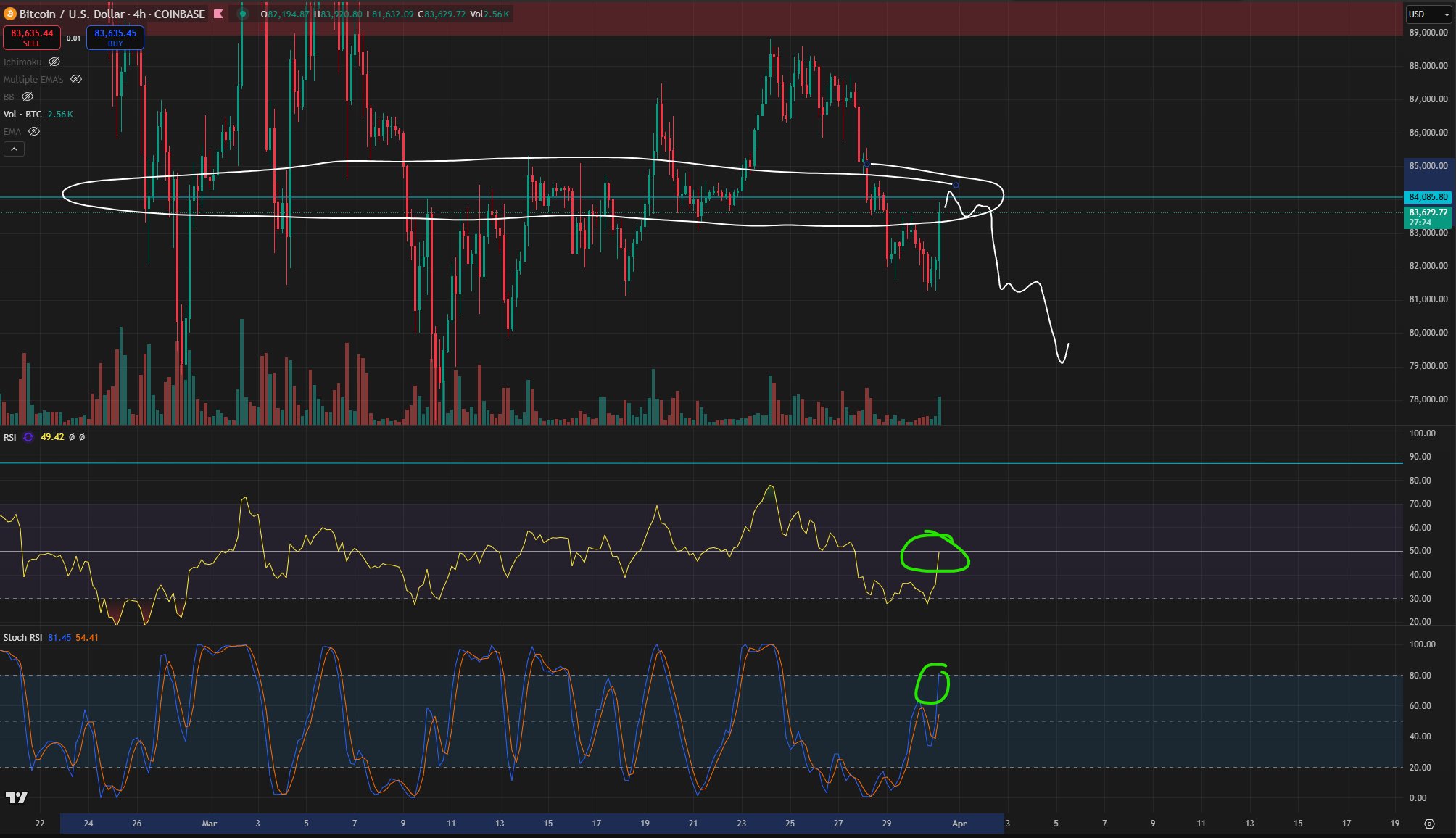

” Retesting our 84k location of interest,” popular trader Roman composed in his newest X analysis of the 4-hour BTC/USD chart.

Roman referenced the relative strength index (RSI) while anticipating a go back to levels closer to the $80,000 mark.

” To me, it appears like we need to start to head lower as we have a breakdown and bearish retest on LTF,” he continued.

” RSI likewise retesting the 50 location with stoch overbought. HTF still leans bearish also.”

BTC/USD 4-hour chart with RSI information. Source: Roman/X

Popular trader and expert Rekt Capital went even more on RSI signals, exposing an assistance retest on day-to-day timeframes after an essential breakout from a multimonth drop.

” The $BTC RSI is attempting to retest its Drop as assistance. On the other hand BTC’s cost action is likewise dealing with a Sag,” he summed up to X fans.

” If the RSI effectively retests its Drop … That would show emerging strength & & cost would have the ability to break its own Drop.”

BTC/USD 1-day chart with RSI information. Source: Rekt Capital/X

Previously, Cointelegraph reported on different BTC cost metrics integrating to produce a dull image of the existing stage of the booming market, hinting that the correction would continue.

BTC cost targets, on the other hand, now reach $65,000, with forecast platforms seeing even lower.

BTC cost analysis draws contrasts to late 2024

Both March and Q1 efficiency therefore left much to be preferred.

Related: Worst Q1 for BTC cost considering that 2018: 5 things to understand in Bitcoin today

Amidst a broad absence of advantage drivers, BTC/USD traded down 10.8% year-to-date at the time of composing and 1.1% lower for March, per information from keeping track of resource CoinGlass.

BTC/USD month-to-month returns (screenshot). Source: CoinGlass

In its newest analytics report, “Bitfinex Alpha,” launched on March 31, crypto exchange Bitfinex acknowledged that 2025 was Bitcoin’s worst very first quarter in years.

” Any purchasing momentum is presently being topped at the $89,000 level– accompanying the previous variety lows seen in December 2024, and serving as a company resistance level to additional gains,” factors observed.

” This resistance is likewise accompanying additional drawback in equities, with the S&P 500 closing the week 1.5 percent lower.”

BTC/USD 1-week chart (screenshot). Source: Bitfinex

The report highlighted the growing connection in between Bitcoin and United States stocks.

” Regardless of the turbulence, cost action in current weeks appears to have actually taken a debt consolidation variety in between $78,000 and $88,000. Significantly, indications of capitulation are reducing, with less reactive sellers present and long-lasting holders starting to collect once again,” it included.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.